Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

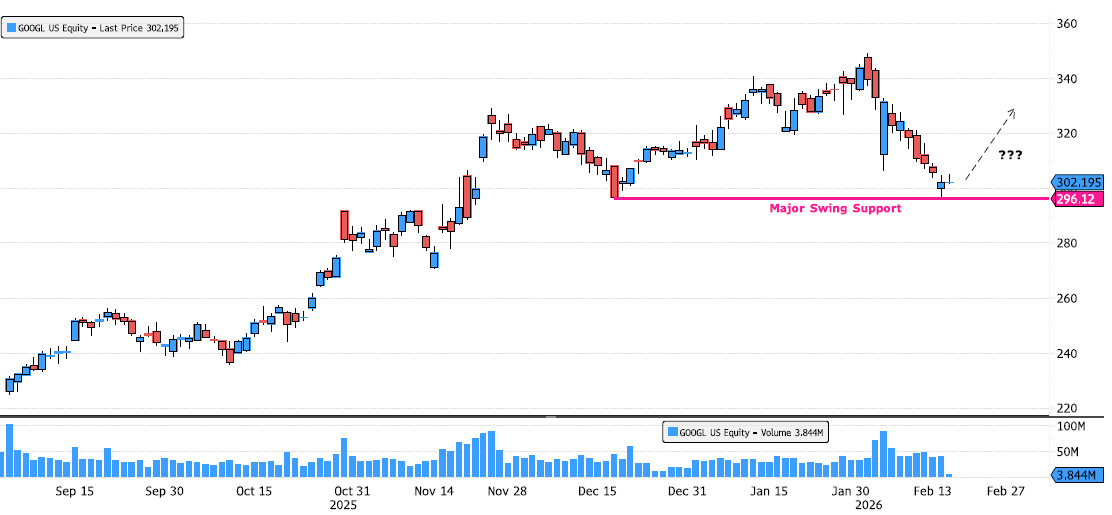

Alphabet Inc. back on swing support

The stock has consolidated roughly 15% since the beginning of February, digesting prior gains and working off overbought conditions. Yesterday’s session saw a rebound right on major swing support at 296.12, with an intraday low at 296.25 — a precise technical reaction that shouldn’t be ignored. It’s still a bit early to call for a confirmed reversal, but this level is clearly one to monitor closely. What would strengthen the bullish case? • 📈 A clear pickup in volume • 🟢 Strong follow-through candles off support • 🔁 Higher lows on lower timeframes • 💥 Reclaiming short-term moving averages If buyers step in with conviction, this zone could mark the start of the next leg higher. If not, a clean break below opens the door to further downside. For now, it’s about watching price + volume confirmation. Are you waiting for confirmation — or positioning early at support? Source: Bloomberg

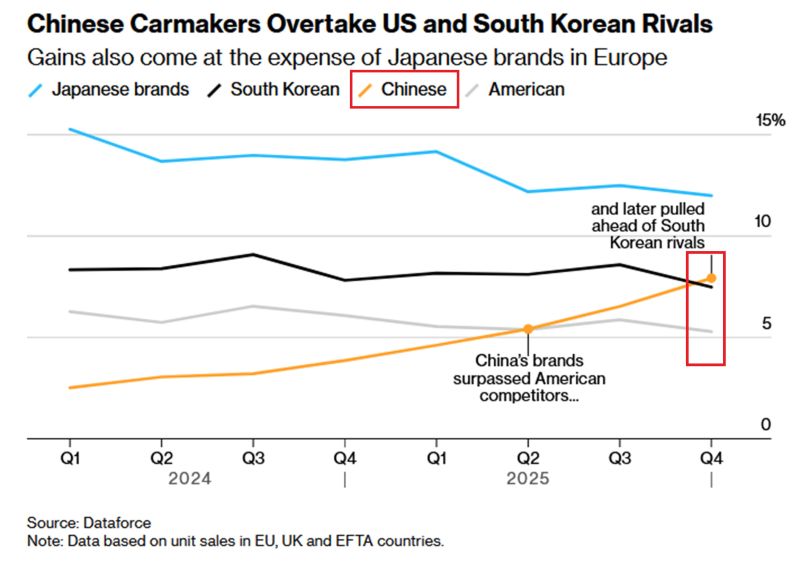

🚨Chinese carmakers are taking over Europe:

Chinese brands now represent a RECORD ~10% of all passenger cars sold in Europe. This surpassed both US and South Korean rivals for the 1st time EVER. Their EV market presence more than DOUBLED in 2025, to 11%, and hit 16% in December alone. Japanese brands remain the leaders at ~13% but at this pace China will overtake Japan as early as 2026. China is starting to dominate the global car market. Source: Global Markets Investor Bloomberg, Dataforce

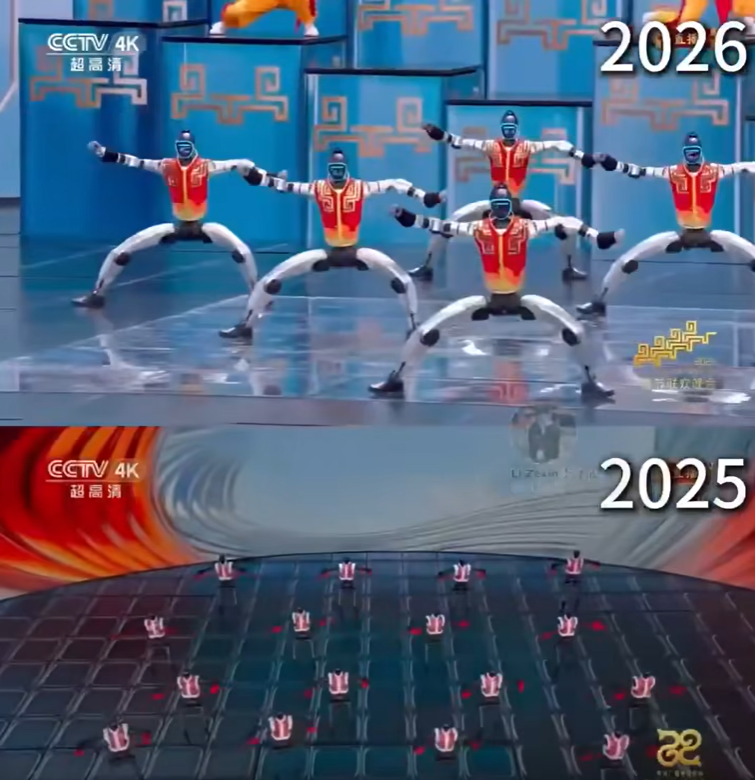

A mind-blowing robot kung fu show took place during China’s 2026 Spring Festival Gala (Lunar New Year Gala) on February 16.

It was entirely real not AI or CGI. Humanoid robots from Unitree Robotics performed synchronized martial arts routines with swords, poles, and nunchucks alongside children on live national television. Described as the world’s first fully autonomous humanoid robot kung fu performance, it highlighted major advances in balance, precision, and hardware within just 12 months. While commercialization still faces challenges like cost and reliability, the performance signals China’s rapid progress in humanoid robotics. Source: Evrim Kanbur (@WhileTravelling), Cyrus Janssen on X (@thecyrusjanssen)

Investing with intelligence

Our latest research, commentary and market outlooks