Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

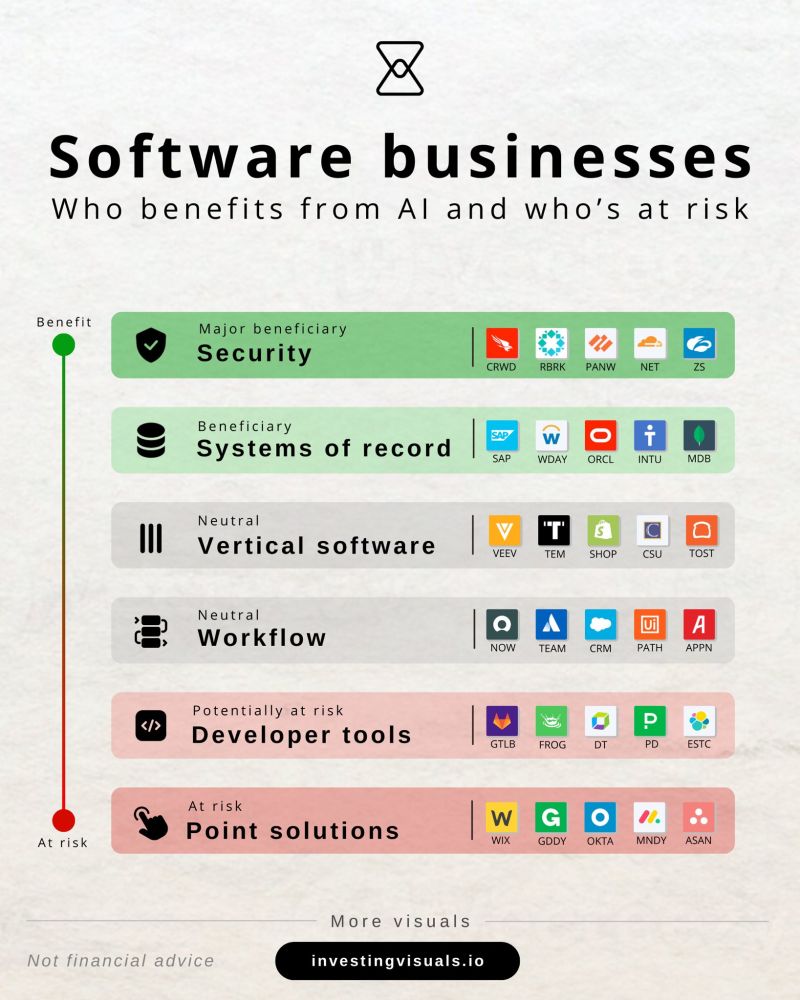

Here’s a mental framework by InvestingVisual on the software universe.

The market keeps selling off high quality names. Not all software is created equal, but the market is treating it like that. Some buying opportunities?

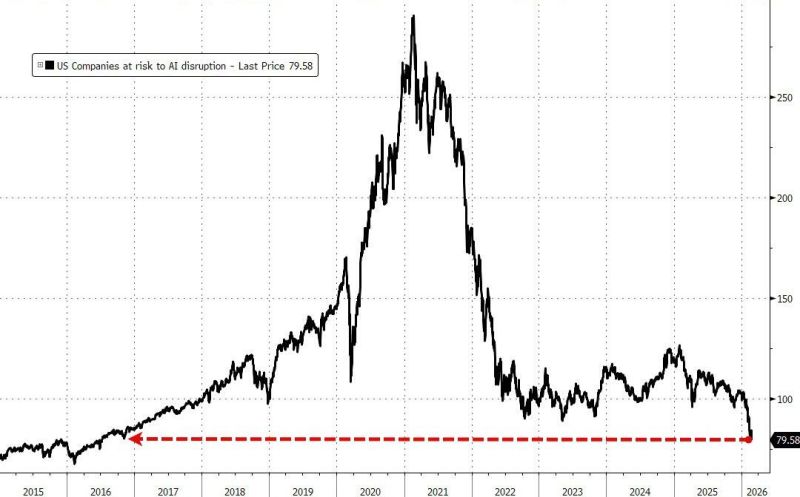

Yesterday, rising anxiety over the impact of AI disruption on multiple sectors resurfaced

exacerbated by a note from Citrini Research that was passed around getting over 20mm views, saying nothing new but re-highlighting the potential impact on jobs and tech firms in the next few years... “The sole intent of this piece is modeling a scenario that’s been relatively underexplored,” a preface to the article, which was published Sunday, said. “Hopefully, reading this leaves you more prepared for potential left tail risks as AI makes the economy increasingly weird.” Investors, once again, dumped shares of any company seen at the slightest risk of being displaced which lead Goldman's AI-at-Risk basket fell to its lowest since Nov 2016... Since: Bloomberg, zerohedge

After a landmark Supreme Court ruling struck down previous trade policies, the new 15% global blanket tariff is officially set to go live this Tuesday.

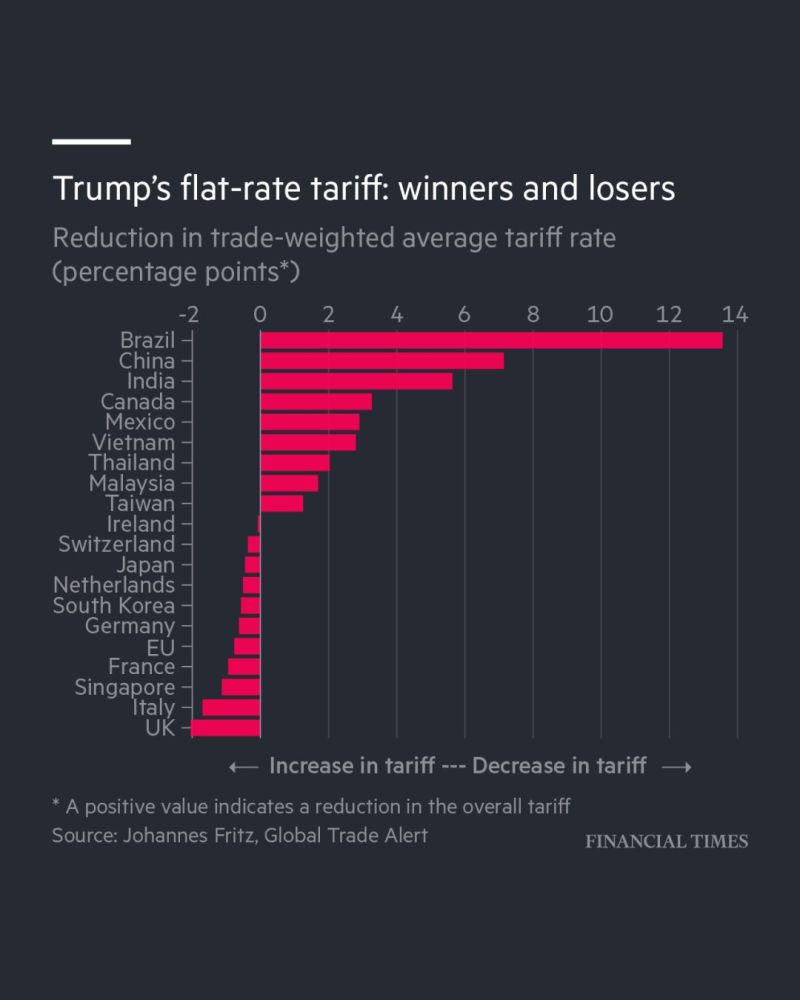

But the data reveals a massive irony that most people are missing. According to new analysis from Global Trade Alert, the very countries frequently singled out for criticism are set to see their average tariff rates drop the most. The Winners (The Surprise): Brazil: Enjoying a massive 13.6% reduction in average tariff rates. China: Seeing a 7.1% reduction. Vietnam, Thailand, & Malaysia: Set to benefit significantly as previous specific levies are replaced by the blanket rate. The Losers (The Allies): Traditional US allies—including the UK, EU, and Japan—are bracing for the biggest hit. They are moving from lower historical rates straight into the 15% line of fire. The Bottom Line: US Trade Representative Jamieson Greer is holding firm, stating the "urgency of the situation" demanded the jump from 10% to 15%. While this new regime is only valid for 150 days without Congressional approval, the message to global markets is clear: Volatility is the new constant. Source: FT

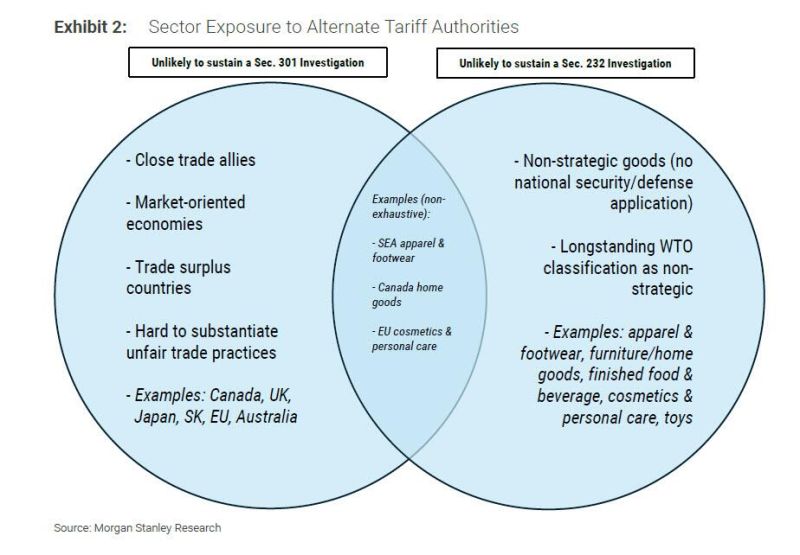

A trade-off between more uncertainty in the near term and a lighter tariff regime in the medium to long term

LONG-TERM: Morgan Stanley sees an opportunity for the President to alleviate some components of the existing tariff regime over time IN THE NEARER TERM: uncertainty will likely prevail in terms of which authorities will replace the existing tariffs, which sectors/countries will face more legally durable tariffs (Sec. 232/301 after months of investigation), and most importantly, what happens to the bilateral framework deals that are currently in place. That means the broader macro impact could be modest in the context of these two competing factors. Source: zerohedge

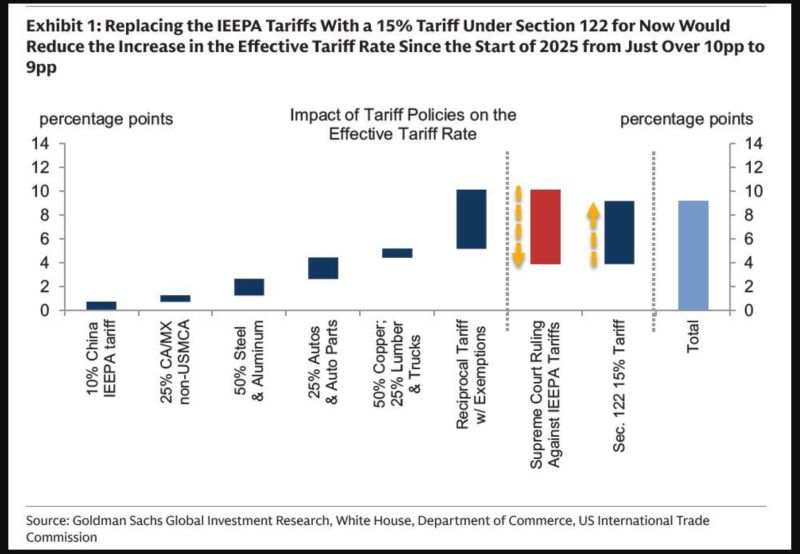

Replacing the IEEPA Tariffs With a 15% Tariff Under Section 122 for Now Would Reduce the Increase in the Effective Tariff Rate Since the Start of 2025 from Just Over 10pp to 9pp

Goldman Sachs estimates that the changes will reduce the increase in the effective tariff rate since the start of 2025 from just over 10% to about 9% once the Sec. 122 tariffs are implemented. Source: Zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks