Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

President Trump announced that the United States will provide insurance for "ALL Maritime Trade" via the US Development Finance Corporation (DFC), and will provide Navy escorts, "if necessary."

Effective IMMEDIATELY, I have ordered the United States Development Finance Corporation (DFC) to provide, at a very reasonable price, political risk insurance and guarantees for the Financial Security of ALL Maritime Trade, especially Energy, traveling through the Gulf. This will be available to all Shipping Lines. If necessary, the United States Navy will begin escorting tankers through the Strait of Hormuz, as soon as possible. Markets bounced and oil retreated on the news Source: zerohedge

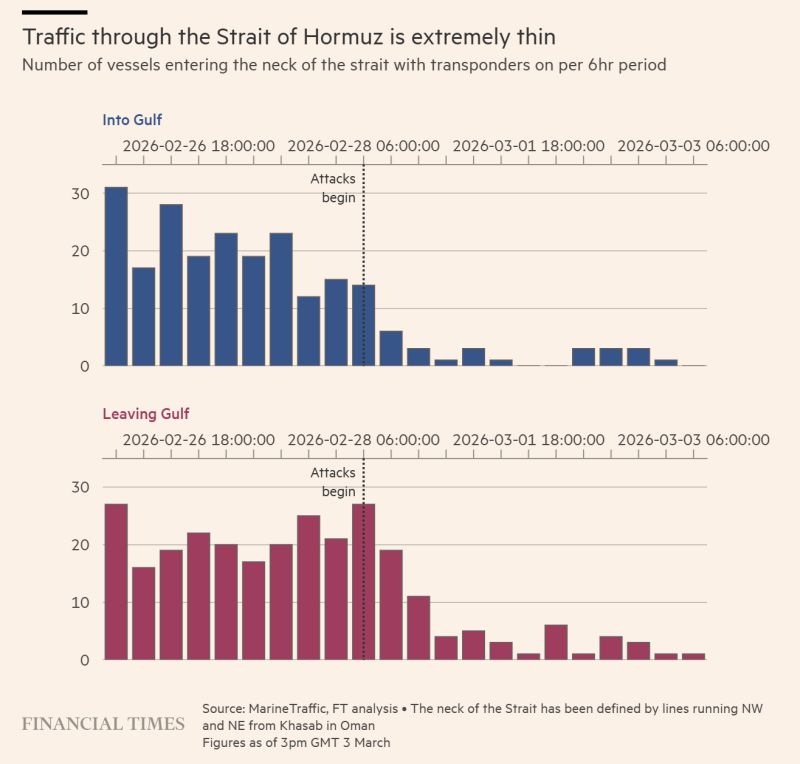

The FT graphic below shows the Strait of Hormuz flow.

(Note: likely understates flow because this will not capture tankers who are making the run with their transponders turned off) Source: Rory Johnston, FT

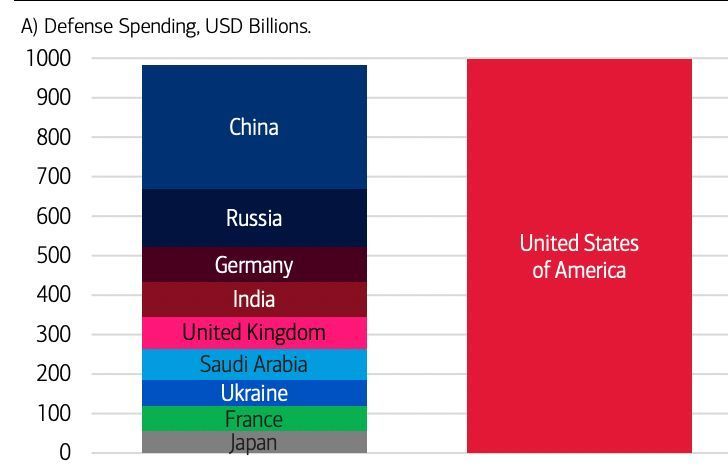

The US spends more on defence than the next nine countries COMBINED

Source: Cheddar Flow

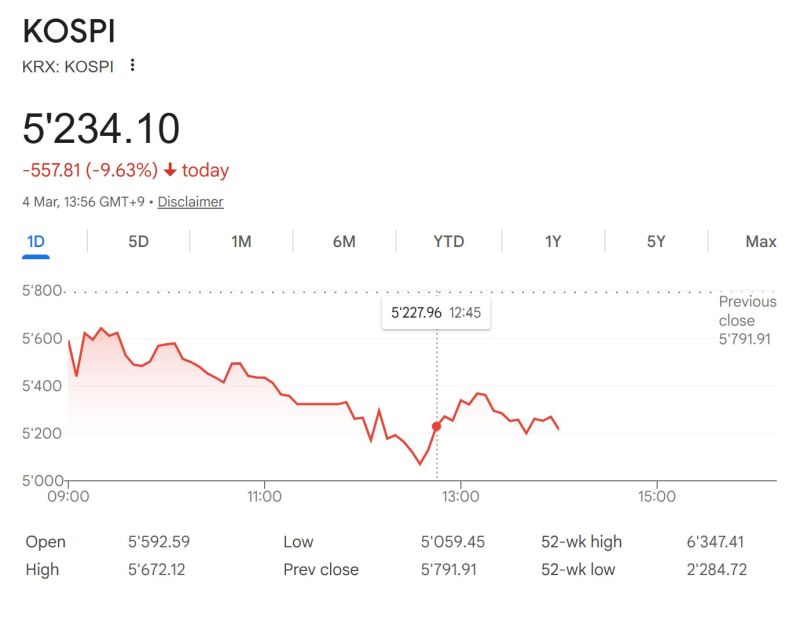

Everyone says the Korea market crash is about geopolitics.

That’s the surface story. The real story might be the biggest hidden risk in the AI boom. In 48 hours, the KOSPI fell 17%. $275B wiped out. Circuit breakers triggered. Tech giants took the hit: • Samsung −10% • SK Hynix −12% Most analysts blame rising tensions in the Middle East and oil above $80. But something deeper is being exposed. Samsung + SK Hynix control: • ~67% of global DRAM • ~80% of high-bandwidth memory (HBM) HBM is the critical fuel of AI infrastructure. Every AI datacenter depends on it. NVIDIA chips. Google TPUs. Hyperscaler AI clusters. And almost all of it comes from one country: South Korea. Here’s the vulnerability: South Korea imports 97% of its energy. Much of it flows through the Strait of Hormuz. The same strait currently under geopolitical threat. That means the AI supply chain may have a single hidden chokepoint: Not chips. Not talent. Not capital. Energy. Because semiconductor fabs cannot run without massive power. And global memory inventories are thin: • DRAM: ~2–3 weeks • NAND: ~3–4 weeks If energy flows are disrupted for more than a month, the entire AI infrastructure buildout could face delays. Markets are already reacting. While semiconductors crashed, defense stocks surged. Capital isn’t leaving Korea. It’s rotating into a new thesis: Energy security is the real constraint of the AI era. The market may have just discovered the weakest link in the AI supercycle. And it’s only 21 miles wide. (The Strait of Hormuz.) Source: Shanaka Anslem Perera ⚡

Double top?

Gold is printing a sizable down candle following yesterday’s shooting star formation. We may be looking at a second lower high developing, raising the risk of a potential double top. The steep trend line sits well below current levels, and the 50-day moving average doesn’t come in until around $4,830. Source: The Market Ear

Despite all things going on, the 6700/7000 range remains intact.

At least for now... Source: TME

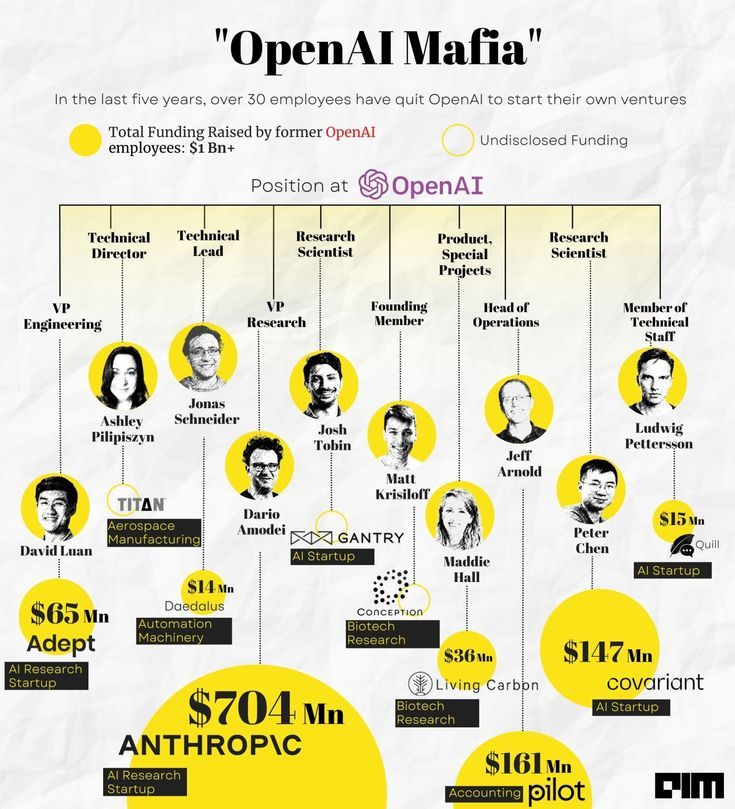

Open AI Mafia

In the last 5 years, over 30 employees have quit OpenAI to start their own ventures Source: The Market Mind

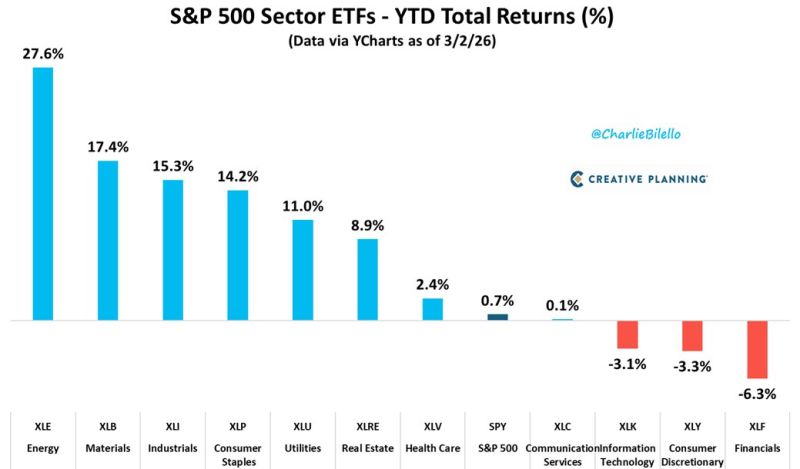

The sector rotation so far this year has been absolutely stunning...

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks