Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

What’s worrying billionaires?

• Trade tensions, geopolitics, and policy uncertainty top the list • Tariffs dominate in Asia-Pacific and inflation and conflict lead fears in the Americas Source: Visual Capitalist

Blue Owl permanently halts redemptions at private credit fund aimed at retail investors

Blue Owl Capital Corp II (OBDC II) has halted regular withdrawals from its retail debt fund, shifting to "episodic payments" after redemptions surged 20% in early 2025. The firm sold $1.4B of assets at near-par to manage liquidity, highlighting strong underwriting despite fund pressures. The case shows that illiquid private loans in retail structures carry risks, and liquidity is crucial when markets tighten. Source: FT

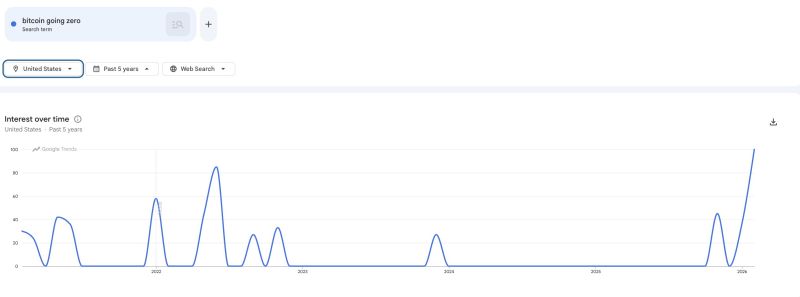

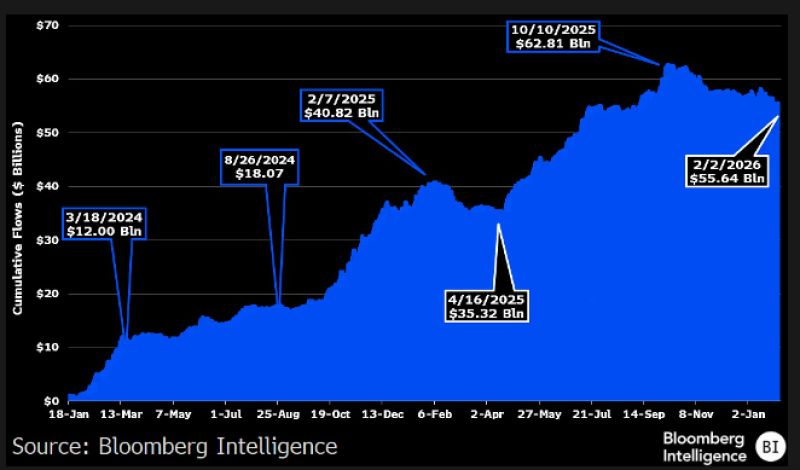

Bitcoin ETF's cumulative net inflows peaked at +$63B in October. Today (after the "massive" outflows) it's +$53B. That's NET NET +$53B in only two years.

Initially, most predictions were for $5-15B in the first year. This is an important context to consider when looking/writing about the $8B in outflows since 45% decline and/or the relationship between $BTC and Wall street, which has been overwhelmingly positive. h/t @JSeyff

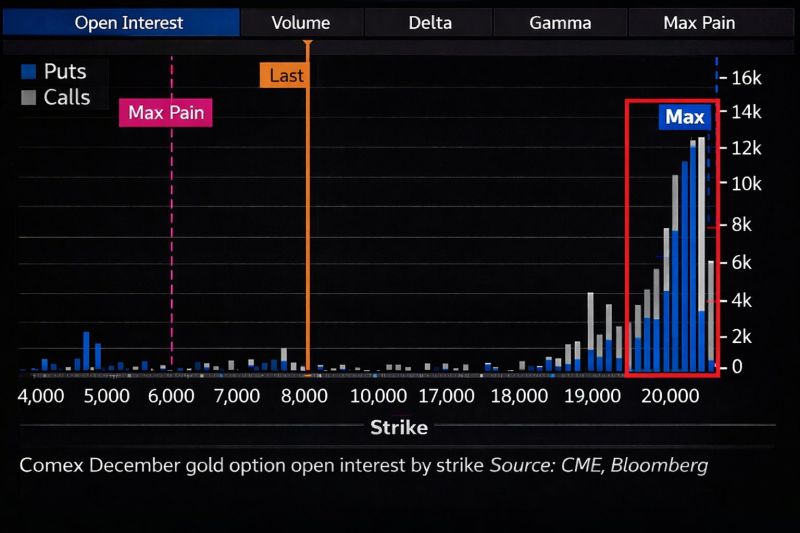

THE BIG MONEY IS QUIETLY POSITIONING FOR A GOLD EXPLOSION.

While retail investors are panic-selling the dip, the "smart money" is doing something absolutely radical. I’m looking at the COMEX data, and the numbers are staggering. The Strategy: Insiders are loading up on gold options with strike prices between $15,000 and $20,000 for December 2026. The Context: Current Gold Price: ~$4,961 The Target: A 3x to 4x increase in value. Here is the part most people missed: This buying spree didn't happen during the hype. It started right after gold hit $5,600 and "dumped" hard. When the price dipped below $5,000, retail investors ran for the exits. They saw a correction; the insiders saw a generational entry point. Right now, they are sitting on over 11,000 contracts. Why does this matter? Because you don’t place a bet that gold will triple out of "optimism." You do it because you see a fundamental shift in the global financial system that others are ignoring. Source: Alex Mason @AlexMasonCrypto

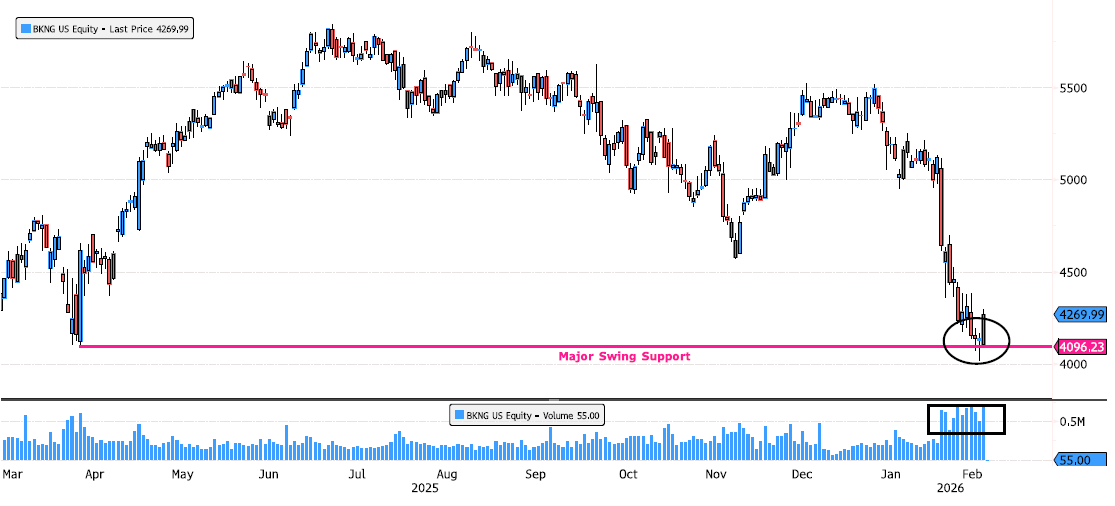

Booking Holdings (BKNG) – Swing Support Holding on Earnings

Booking Holdings (BKNG) rebounding right where it matters — on major swing support during earnings week. After consolidating 31% over the last 32 weeks, the stock has now tested the 4096 key swing level for three consecutive sessions. 👉 Important detail: Price pierced intraday, But never closed below 4096 That tells us institutions were willing to defend the level. Yesterday’s session printed a strong power bar, suggesting demand stepping in at support. Another key observation: Since topping around 5000, volume has been consistently elevated all the way down to the 4100 area. This isn’t a quiet drift lower. This is heavy participation. Now the question becomes: Is this accumulation at support… or just temporary stabilization before another leg down? 📍 Next level to watch: 4438 If price can build momentum and reclaim 4438, that would strengthen the case for a broader rebound and potential shift in short-term structure. Until then, 4096 remains the line in the sand. Source : Bloomberg

The World uncertainty index reaches the highest level in history, surpassing Covid, the Global Financial Crisis, and the Dot Com Bubble

Source: Barchart @Barchart

Investing with intelligence

Our latest research, commentary and market outlooks