Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

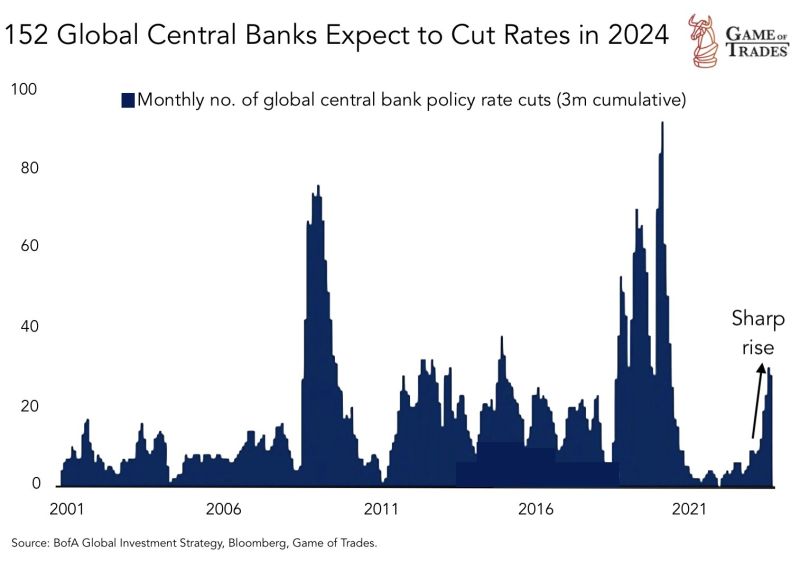

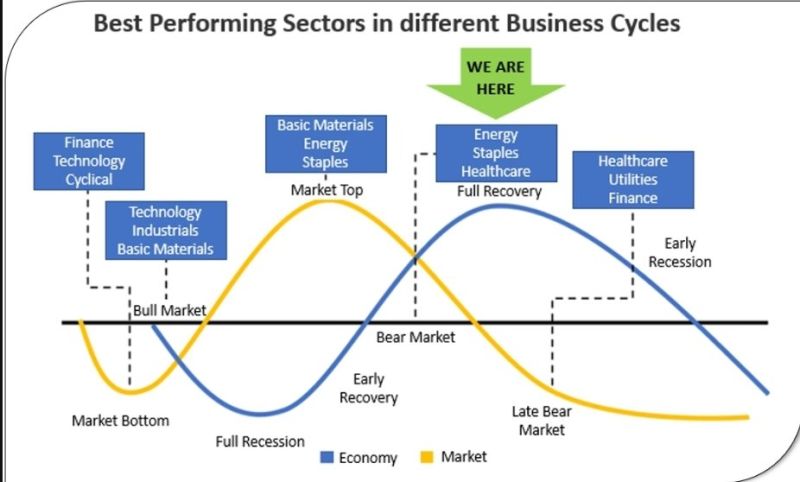

After an aggressive tightening cycle, 152 centralbanks around the world expect to cut rates in 2024, including the Fed.

Source: Games of Trades

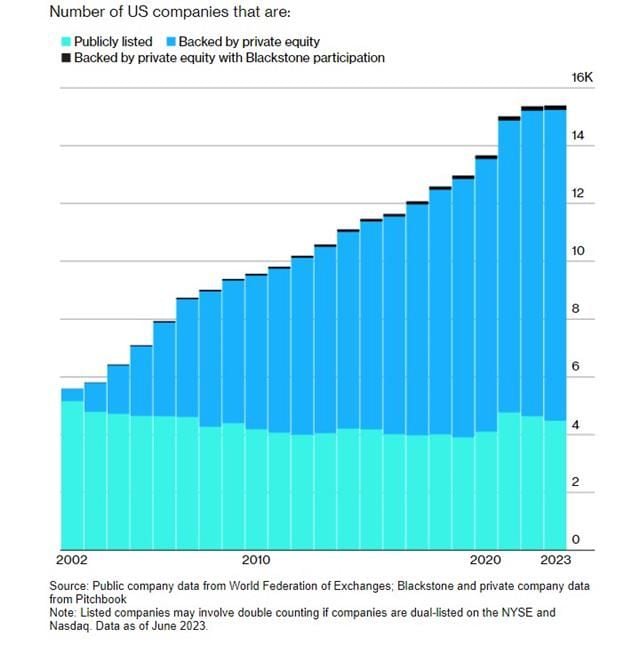

More and more companies are staying private for longer, avoiding IPOs until much later in their growth cycle (if they get there at all).

Source: Markets & Mayhem

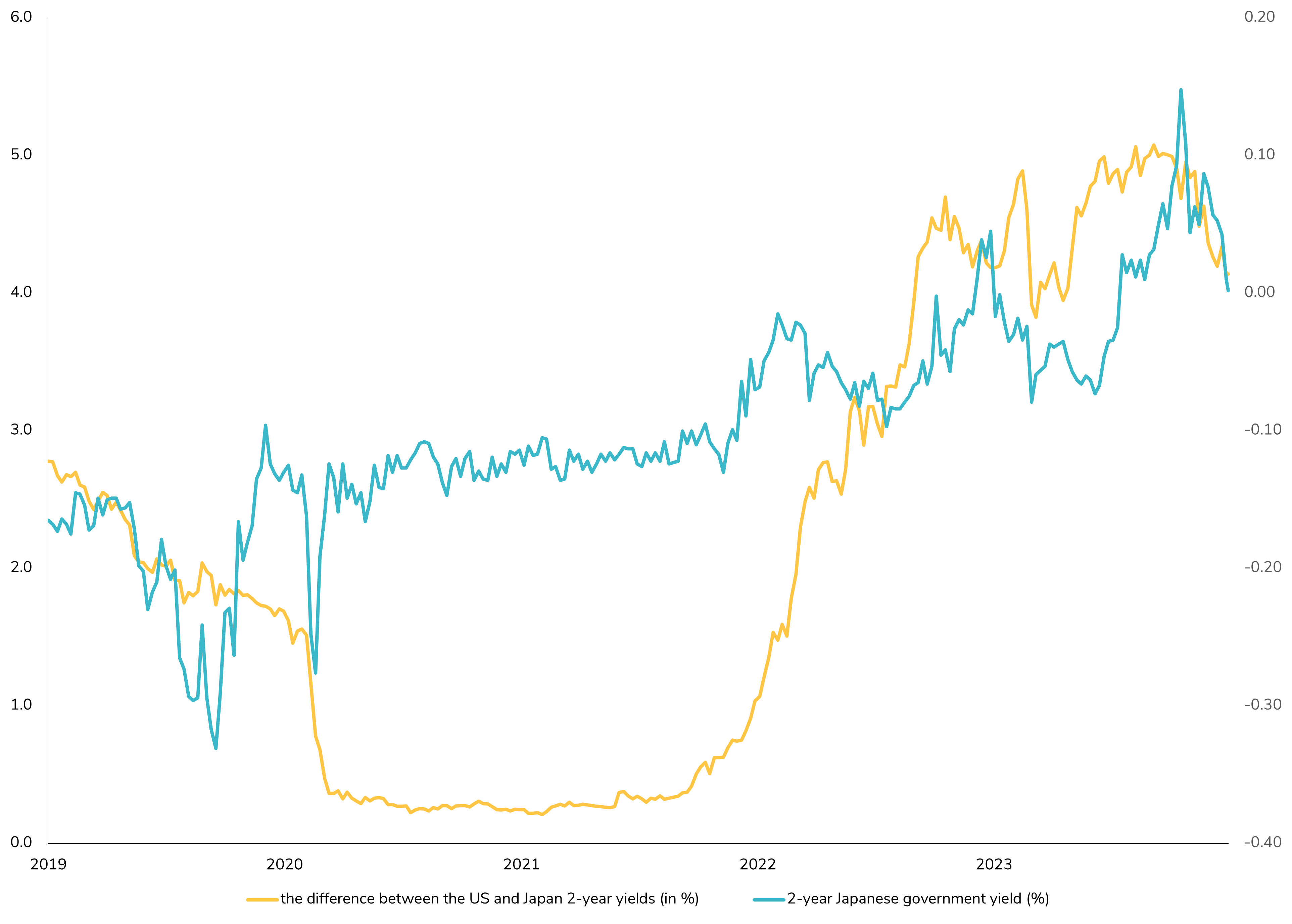

The 2-Year Japanese Yield Back in Negative Territory 📉

While the anticipation has been building for the Bank of Japan (BoJ) to exit its negative rate monetary policy in April 2024, the market seems to be taking a different turn. Today, the 2-year Japanese bond yield closed in negative territory. The BoJ has signaled its readiness to end the negative interest rate policy, but it's contingent on economic data and the outcomes of the March wage talks. Japan's path to normalization will be unique, as its economy still requires some level of monetary easing. The BoJ's terminal rate is projected to gradually reach around 0.5% over three to four years, potentially beginning with one or two rate hikes in the first year. However, the timeline for the BoJ to abandon its negative interest rate policy is now being seen as possibly extending further into 2024. Governor Kazuo Ueda's cautious statements, combined with unforeseen challenges like the recent earthquake, have led many economists to reconsider their forecasts, shifting expectations from January to potentially April or later. Stay tuned for more updates on this evolving situation. The Japanese monetary policy landscape is certainly one to watch closely in the coming months. Source: Bloomberg.

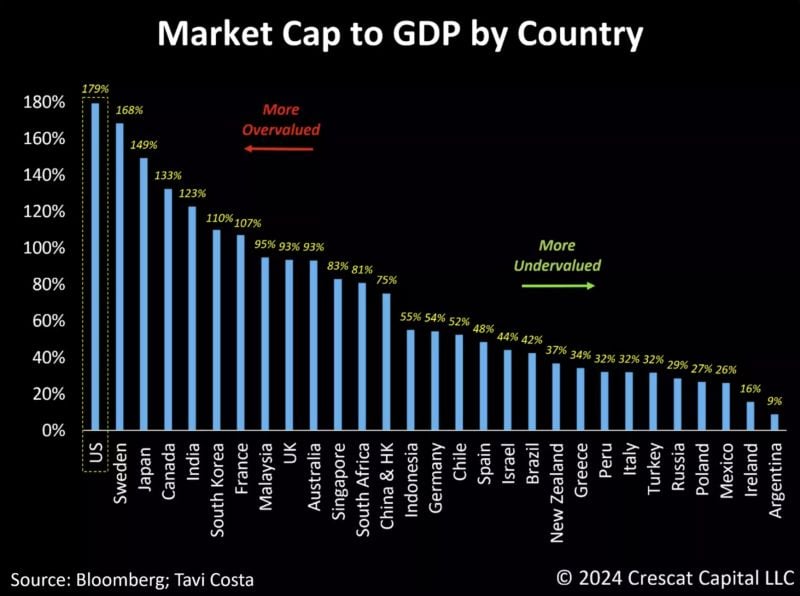

The current macro environment across global equity markets presents a sharply divided investment setup for 2024 and the remainder of the decade.

Source: Tavi Costa

Swiss inflation vs. German inflation.

The inflation rate in Switzerland is already well below the target of 2%. At 1.7%, it is a full 2ppts lower than the German rate. Source: Bloomberg, HolgerZ

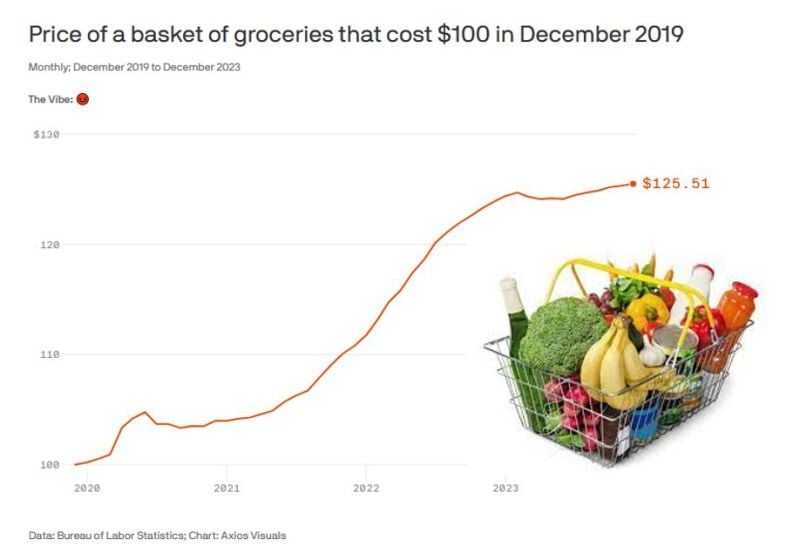

Your grocery bill has increased more than 25% over the last 4 years!

Source: barchart

Investing with intelligence

Our latest research, commentary and market outlooks