Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

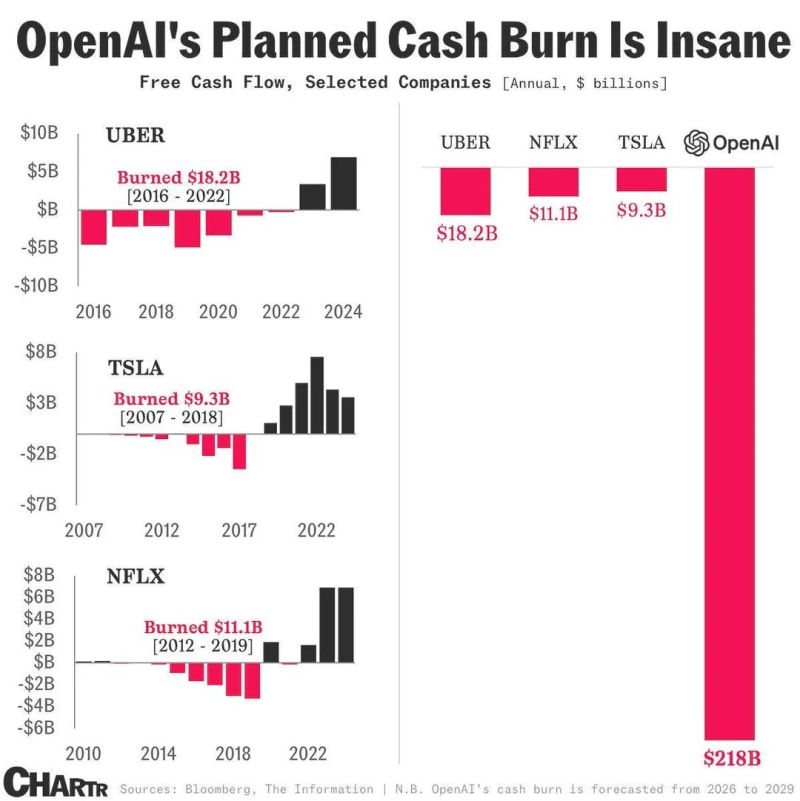

OPENAI IS ON TRACK TO BURN $218 BILLION AND THAT SHOULD MAKE PEOPLE PAUSE

OpenAI is projected to spend $218B from 2026–2029—far more than Uber, Netflix, and Tesla combined (~$39B)—while top AI researchers note that more compute now yields marginal gains (Source: Hedgie). Unlike companies with clear revenue paths, OpenAI is losing money on $200/month plans, chasing scale in a field with diminishing returns, driving GPU shortages and higher costs. Meanwhile, AI’s actual contribution to U.S. economic growth was minimal, raising questions about sustainability once investor optimism fades.

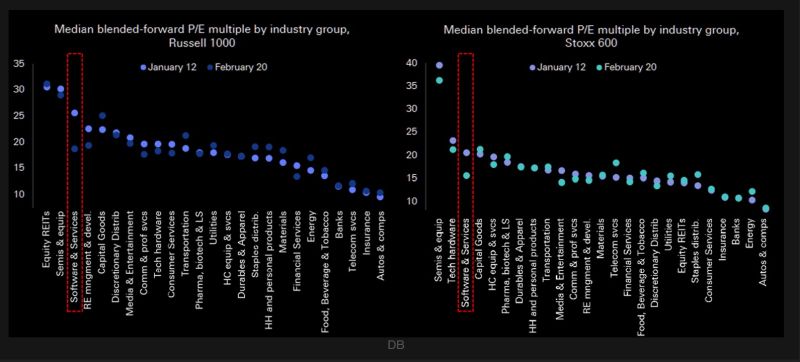

Software is deeply oversold (see below $IGV ETF) - Deutsche Bank seems to agree

1. DB argues Anthropic’s Enterprise Agents event reinforces that model providers are more likely to act as orchestration layers on top of incumbent software systems, not replace them, given the deep data, workflows, and metadata embedded in existing platforms (“Claude is only as useful as the data it connects to”). 2. This supports DB’s prior view that AI displacement risk to core software is over embedded in current multiples, making the event incrementally positive for the software sector. 3. Risks remain, including pressure on software development costs, potential changes to the interaction layer that could lower switching costs, and increased competition around the “control plane” for agentic AI, though DB continues to see this dynamic as supportive for infrastructure and compute demand.

P/E multiples tell the story

Software & Services used to rank as the 3rd most expensive industry group, it now sits 9th (and has fallen from 3rd to 13th in Europe). Multiples are down roughly 5.8x globally (around 5x in Europe), a re-rating unmatched by any other industry group. Source: DB, TME

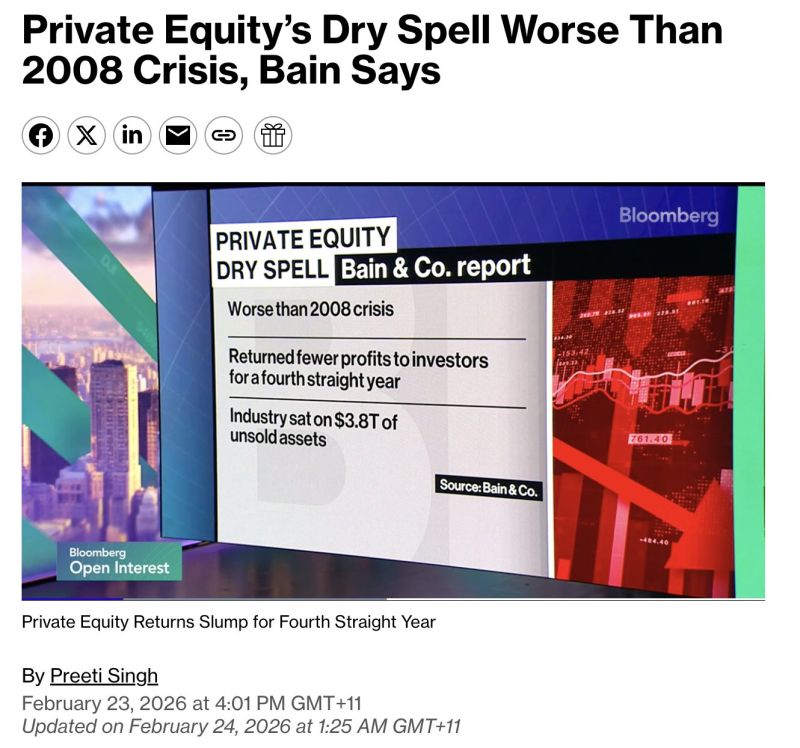

Jamie Dimon is warning about “people doing dumb things,” while Boaz Weinstein believes private credit is still in the very early innings of the wheels starting to come off.

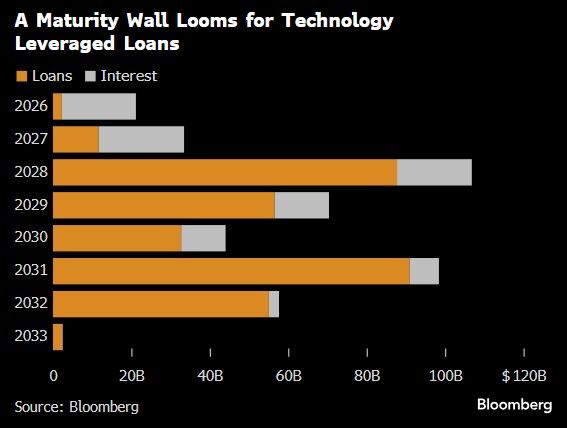

Few areas feel more topical right now than software-backed loans. If anything, it looks like we’re still about two years away from the real surge in extend and pretend activity. Source: RBC, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks