Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

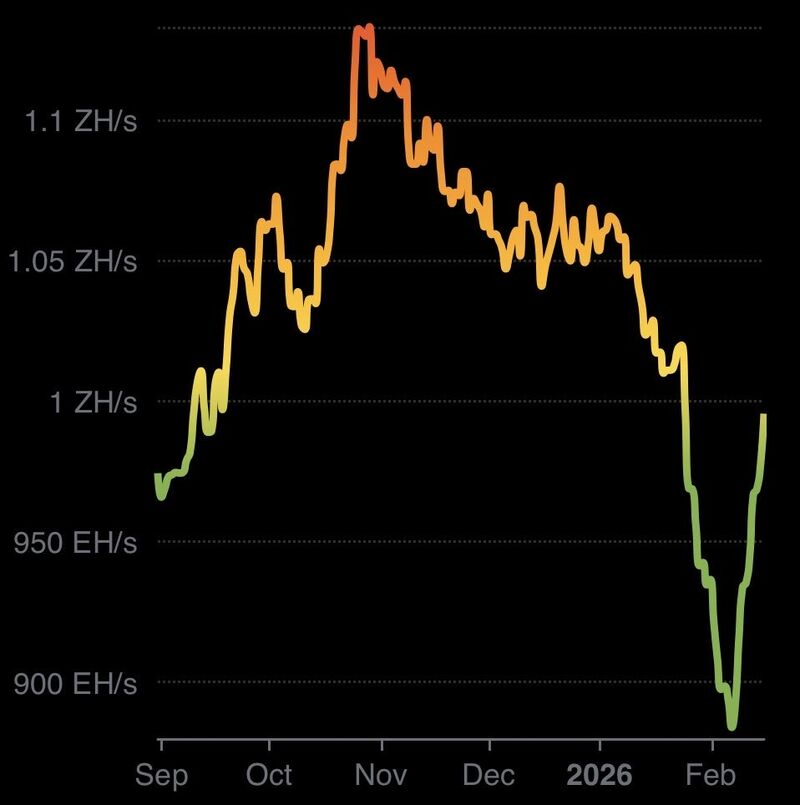

The February hashrate drop was a "perfect storm" that triggered an 11.4% downward difficulty adjustment, the largest since 2021.

Why it happened: - Texas Weather: Severe winter storms forced industrial miners to shut down to save the power grid (or sell their energy back for higher profits). - Price Correction: Bitcoin’s drop toward $60,000 made older rigs unprofitable. Some firms pivoted their hardware toward AI training for better margins. - Regulation: Renewed crackdowns on "gray" mining in Russia and China removed significant hardware from the network. The Result: The network has already begun a "V-shaped" recovery. The lower difficulty has made mining profitable again for the remaining operators, and hashrate is already bouncing back. This is actually one of the sharpest V shape recovery in hashrate we've ever seen. Source: ₿ Isaiah ⚡️ @BitcoinIsaiah

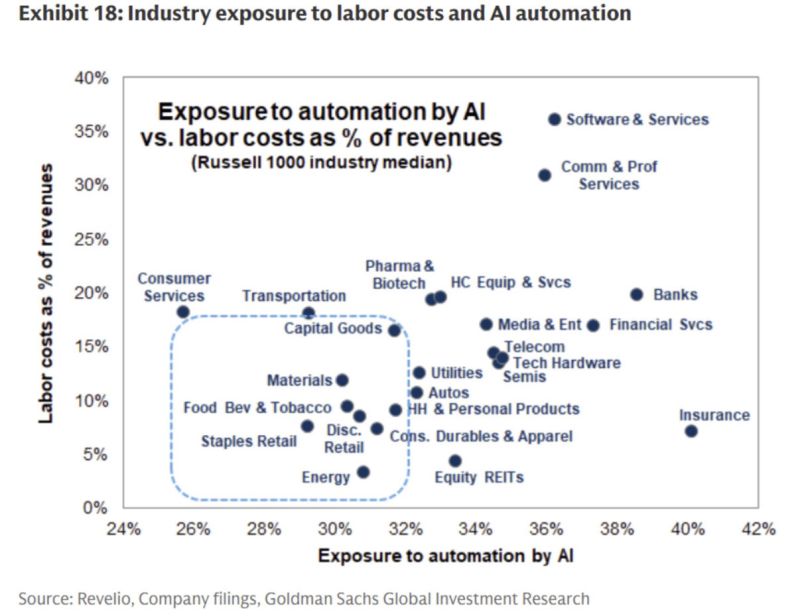

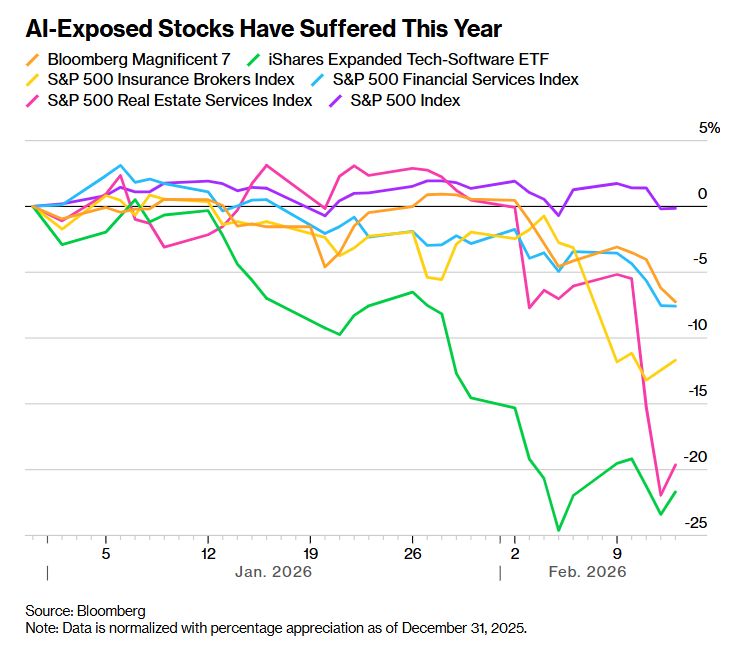

Banks and insurers might be longs as structural beneficiaries in the AI era.

Back office tasks get automated and margins improve. Software has a large opportunity to improve efficiency as well. Source: Greg @GS_CapSF

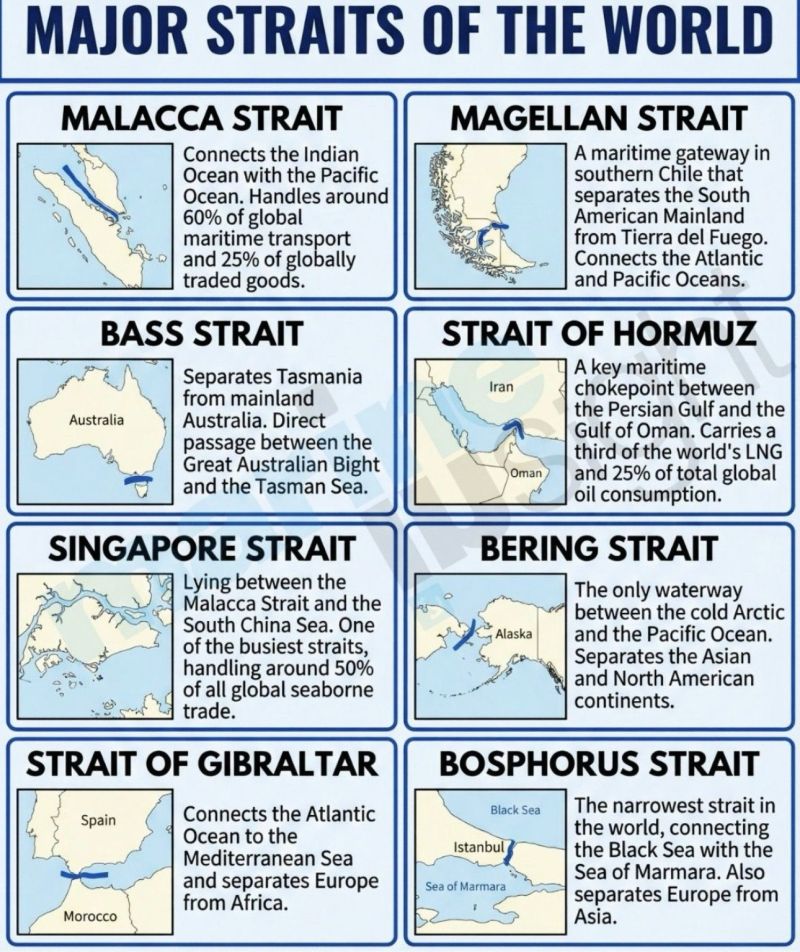

THE WORLD RUNS THROUGH 8 STRAITS

Here are the key chokepoints: • Malacca ~25% of global traded goods • Hormuz ~25% of global oil, ~⅓ of LNG • Singapore ~50% of global seaborne trade • Gibraltar Atlantic ↔ Mediterranean • Bosphorus Black Sea outlet • Magellan Atlantic ↔ Pacific backup • Bering Arctic gateway • Bass Australian passage These are pressure points. Close Hormuz... Oil spikes. Disrupt Malacca... Asia freezes. Block Bosphorus... Black Sea trade halts. Geopolitics isn’t abstract. It’s maritime geometry. Source: Jack Prandelli @jackprandelli on X

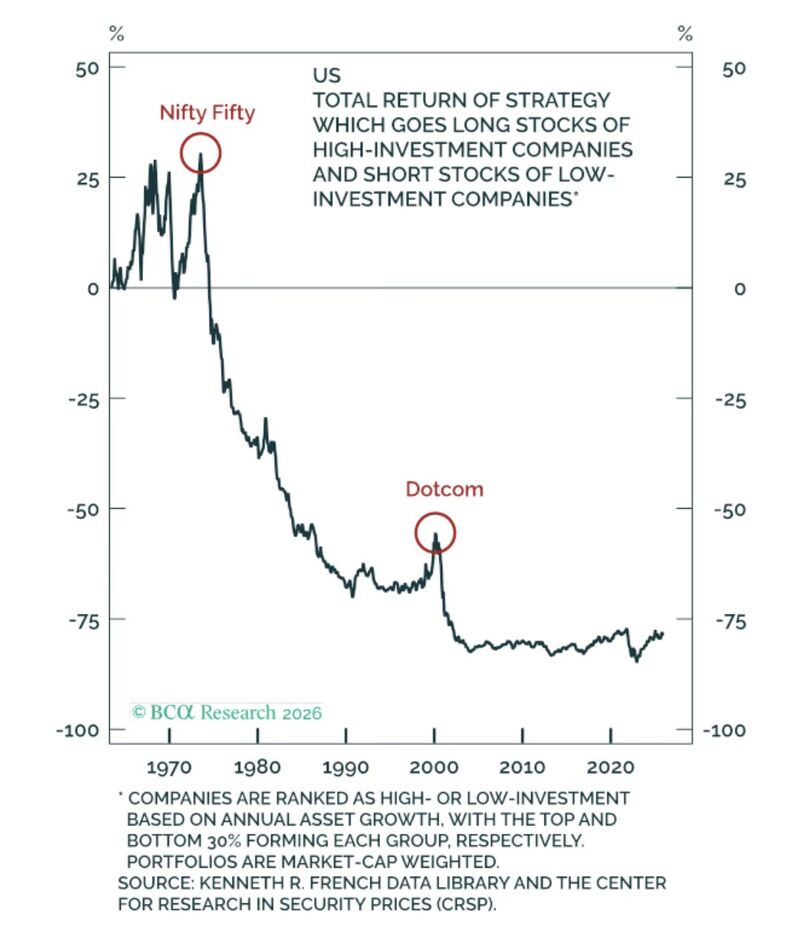

hey, capex is good. It will pay off” consider the historical record

Source: Peter Berezin @PeterBerezinBCA

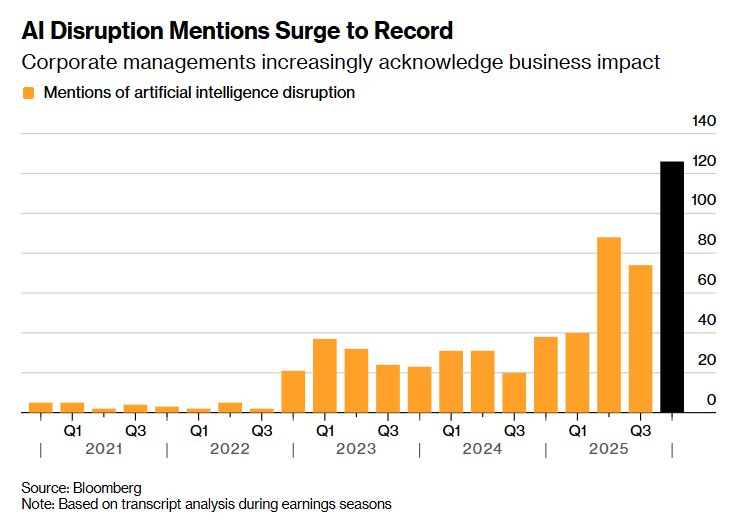

AI Risk Is Dominating Conference Calls as Investors Dump Stocks

Source: Bloomberg

A Stock Market Doom Loop Is Hitting Everything That Touche AI

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks