Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

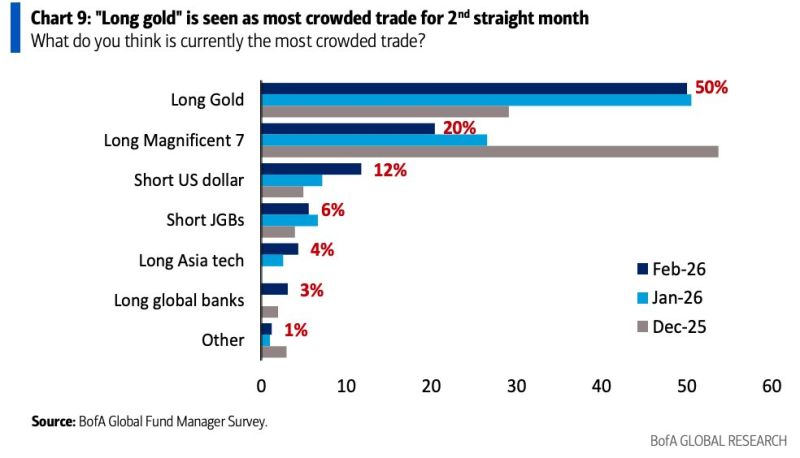

Long gold is by far the most overcrowded trade according to the latest BofA fund manager survey

Source: BofA Global Fund Manager Survey

Christine Lagarde is expected to leave the ECB before her term ends in 2027, aiming to give Emmanuel Macron and Friedrich Merz the opportunity to choose her successor.

With the French presidential election approaching, Lagarde may step down early to let Macron and Merz influence her ECB successor. Key stakes: filling the power vacuum, deciding among top contenders like Hernández de Cos, Knot, Schnabel, and Nagel, and shaping the ECB’s post-crisis legacy.

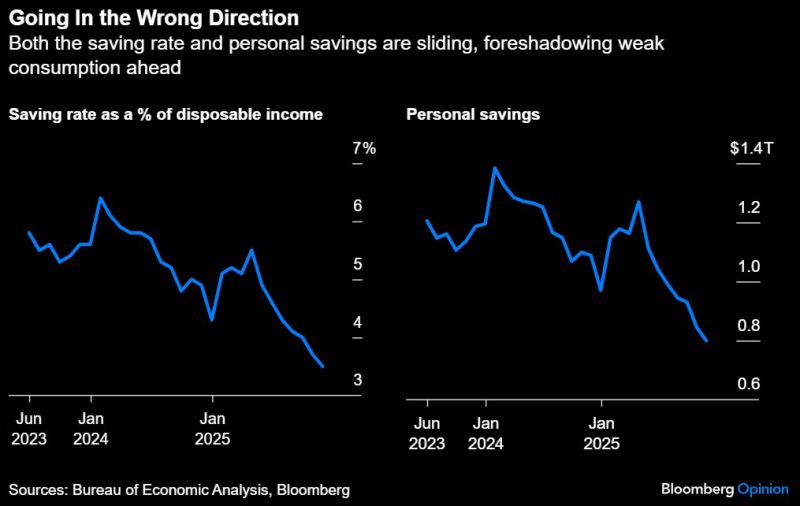

The K-Shaped Economy: Personal savings have dropped by -$469.2 billion since April, a decline of -37%.

The personal saving rate tumbled from 5.5% in April to 3.5% in November, the lowest since 2008, excluding the Covid-era distortions of 2020. Dwindling savings mean there’s less of a cushion to meet necessary payments, let alone make discretionary purchases. Delinquency rates on loans ranging from mortgages to credit cards rose to 4.8% in Q4, the highest since 2017. American's wallets are hurting. Source: Bloomberg, Hedgeye

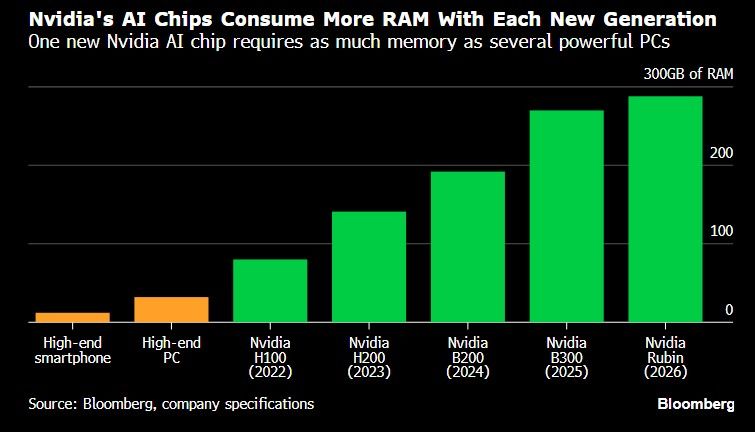

Wondering why memory chips stocks are on fire? Just watch the chart below courtesy of Bloomberg.

Nvidia's chips consume more RAM witch each generation. Rubin requires as much memory as several powerful PCs.

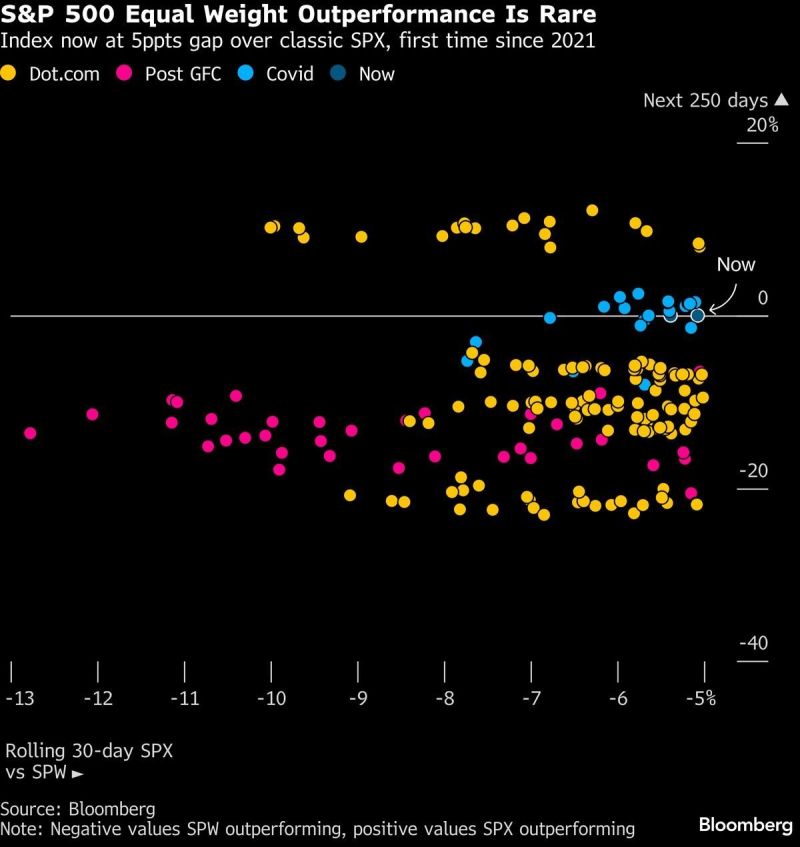

Fascinating study from Bloomberg: S&P Equal Weight outperformance was extremely rare historically:

1999-2002 Dotcom 2009 Post GFC 2020-2021 Covid “Those cases accompanied major shifts in the market.” “Equal-weight S&P managed to maintain some outperformance 250 days later.” “The big question: whether this is the start of an extended period of sharp moves around AI disruptors, and the disrupted.” Source: Macrocharts, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks