Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

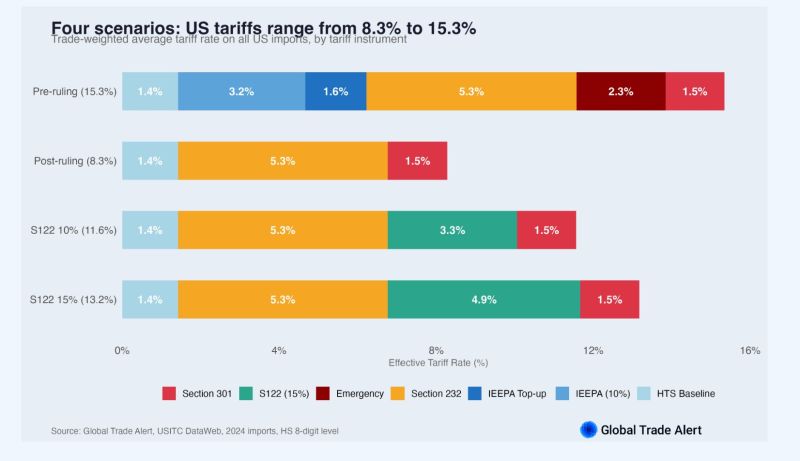

Us Tariffs range from 8.3% to 15.3%

The headline: The trade-weighted average US tariff rate is now 13.2% under Section 122 at 15%. That's down from 15.3% before the ruling, but well above the 8.3% that would have applied with no replacement. Source: Global Trade Alert

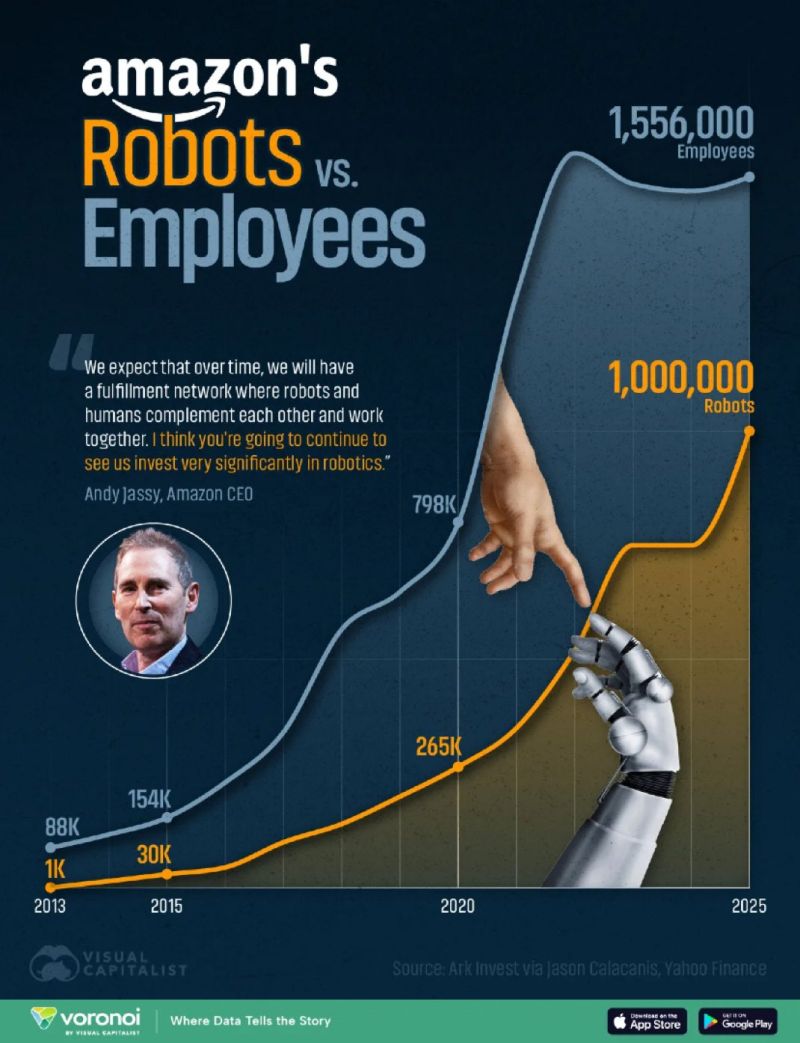

Amazon Is Hiring Robots While Cutting Human Jobs

Source: Visual Capitalist

Investing with intelligence

Our latest research, commentary and market outlooks