Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

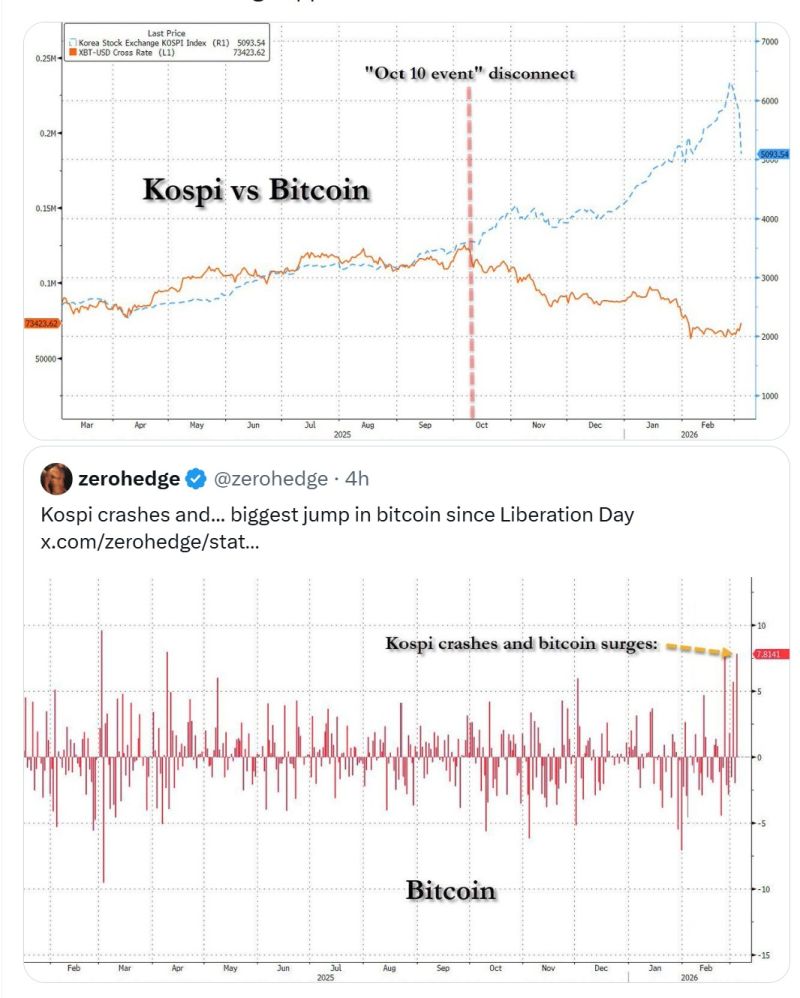

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

U.S. Dollar Index $DXY now trading above its 200-day moving average by the largest margin in 12 months 🇺🇸💵📈

Source: Barchart

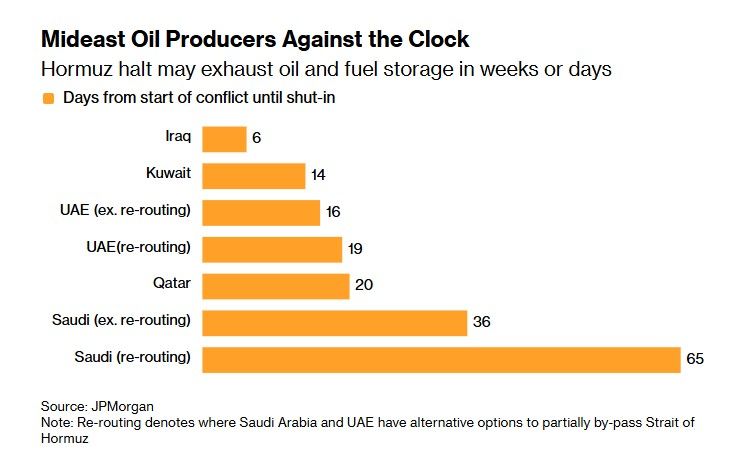

Is this the most important countdown in the global economy right now? ⏳

Gulf oil exporters are facing a scenario few markets are pricing in. With exports disrupted through the Strait of Hormuz, some of the world’s largest oil producers may soon hit a hard physical limit: Storage capacity. If crude cannot leave the Gulf and storage tanks fill up, producers will have no choice but to shut down production at some of the largest oil fields on earth. Countries exposed to this risk include: Iraq, Kuwait, the UAE, Qatar, and Saudi Arabia. And shutting down oil wells is not like flipping a switch. Depending on the geology of the reservoir and extraction technology, halting production can damage fields and infrastructure, sometimes permanently. Restarting production is costly, slow, and in some cases impossible at previous levels. That means the impact wouldn’t just be temporary. It could lead to a medium-to-long-term reduction in Middle Eastern oil supply. If that happens, markets won’t just price in disruption. They will price in scarcity. The result: a massive risk premium on global oil prices, especially for regional crude grades. And here’s the critical detail most people miss: Storage tanks are rarely filled beyond ~80% capacity for operational and safety reasons. So the real countdown to forced production cuts may be much shorter than expected. Two more strategic realities: • Some producers—especially Saudi Arabia and the UAE—could redirect part of their exports through alternative pipelines and routes. • But those routes would instantly become high-value strategic targets in any regional escalation. At that point, the stakes change. This is no longer just about the survival of Iran. If production across the Gulf begins to halt, the economic survival of major producers like Saudi Arabia and Iraq—the first and second largest producers in OPEC—would also be at risk. And when the core of the global oil system is threatened with shutdown… The pressure for the war to expand becomes almost inevitable. Source: Francesco Sassi, Bloomberg

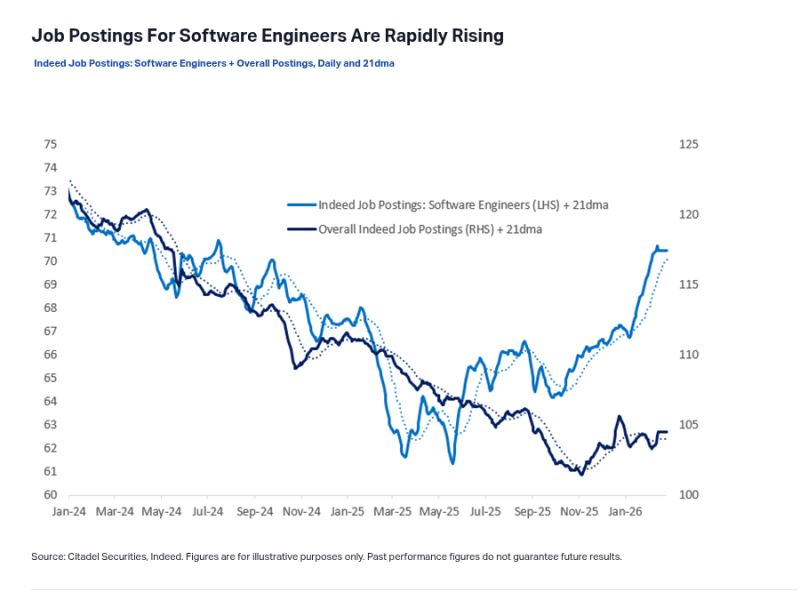

Citadel Securities shared a graph highlighting an interesting trend: job postings for software engineers are actually rising sharply.

This may be an example of the Jevons paradox. When AI makes coding faster and cheaper, demand for software development can increase rather than decrease. As the cost of building software drops, companies start creating far more of it. That means software gets embedded in industries, products, and internal tools where development used to be too expensive to justify. The result is that businesses may end up needing more software engineers, not fewer. Source: Rohan Paul, Chart from citadelsecurities .com/news-and-insights/2026-global-intelligence-crisis/

AI, power, and the Pentagon, things just got messy.

Last week, negotiations between Anthropic and the US Department of Defense collapsed. Now CEO Dario Amodei is racing to repair the relationship before the company is locked out of the military AI supply chain. Why this matters 👇 Anthropic’s models are already used by US national security agencies and were among the first AI systems approved for classified environments. But talks with the Pentagon broke down after a major disagreement: How far should AI be allowed to go? The US military wants the freedom to use AI for any “lawful purpose.” Anthropic drew a hard line. Two red lines: • ❌ Mass domestic surveillance • ❌ Lethal autonomous weapons During negotiations, the Pentagon reportedly asked Anthropic to remove a clause restricting “analysis of bulk acquired data.” That clause was specifically designed to prevent large-scale surveillance use cases. Anthropic refused. Things escalated quickly. A senior defense official publicly called Amodei: “A liar with a God complex.” The next day, talks collapsed. Now the stakes are enormous. The Pentagon is considering labeling Anthropic a “supply chain risk.” If that happens: • Military contractors would be forced to cut ties • Anthropic could lose major government access • The AI defense market could shift dramatically Meanwhile, OpenAI signed its own agreement with the Pentagon. Amodei hinted at something deeper in an internal memo: “Much of the messaging from the Pentagon and OpenAI is just straight up lies or attempts to confuse the issues.” He even suggested Anthropic may be at a disadvantage because it hasn’t given “dictator-style praise” to Trump — unlike rivals. Whether you agree with Anthropic or not, this moment reveals something critical: The real battle in AI isn’t just about technology. It’s about who controls how the technology is used. And governments are moving fast. The companies that set their principles today will shape how AI power is deployed tomorrow. Source: FT

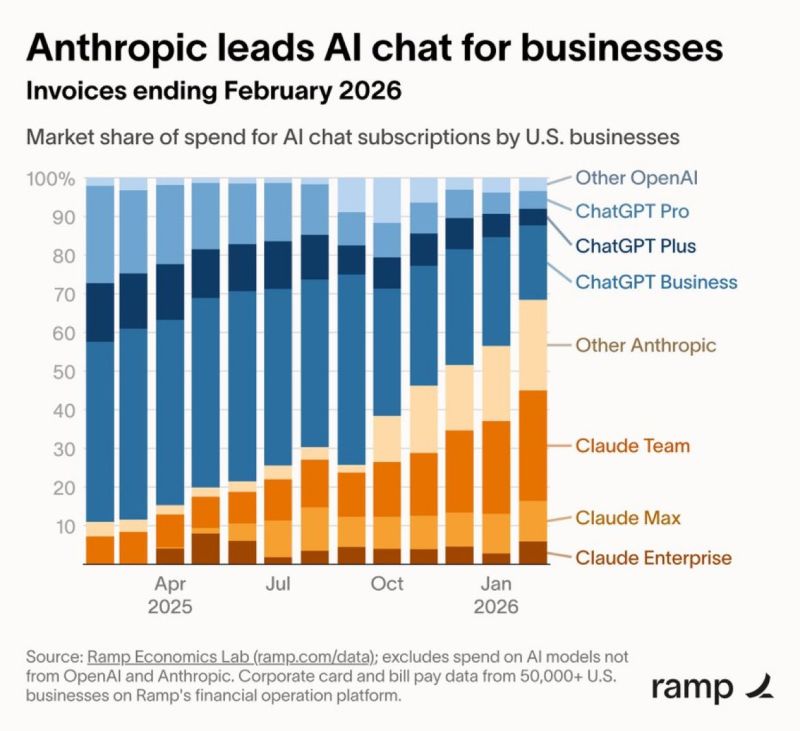

Feb 2025: ChatGPT held 90% of the US business market.

Feb 2026: Claude share has surged to ~70%. Absolutely insane growth of Anthropic. Their bet on coding and agents clearly paid off. Source: Yuchen Jin

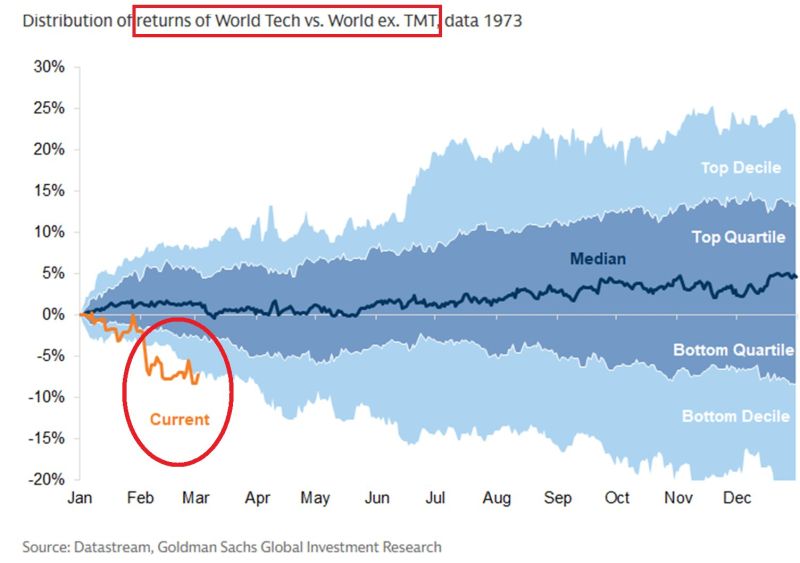

🔴Technology stocks are STRUGGLING:

World tech equities are underperforming other stocks by ~7 percentage points, one of the worst starts to a year in HISTORY. Tech relative performance is now tracking in the bottom 10% of years since 1973. Historically, the median outcome by year-end has been +4 percentage points of outperformance for tech. The last time tech underperformed this badly was during the 2000 Dot-Com Bubble. Is the tech bubble starting to pop? Source: Goldman Sachs, Global Markets Investor

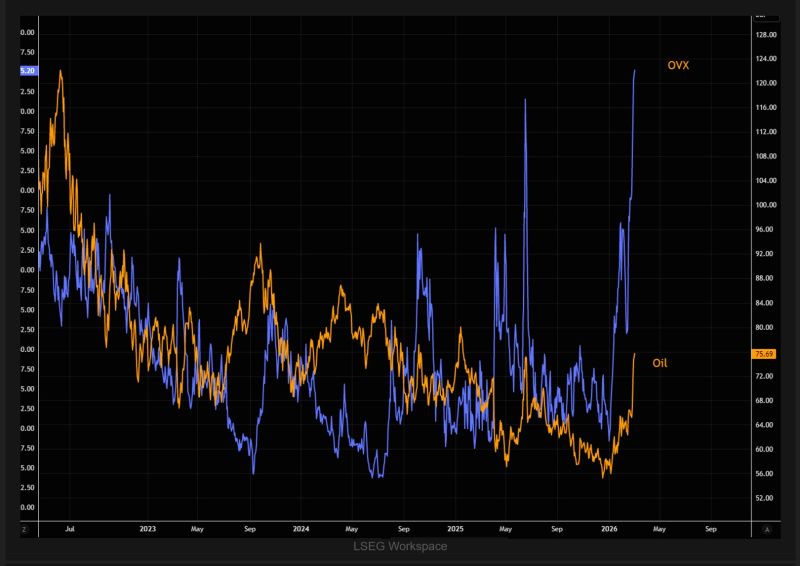

Oil is still trading at these new elevated levels, but above all, oil volatility (OVX) remains in pure panic mode.

Source: TME, LSEG Workspace

Investing with intelligence

Our latest research, commentary and market outlooks