Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Korean stock market FOMO risks crash

"The Bank of Korea noted rising market volatility and investor anxiety, with VKOSPI spiking to levels typical of market crashes" It's very unusual for implied options volatility to rise during a rally unless there is extreme reach for call options. Normally volatility spikes at the lows not the highs. Imagine what volatility will be like at these lows... Source: Mac10

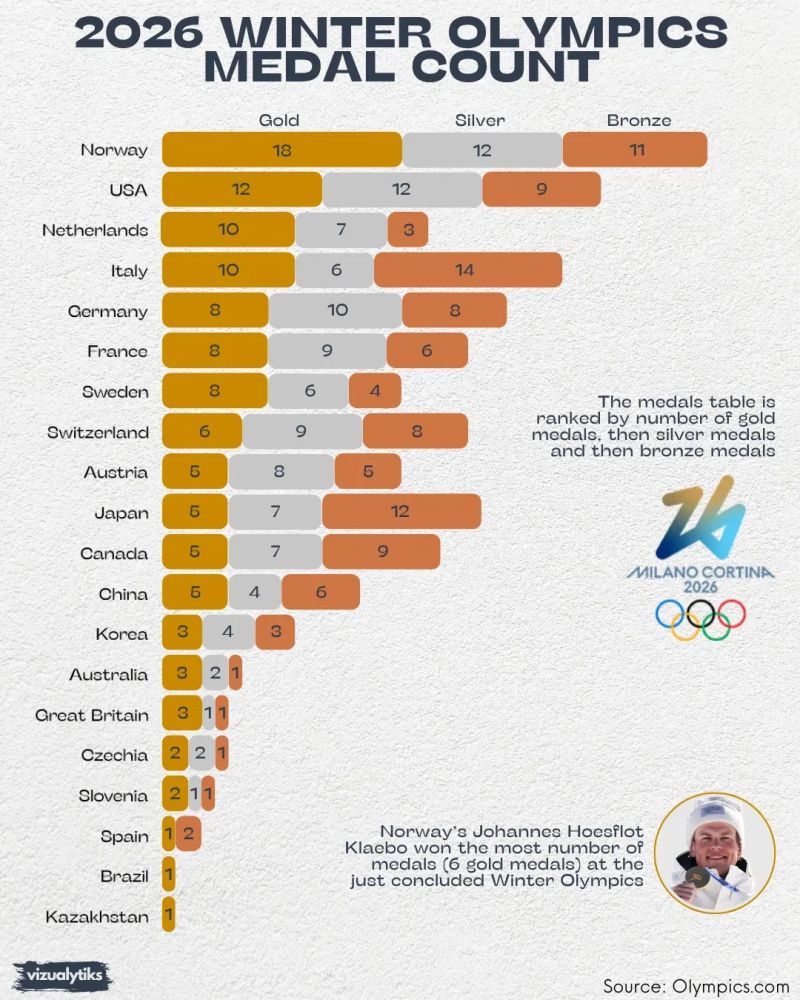

2026 Winter Olympics medal count by Voronoi

Great to see switzerland ranked #8 !

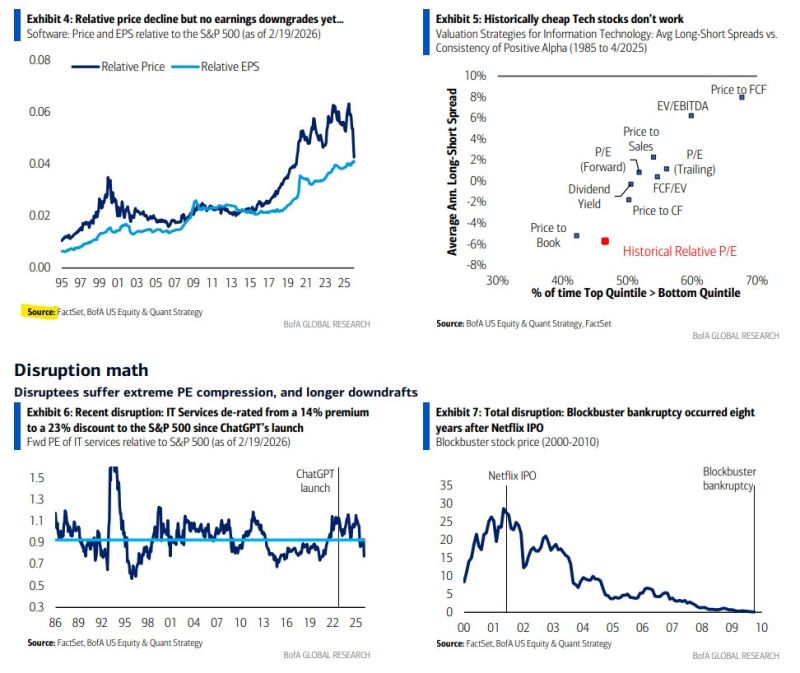

Why Software Valuations May Drop Despite Earnings Growth

BofA highlights that software stocks could see lower P/Es even with strong earnings. Market disruption is priced before profits, low-multiple tech tends to lag, and EPS growth can compress valuations when equity supply rises. Post-ChatGPT, IT Services lost their premium, reflecting repricing rather than sentiment. Rising asset intensity, weaker leverage, and private market issues add risk. Valuations fall not from failure but from resetting expectations, meaning even strong software companies aren’t immune. Source: BofA, Neil Sethi @neilksethi

US Wholesale Inflation Surges in December

US wholesale inflation rose sharply in December as the producer price index (PPI) jumped 0.5% month-over-month, exceeding expectations, driven by higher service costs. Core PPI also accelerated, climbing 0.8% MoM and 3.6% YoY, well above forecasts. The surge pressures corporate margins, especially for companies lacking pricing power, and may influence inventory cycles and earnings revisions. Market reactions, particularly in bonds and high-multiple equities, often precede headline recognition, highlighting the importance of liquidity signals. Source: Bloomberg TV @BloombergTV

UBS Warns of Cascading Defaults

UBS projects private credit defaults could surge to ~15%, driven by AI disruption in leveraged tech and services. High leverage, weak covenants, and concentrated exposure—especially in software—raise the risk of cascading defaults. Contagion could spread to public credit, widening spreads and threatening liquidity, while banks and insurers’ large exposure increases systemic risk. The private credit market isn’t in crisis yet, but all conditions for a severe credit cycle are present. Source: zerohedge

Credit crunch default rates ?

FT: “.. Holy moly. These are big global financial crisis-like — or at least dotcom-bust-like — numbers. While we haven’t spotted a time horizon for the forecast, we’ve whacked them onto this chart of historic default rates to give you a sense ..” Source: FT, Carl Quintanilla @carlquintanilla

Investing with intelligence

Our latest research, commentary and market outlooks