Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

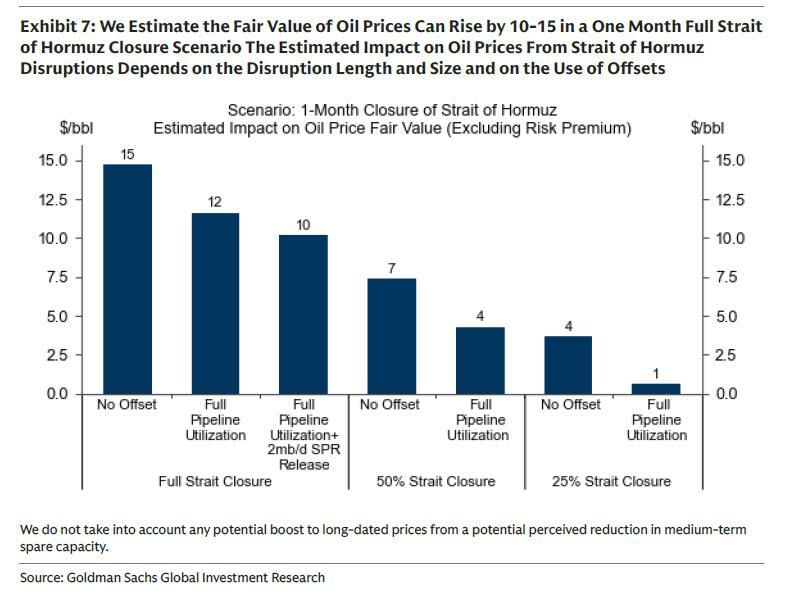

Goldman estimates the following effects on the fair value of oil prices in scenarios for one-month disruptions to oil flows through the Strait:

+$15 for a full one-month closure if there are no offsets (e.g. utilization of spare pipeline capacity, SPR release) +$12 for a full one-month closure if all estimated 4mb/d spare pipeline capacity is used +$10 for a full one-month closure if all estimated spare pipeline capacity is used and global SPRs are released for one month at a 2mb/d pace +$4 for a partial 50% one-month closure if all estimated spare pipeline capacity is used +$1 for a partial 25% one-month closure if all estimated spare pipeline capacity is used Source: Goldman Sachs, zerohedge

🚨 The cloud just became a battlefield. An Amazon Web Services data center in the UAE just got hit ‼️

For the first time in history, a hyperscaler data center was physically struck during a war. An Amazon Web Services facility in the hashtag#UAE went offline after “objects struck” it—AWS’s carefully chosen words for what appears to be missile or drone debris. Power was cut. One availability zone went dark. Others stayed up. If reports from The Jerusalem Post are accurate that the facility supported Israeli military workloads, the implications are massive: dual-use cloud infrastructure just became a legitimate military target. That collapses a long-standing assumption: Data centers are civilian assets protected by fences and biometrics—not by missile defense systems. AWS, Azure, and Google Cloud all cluster regions in the same conflict-adjacent corridor. Oracle operates infrastructure in Dubai Will Wall Street price in this new risk for the hyper-scalers? Source: Shanaka Anslem Perera

Goldman Sachs on near-term oil price outlook following start of Operation Epic Fury:

"Based on the 15% weekend gain in retail prices, we estimate an $18/bbl real-time risk premium in crude oil prices, which corresponds approximately to our estimate of the fair value effect of a six-week full halt in Strait of Hormuz flows (allowing for spare pipeline capacity use as a partial offset). This estimated impact moderates to +$4 if only 50% of the flows are halted for one month. However, oil prices can rise substantially more if the market demands a premium for the risk of more persistent supply disruptions." Source: Brian Sozzi

From Yardeni:

“.. in our short-war scenario, oil prices should fall in the coming weeks after a ceasefire .. boosting US consumer spending and benefiting global economies .. The weekend’s Middle East developments make us even more confident in our Roaring 2020s scenario.”

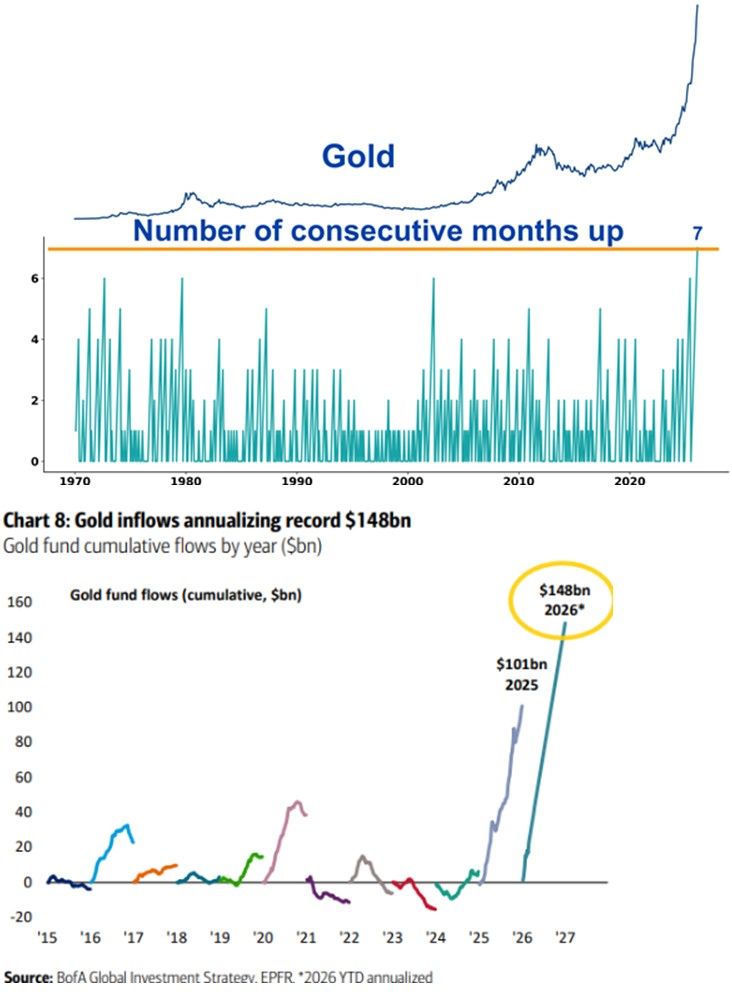

Gold just finished its 7th consecutive month higher, the longest streak in history.

Source: RBC, BofA

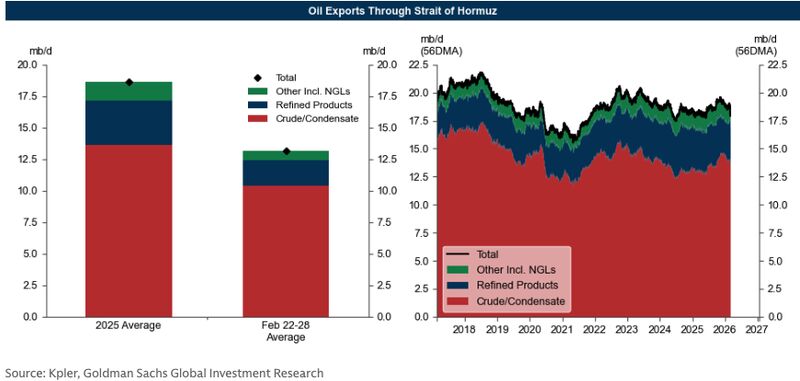

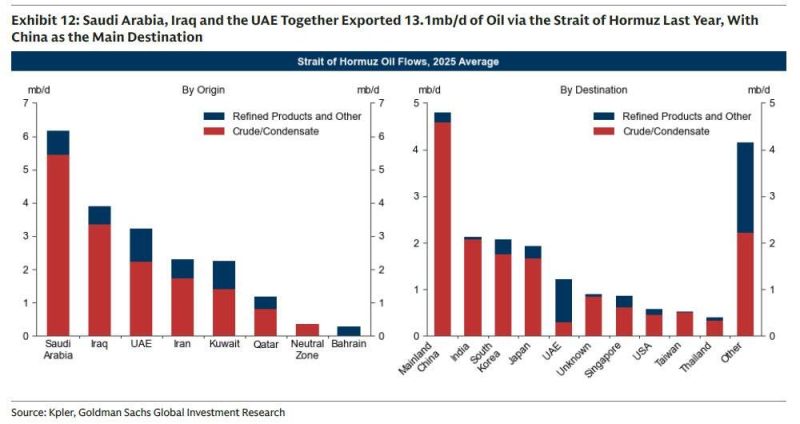

While prices are fungible, the biggest loser from a Hormuz closure in terms of actual physical oil is China

China is the main destination of the 13.1mm barrels of oil that passes through the Strait every day. Source: zerohedge, Goldman Sachs

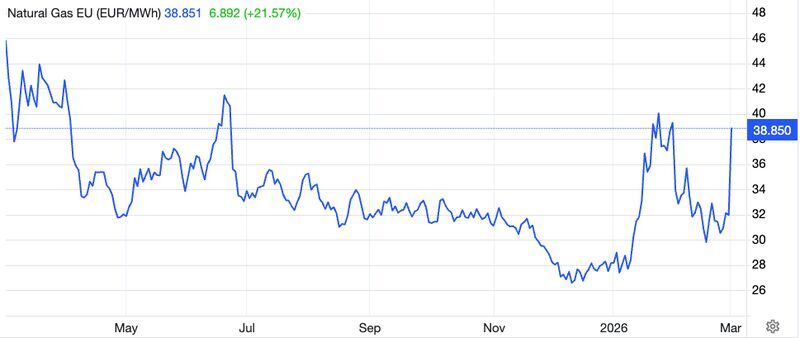

🚨 TTF +25% to ~€40/MWh Biggest day jump since Aug 2023. 8 month high.

Why? Hormuz risk = 15% of global LNG flows exposed, mainly Qatari cargoes. Europe replaced Russian pipeline gas with seaborne LNG. Now that LNG must pass the Gulf. Starting point isn’t comfortable: • EU storage ~31% vs ~40% last year • Germany ~20% • France ~21% Add: • Large speculative shorts • Forced short covering • Front-month panic buying If Qatari LNG is materially disrupted for weeks, analysts see €80–100/MWh possible. Source: Jack Prandelli

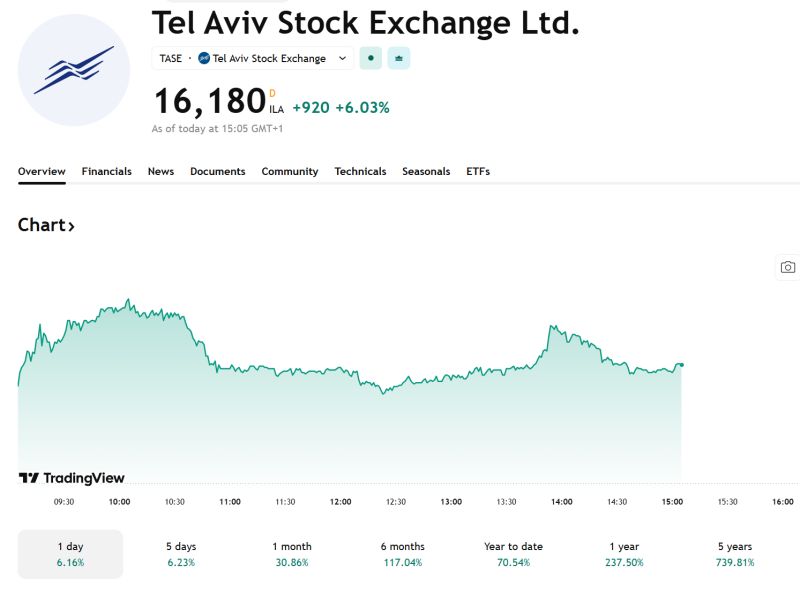

Israel’s stock exchange is up 8.85% in live markets now.

The local index is up 3.74% today as well. It looks absurd as missiles fly toward Israel. However, markets are likely pricing in the perception of a "decisive victory" and long-term risk reduction of Iran. Source: Trading View, Serenity

Investing with intelligence

Our latest research, commentary and market outlooks