Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

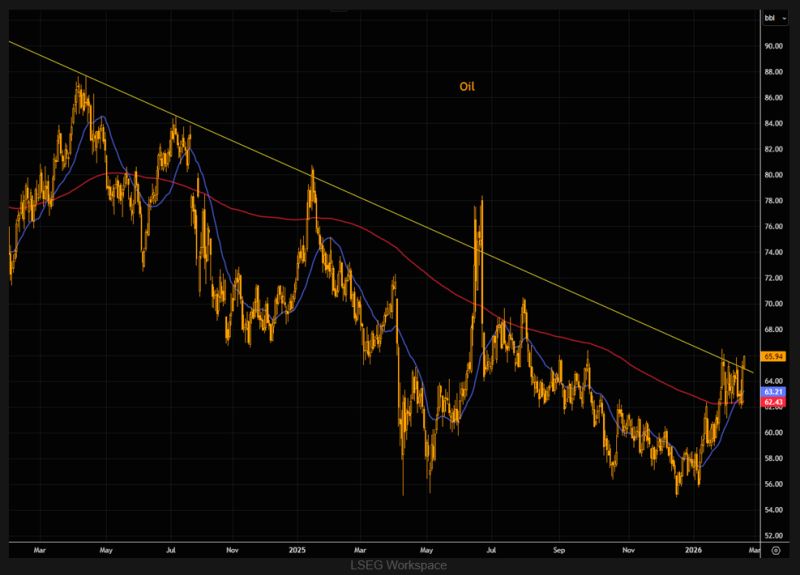

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

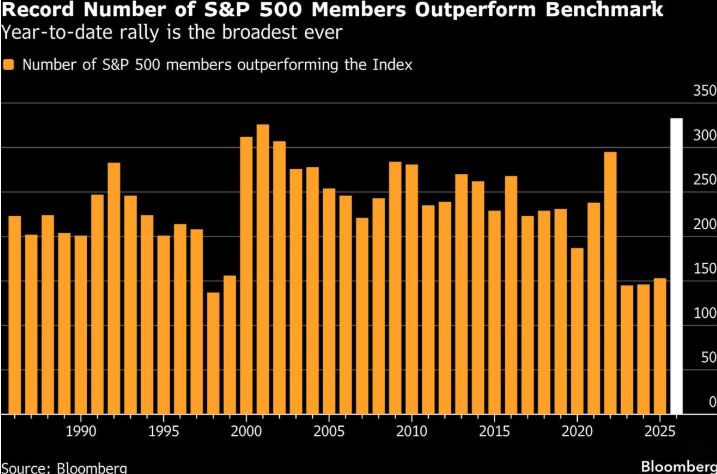

Number of S&P Stocks Beating Index Is at Record (Bloomberg)

Roughly 66% of the individual stocks in the S&P 500 are beating the index so far this year — which would put it on pace for the highest level of breadth in the market in records going back to 1986. Source: Bloomberg, Christian Fromhertz

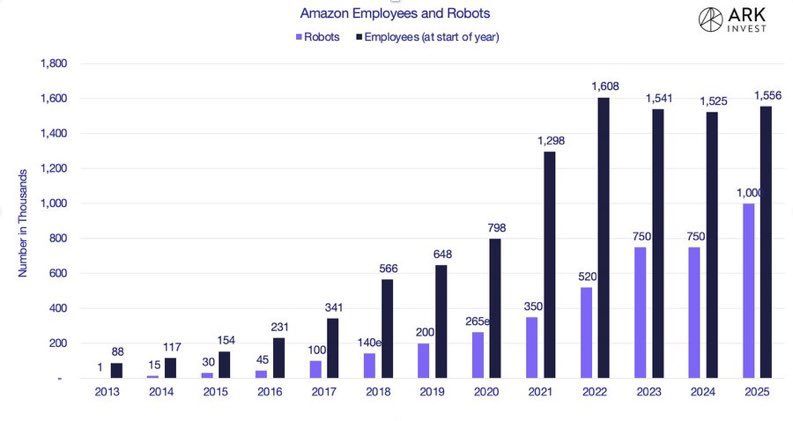

$AMZN has 1.5 million employees and deployed 1 million robots.

It’s actively replacing humans with robots as human/robot ratio declined from 3 in 2020 to 1.5 in 2025. Imagine what’ll happen to margins as the number of robots deployed passes the number of employees. Source: Oguz Erkan @oguzerkan Ark Invest

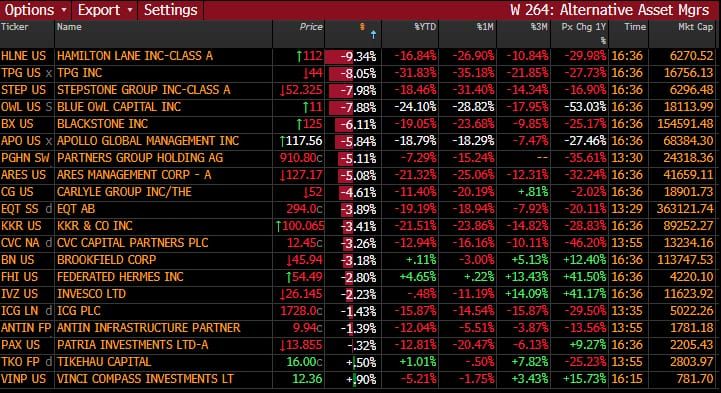

How are alternative asset managers stocks doing?

Source: Nico 15% only 🇨🇭🇹🇭 @NicoGladia

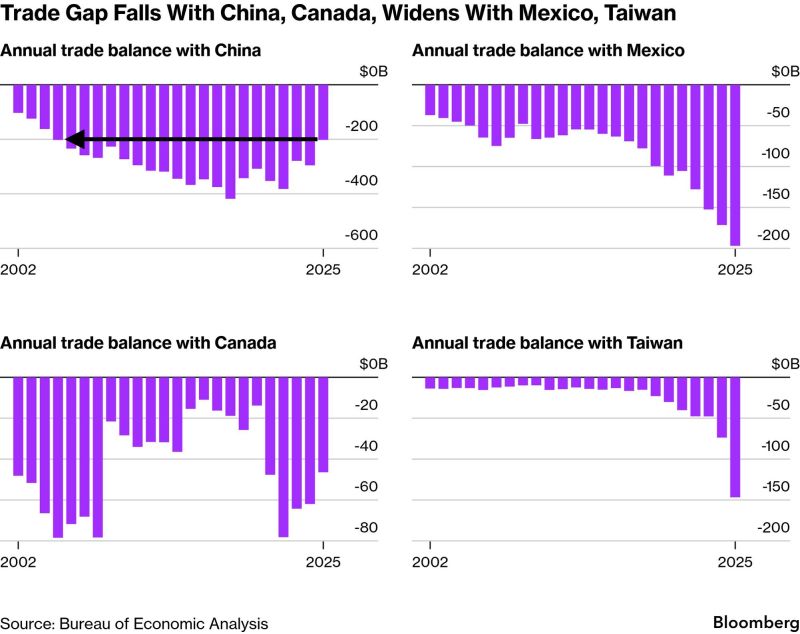

JUST IN: US Trade Deficit with China Shrinks to 21-Year Low

Source: zerohedge

Software stocks didn’t just pull back. They got repriced.

Le discours affirmant que le SaaS est mort se répand, mais la réalité est plus nuancée. Même les entreprises SaaS solides, avec des revenus récurrents, des clients fidèles et des bilans robustes, sont sous pression car l’IA transforme radicalement les règles du jeu : un seul développeur peut désormais créer des outils en quelques minutes, automatiser des processus et réduire le besoin d’équipes entières. Cela remet en cause leur capacité à maintenir des prix élevés, la nécessité d’un grand nombre d’utilisateurs, et la solidité de leurs avantages concurrentiels. Si l’IA réduit presque à zéro le temps de développement, les solutions isolées deviennent vulnérables, tandis que survivront surtout les entreprises disposant de données propriétaires, d’un fort réseau de distribution, d’une sécurité de niveau entreprise et d’intégrations profondes dans les systèmes. Ce n’est pas la fin du logiciel, mais celle des entreprises qui ne s’adaptent pas, et la reprise sera très sélective. Source : Danny Naz @ThePupOfWallSt

Shares of alternative asset managers tumbled on Thursday

After Blue Owl Capital Inc. restricted withdrawals from one of its retail-focused private credit funds, a fresh blow to a sector that’s faced heightened scrutiny in recent weeks. ... The selloff extended to Europe as big private equity players there tracked US peers lower in afternoon trading. CVC Capital Partners Plc fell as much as 4.5% in Amsterdam, while Switzerland’s Partners Group Holding AG slid as much as 5.3%. Source: zeibars @zeibars

Investing with intelligence

Our latest research, commentary and market outlooks