Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Don’t lose sight of the big picture!

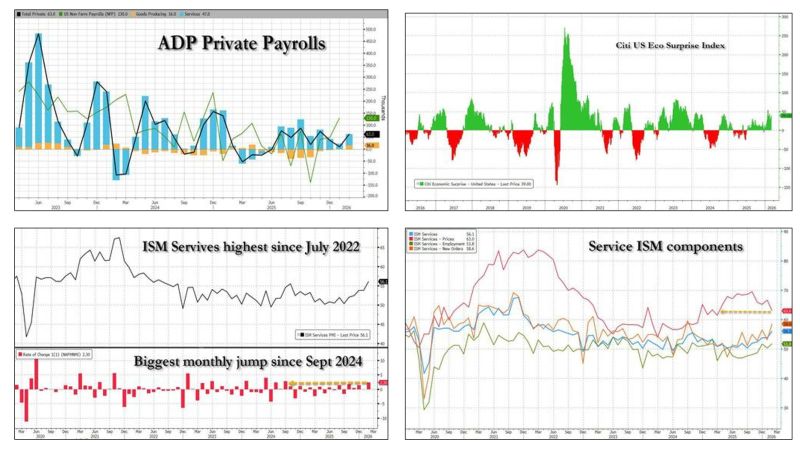

Investors are currently facing major unknowns: 1/ A major conflict in the Middle East. In this context, we believe investors should not lose sight of what we think remains a positive backdrop for stocks; 2/ The pendulum around AI which continues to swing between fear and excitement; 3/ Uncertainties about tariffs. But in this context, it is key to NOT OVERREACT to headlines and to keep in mind that the overall context remains positive for stocks: 1/ Corporate earnings continue to strengthen within and beyond AI 2/ The Fed maintains a bias toward easing 3/ The U.S. economy appears to be on track for another year of solid growth. On the later, US economic news published yesterday were impressive, starting with the solid ADP and ending with the blowout Service ISM number. The ADP number was the day's first positive surprise, as private jobs surged 3x from January and beat estimates, as they rose to 63K, the highest since November. Then it was the Service ISM print which smashed expectations (a 6-sigma beat), rising the most since Sept 2024 to the highest level since July 2022. The stagflation narrative was crushed, as the ISM's Prices Paid index tumbled to an 11 month low while everything else rose. The Citi US eco surprise index jumped from 30 to 39 in one session following the unexpectedly strong economic data. This set of very positive data was good enough to offset some of the scary news on the war front and propelled risk assets higher yesterday. Source: zerohedge

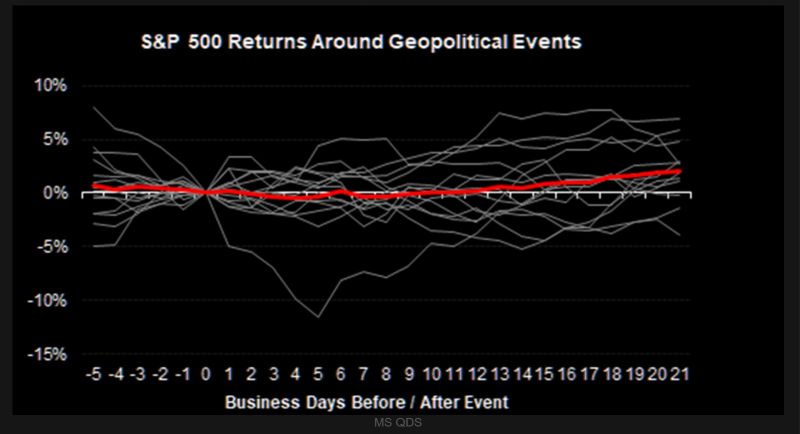

US equities are generally resilient to conflicts

MS: "While this is not an exhaustive study, based on 14 events over the last few decades (generally major, as well as some recent smaller Iran related incidents) the S&P 500 is generally range bound following the start of a conflict. The event causing the largest drawdown in this sample was September 11th, 2001." Source: TME, MS

Why Iran Is Now in a Weak Position

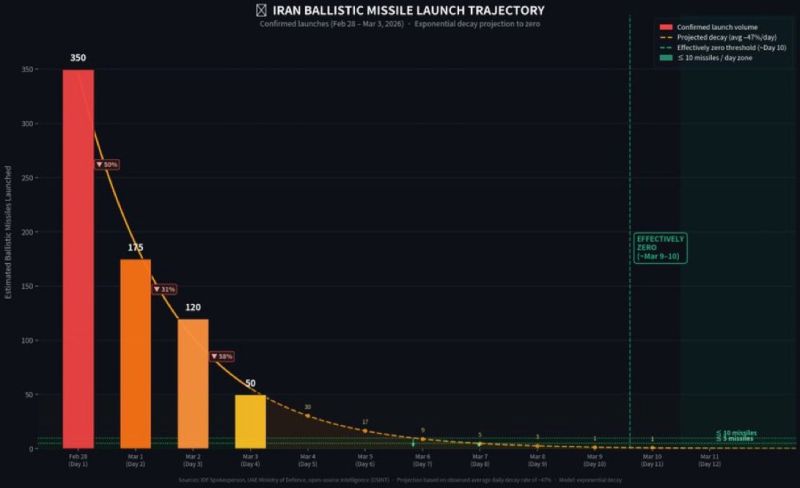

Iran finds itself in a dramatically weakened state following the opening days of the conflict. The country's leadership structure was effectively dismantled almost immediately, with Supreme Leader Khamenei killed within the first 30 minutes of fighting — a catastrophic blow to a regime that had spent decades positioning itself as a regional power bent on confronting Israel and the United States. Without coherent leadership, Iran's military response has been visibly deteriorating. On the first day of fighting (February 28), Iran launched its largest barrage — an estimated 150–200 ballistic missiles targeting Israel and other regional positions. By the following day, launch volumes had already fallen sharply to single or low double digits per barrage. By day four, only around 40 missiles were fired, with a near-total interception and miss rate of 99.9%. That represents a decline of roughly 80% in missile launch capacity in under a week — a strong indicator that Iran has rapidly exhausted a significant portion of its arsenal. Compounding the military setbacks is Iran's growing diplomatic isolation. Rather than rallying regional support, the conflict has seen Arab nations turn against Tehran, further limiting Iran's options. While fears of escalation into a broader or nuclear conflict have circulated, the data on the ground suggests the opposite trajectory: Iran's strike capability has already peaked and collapsed, and the conflict may wind down sooner than many analysts expected. Source: Jacob King on X

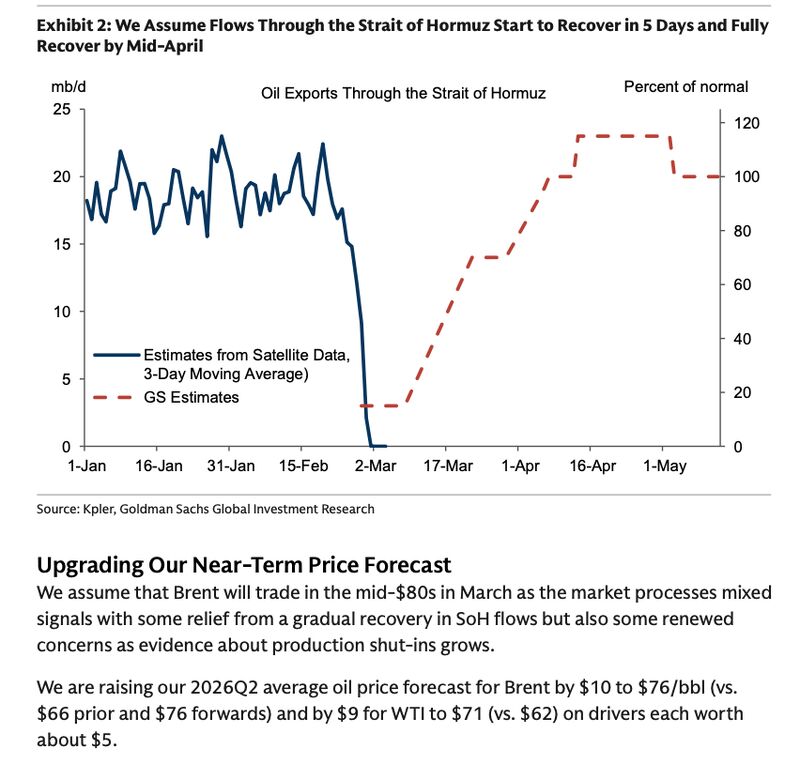

Goldman is assuming that Strait of Hormuz reopens in 5 days. Flows normalize by mid-April. Q2 average Brent price $76/bbl.

Source: Open Square Capital, Goldman Sachs

Will we ever break out of that SPX range?

The index has spent almost six months trading mostly within a 200-point range (with a few over- and undershoots). Impressive given the many under-the-hood moves and the latest political chaos. Source: TME, LSEG

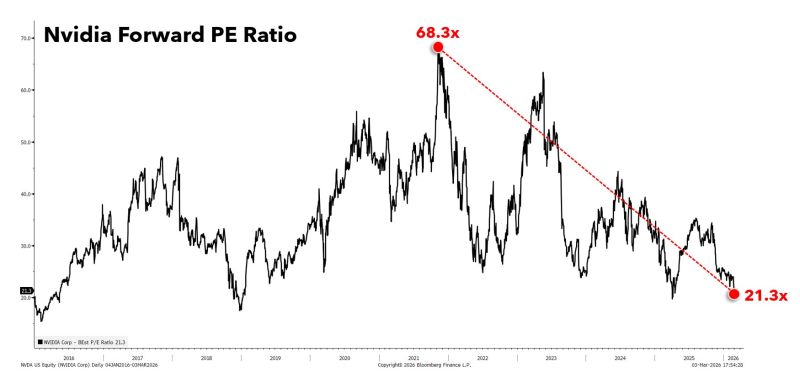

Nvidia's Forward PE ratio is down 47 points, from 68.3x in Nov, 2021 to 21.3x today.

For context, Walmart trades at 43.1x, double Nvidia. Source: Matt Cerminaro

How many days of oil does Asia have in reserve?

Our 2025 AI Job Impacts Analysis found that starting in 2028-2029, AI will create more jobs than it eliminates. Yet, each year, over 32 million jobs will be significantly transformedAcross Asia, reserves range from more than 250 days in some countries to just a few weeks in others. In times of geopolitical tension, energy security is firmly back in focus. Source: Khaosod English

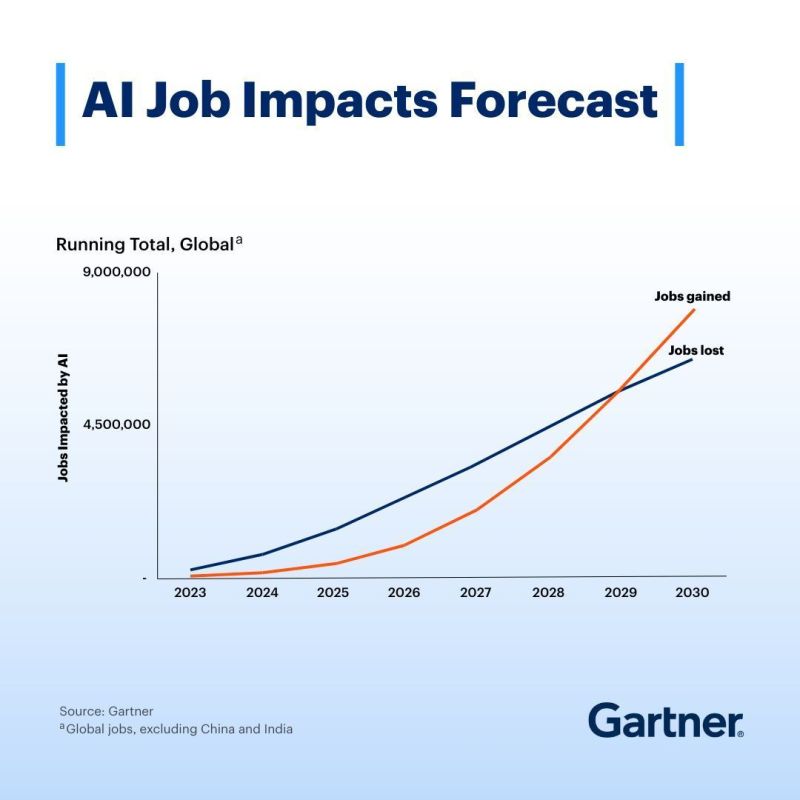

Gartner: There will be no “jobs apocalypse” due to AI — but there will be job chaos.

Our 2025 AI Job Impacts Analysis found that starting in 2028-2029, AI will create more jobs than it eliminates. Yet, each year, over 32 million jobs will be significantly transformed.

Investing with intelligence

Our latest research, commentary and market outlooks