Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

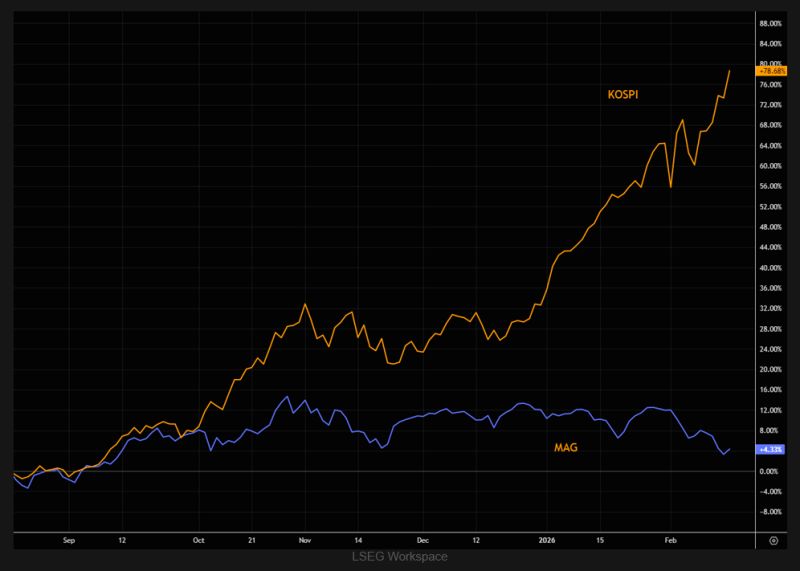

KOSPI vs MAG index performance over the past 6 months needs little commenting.

Source: TME

Alphabet $GOOGL fell below its 50-day moving average last week and now sits right at the 100-day

If that breaks, a return to the 200-day MA might be in play Source: Barchart

A tale of two tech markets semis versus software

Source. TME, Bloomberg / Kevin Gordon

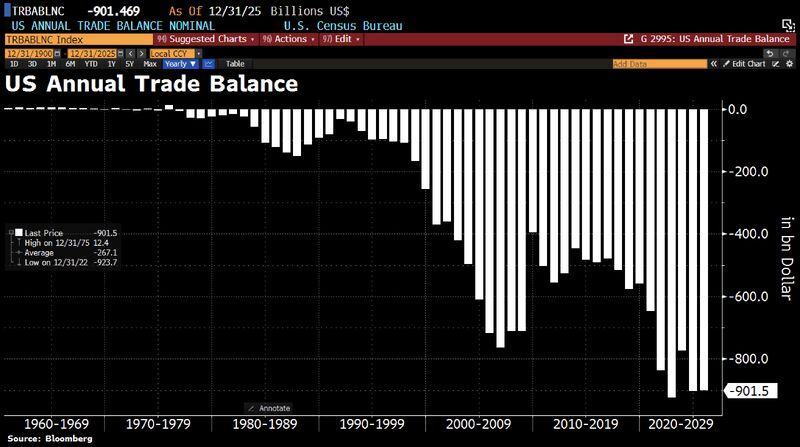

The U.S. trade deficit for 2025 remained in the red at $901.5 billion

This marks one of the largest gaps in history, slightly down (0.2%) from the $903 billion recorded in 2024, despite new tariff policies. December 2025 saw a sharp 32.6% rise in the deficit to $70.3 billion due to surging imports. Source: Bloomberg

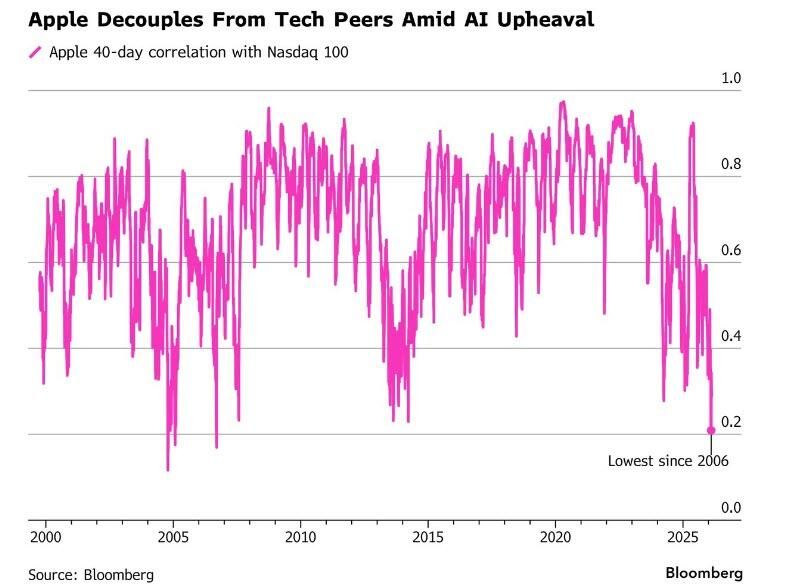

Apple’s 40-day correlation to the Nasdaq 100 Index tumbled to 0.21 last week, the lowest since 2006, according to data compiled by Bloomberg.

Its correlation with the benchmark has been on the decline since May, when it reached 0.92, as Apple’s decision to mostly sit out the AI arms race has turned it into an outlier compared with many of its rivals. Source: zerohedge

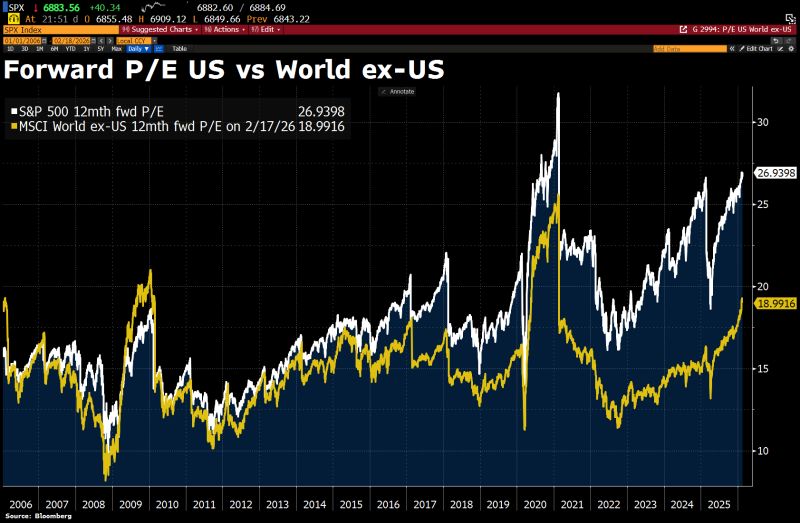

Although global markets have narrowed the gap with the US in recent weeks, US equities still trade at a roughly 40% valuation premium to the rest of the world.

That premium could shrink further if big tech companies lose their capital-light appeal due to rising capex and begin to be valued more like capital-intensive businesses. Source: HolgerZ, Bloomberg

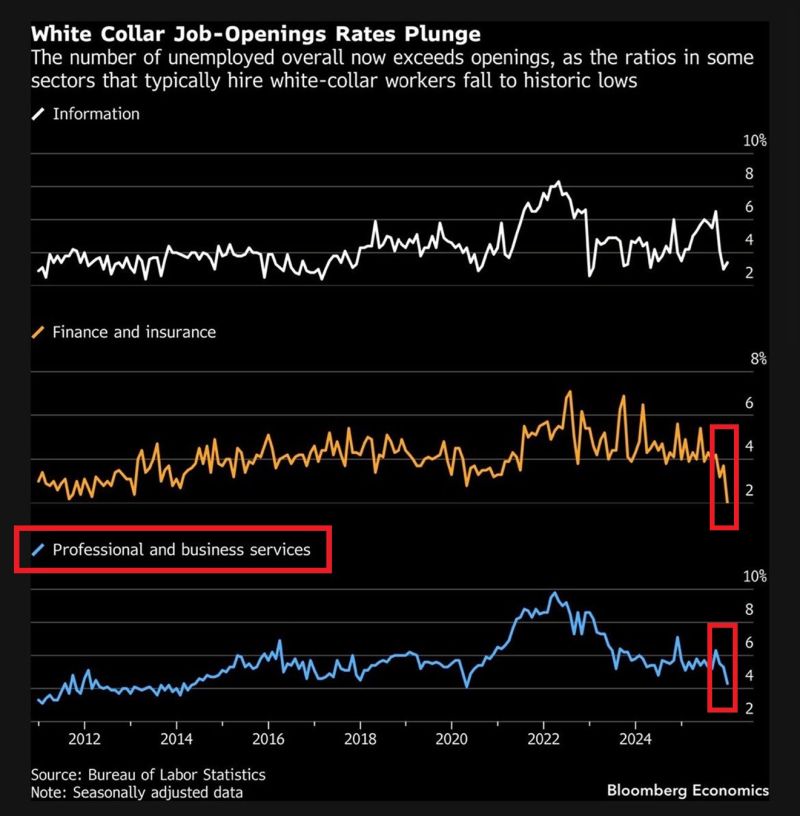

US white-collar recession is getting WORSE:

Job opening rates in key white-collar sectors are plunging to historic lows, according to BLS data. Finance and insurance rate is down to ~2%, the lowest in at least 14 years. Information sector openings are down to ~3%, near the cycle lows. Professional and business services FELL to ~4%, the 2nd-lowest in 12 years. All 3 sectors have seen openings fall -50% or more from their 2022 peaks. Source: Global Markets Investor, Bloomberg

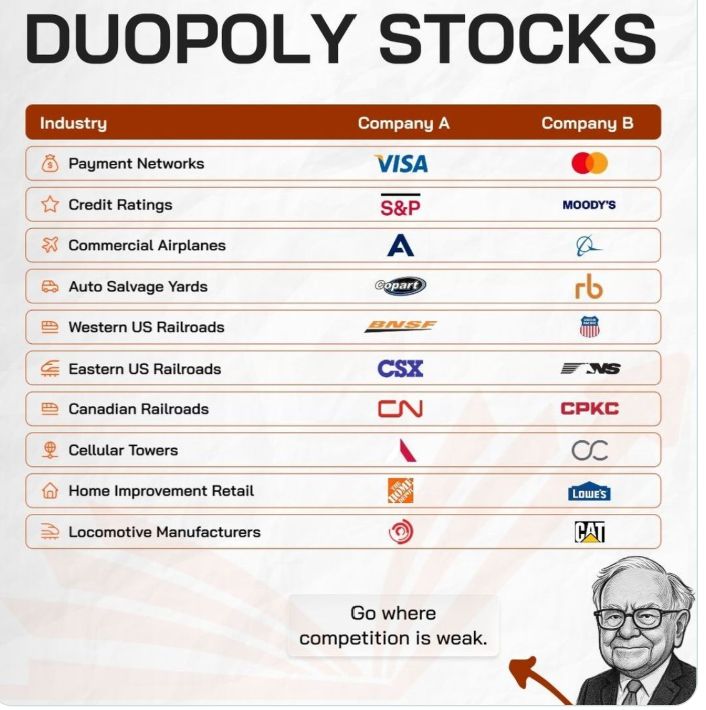

Among the strongest duopoly stories in the world

NB: These are NOT investment recommendations Stocks World @anandchokshi19

Investing with intelligence

Our latest research, commentary and market outlooks