Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

South Korea’s KOSPI hit an all-time high

(+175% YoY), led by semiconductor giants like Samsung and SK hynix, driven by soaring chip exports (+134% YoY) fueled by global AI demand. Retail investors are shifting from crypto to domestic AI and semiconductor stocks, as the “Kimchi Premium” shrinks. Source: Bull Theory

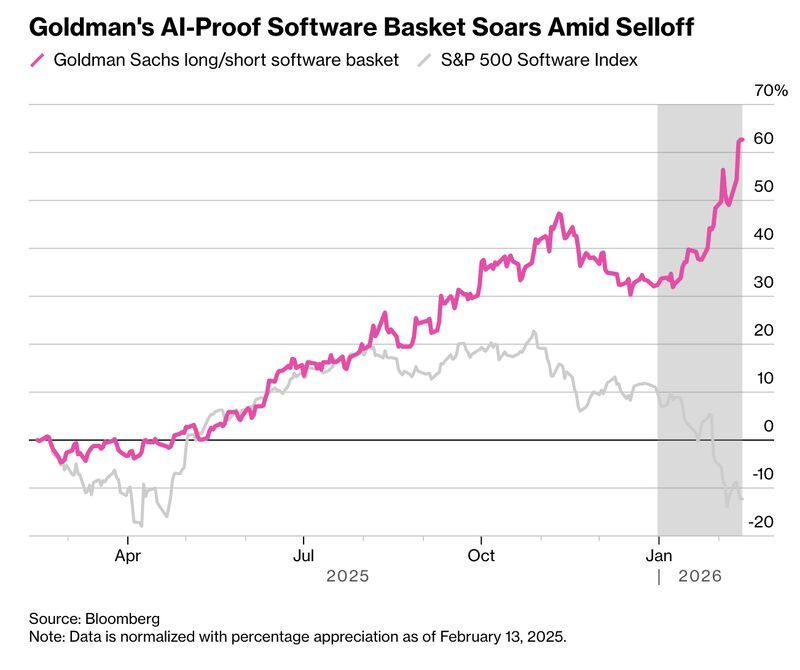

Goldman Sachs Winner and Looser

Goldman Sachs sees AI winners in hardware, cloud, infrastructure, and security (e.g., Nvidia, TSMC, Microsoft, Cloudflare), while traditional software and consulting (e.g., Salesforce, SAP, Accenture) lose as AI commoditizes code and cuts billable hours. The key: compute, power, and security beat software and platforms, reshaping the tech stack. Source: Michael Fritzell (Asian Century Stocks) @MikeFritzell

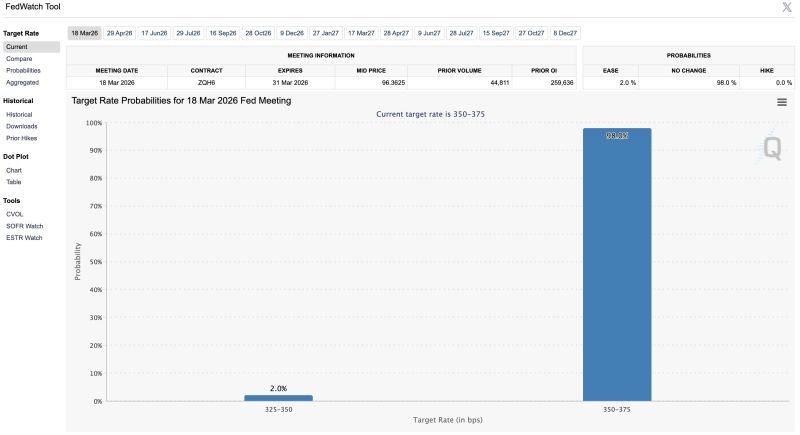

The odds of a March interest rate cut have fallen to just 2%

Source: Barchart @Barchart

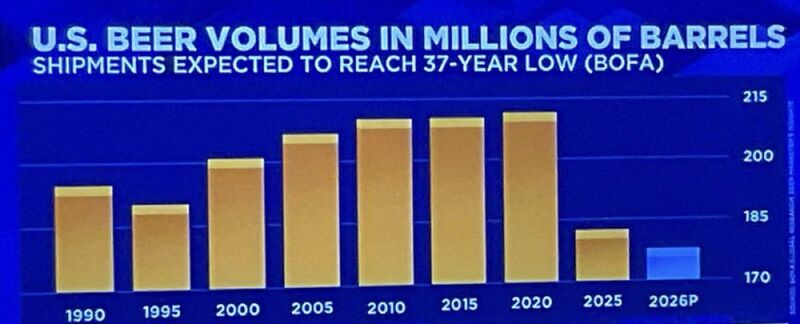

BREAKING Beer

Beer Shipments on track for worst year since the 1980s Source: Barchart @Barchart

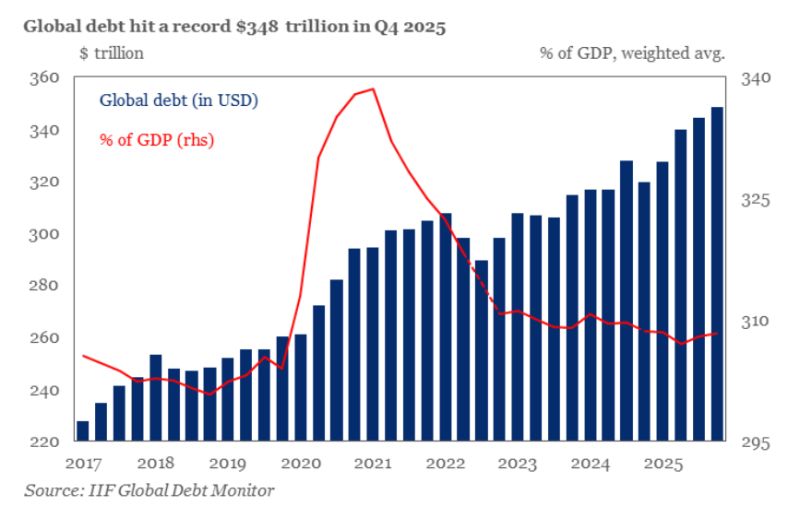

Global debt is surging as governments ramp up spending on national security and economic resilience.

Nearly $29tn was added to global debt in 2025, pushing the total to a record $348tn, according to IIF. Source: IIF, HolgerZ

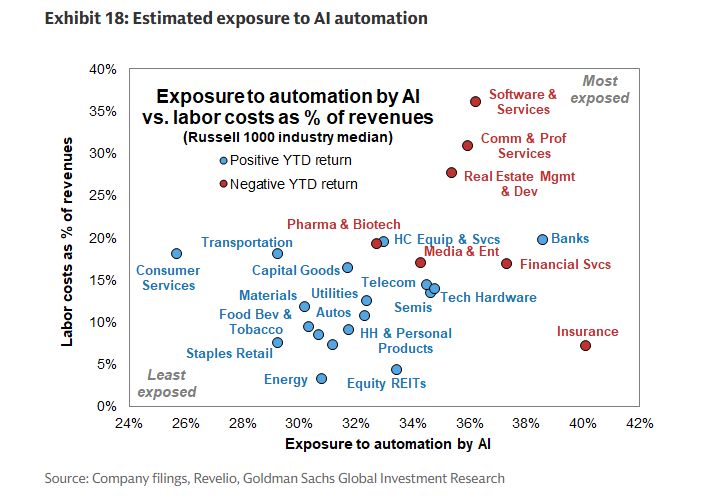

Disruption risk from AI, a sector point of view

The most exposed are in the high/right corner, and most of these have a negative YTD return. Source: Credit From macro to micro @Credit_Junk

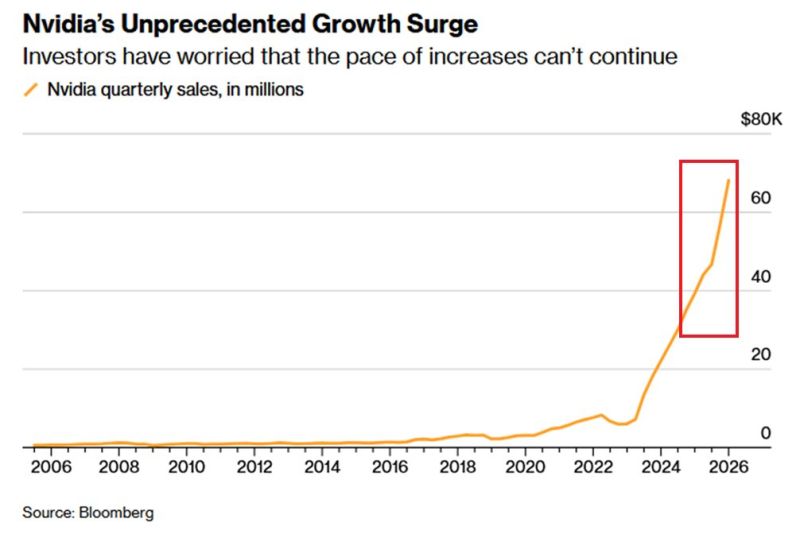

NVIDIA posted its best quarter ever

$68.1B revenue (+73% YoY) and Q1 guidance of ~$78B—but the stock fell, erasing post-earnings gains. CFO Colette Kress flagged potential long-term AI disruption from Chinese chipmakers. China exposure remains limited, with zero H200 chip sales and tariffs on U.S.-licensed shipments. The market reaction shows that when expectations are extremely high, even record results may disappoint. Source: Global Markets Investor, Bloomberg

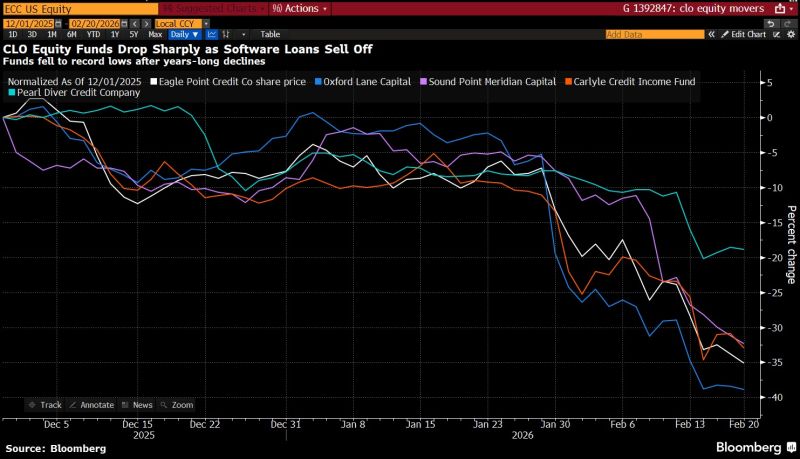

JPMorgan's Bob Michele compared the move in CLO equity to ABX indices from 2005 through 2007.

Two decades ago, traders dismissed some of those ABX moves as noise. Some are doing the same today with this move in CLO equity. (1/2) Source: Lisa Abramowicz @lisaabramowicz1

Investing with intelligence

Our latest research, commentary and market outlooks