Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

AI + STABLECOINS ARE COMING FOR GLOBAL PAYMENTS

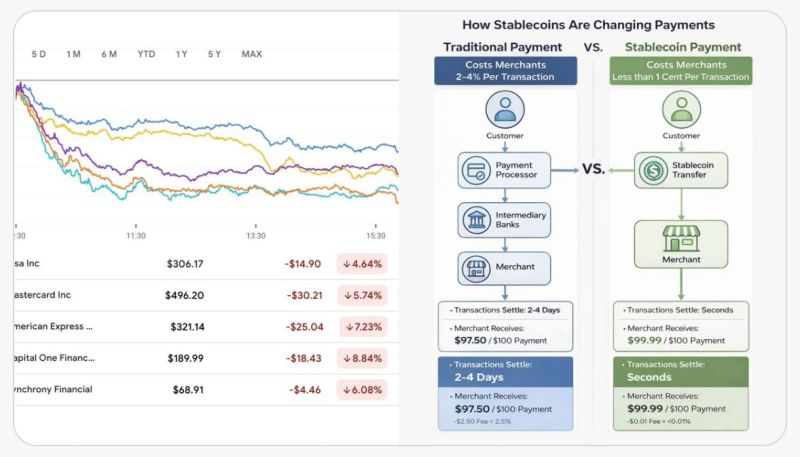

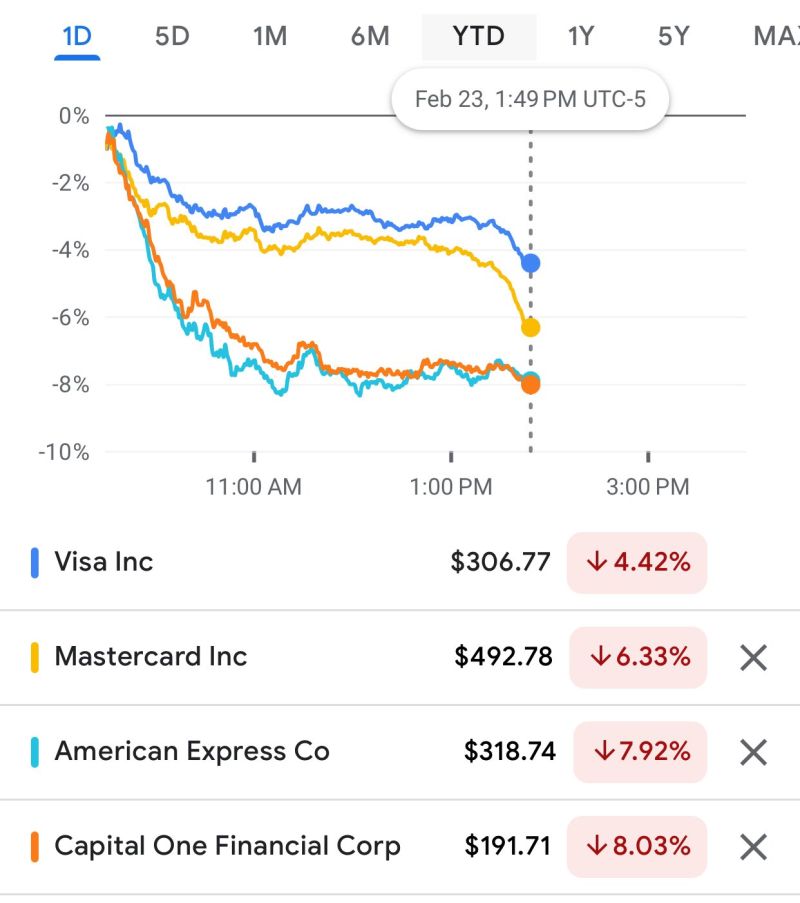

Markets are reacting for a reason (Source: Bull Theory). Visa (-4.6%), Mastercard (-5.7%), AmEx (-7.2%), and Capital One (-8.8%) fell as AI-driven payments and stablecoins threaten traditional card economics. While cards charge 2–3.5% fees and higher cross-border costs, stablecoins offer near-zero fees and instant settlement. With $33T in 2025 volume (+70% YoY) and projections up to $4T supply by 2030, capital is shifting. Even incumbents are integrating stablecoin rails. Source: Bull Theory

$IBM is down over 13% after Anthropic launches an AI tool that converts old COBOL code to modern languages.

AI code translation directly competes with IBM's legacy modernization consulting.

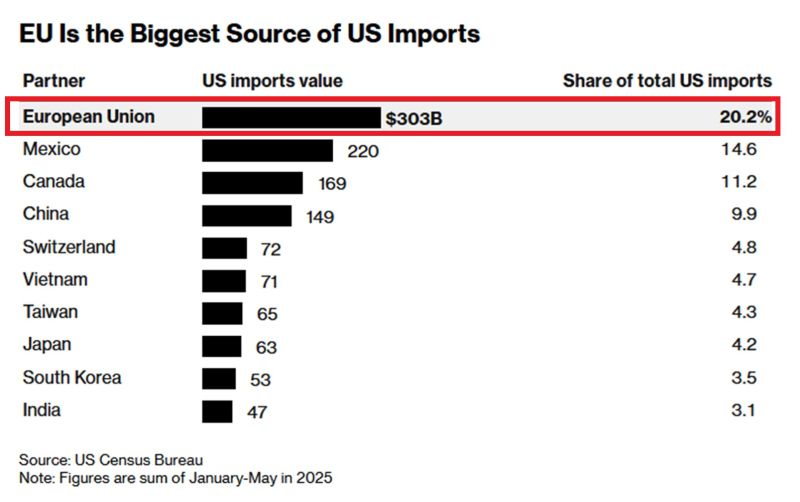

The EU is freezing its trade deal with the U

The main political groups in the EU Parliament suspended legislative work on ratifying the deal on Monday, seeking clarity on Trump's new tariffs. The deal has already faced a rocky path, with the US expanding its 50% metals tariff to hundreds of additional products and Trump threatening to annex Greenland. The agreement, struck last summer, would impose a 15% tariff on most EU exports to the US while removing tariffs on US industrial goods. Source: Global Markets Investor, Bloomberg

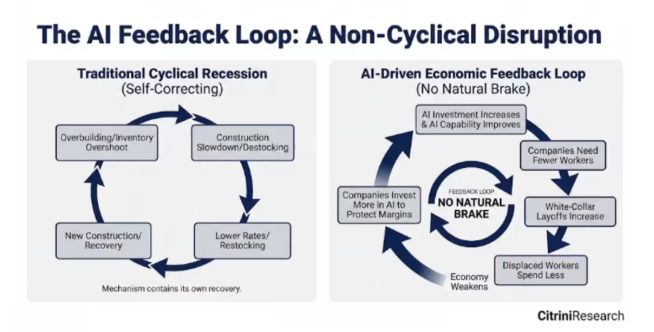

Here's a MarketWatch article on how AI could eventually lead to a job-destroying feedback loop leading to double-digit unemployment rate in the US.

The piece, co-authored by Citrini Research and guest Alap Shah, managing partner at Lotus Technology Management, is written as a lookback from June 2028, when the unemployment rate has just risen to 10.2% and the S&P 500 is down 38% from its Oct. 2026 highs around 8,000. It starts with software-as-a -service companies losing sales as client demand falls, but AI usage quickly this year becomes the default among consumers and businesses constantly finding the cheapest and best option, reducing margins and profits. This leads to a collapse in white-color hiring (white-collar workers represent 50% of employment and drive roughly 75% of discretionary consumer spending), but the downturn will be secular as companies lean into AI, "a feedback loop with no natural break". Initial jobless claims spike to 487,000 by next February, the S&P 500 drops, and by the second quarter of 2027 there’s a recession when “the daisy chain of correlated bets” will start to fracture rippling through the economy impacting everything from house prices to elections. "This isn’t bear porn or AI doomer fan-fiction. The sole intent of this piece is modeling a scenario that’s been relatively underexplored,” they say. Source: Citrini Research, Neil Sethi @neilksethi

Another day, another AI scare.

A Citrini blog post titled “The 2028 Global Intelligence Crisis” triggered another AI-driven selloff in US equities on Monday. The Goldman Sachs Software At Risk Basket fell 6% yesterday and is now down 33% year to date. Source: Bloomberg, HolgerZ

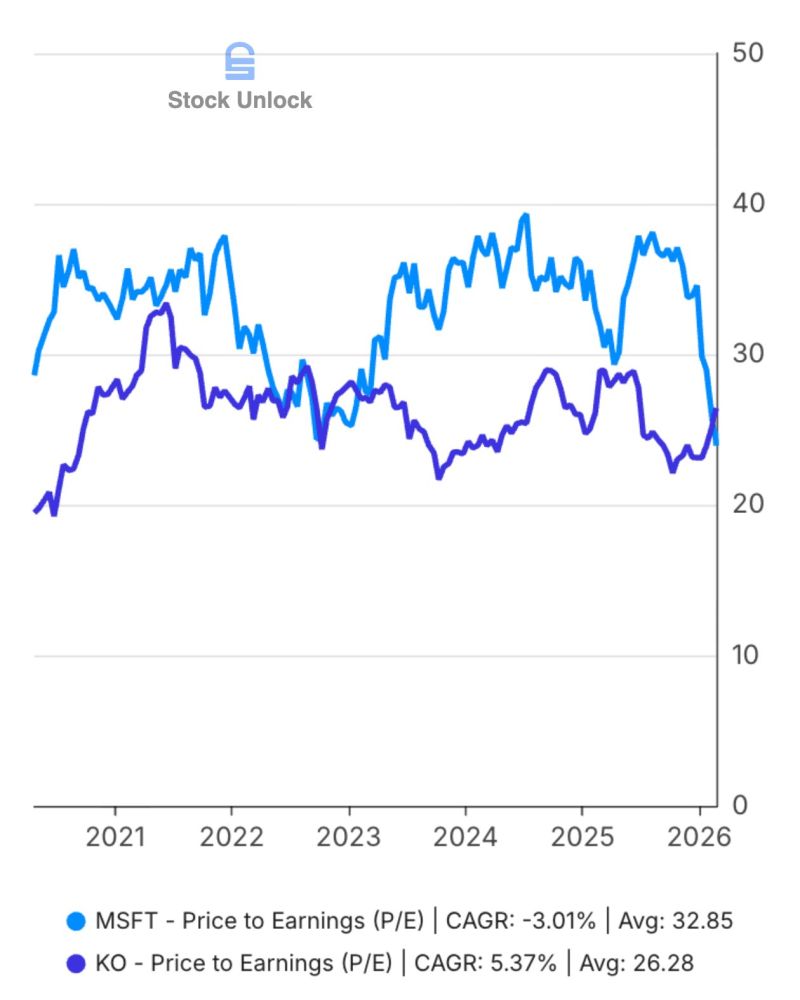

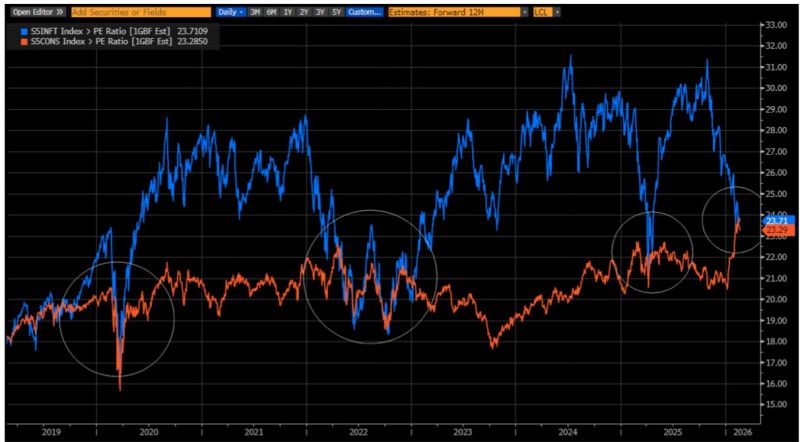

The Fwd P/E of the Tech sector is now at PAR with Consumer Staples.

In other words, the market is now valuing Tech at the same multiple as boring/slow growth Staples companies. That has only happened 3 times in the last 7 years: COVID, the 2022 Bear Market, and Liberation Day. Source: David Marlin

Investing with intelligence

Our latest research, commentary and market outlooks