NFTs against the tide of the crypto-crash

The crypto-currency market has corrected sharply since the beginning of the year. Interestingly, this does not seem to have affected the prices of some NFTs. In this paper, we will attempt to shed light on the reasons behind this unexpected resilience.

Since the end of November 2021, the two largest crypto- currencies - bitcoin and ether - have lost nearly 40 percent of their value, taking the rest of the crypto-currency market down with them. A sell-off that echoes the one suffered by many other so-called "speculative" markets such as SPACs, non-profitable technology stocks, momentum stocks, etc.

However, there is one market segment that seems to have escaped the purge we have been witnessing for several weeks.

The boom of the NFT avatar market

As a reminder, an NFT, or non-fungible token, acts as an exclusive deed of ownership for a digital item such as a work of art, a piece of music, an image, a video, an avatar or virtual land in a video game or even a tweet. It can be purchased at a given price, but the fact that it is non- fungible allows its market value to fluctuate over time.

NFTs have seen explosive growth in 2021: a transaction volume of $10.67 billion in Q3 alone, up 704% from the previous quarter, with continued momentum in Q4 (source: Taurus). Among NFTs, one segment in particular has exploded: the NFT avatars, which enable the development of ecosystems and communities, within which users become increasingly engaged. The best known are the CryptoPunks NFTs, one of which was bought for $150,000 by the credit card giant Visa. Or the Bored Ape Yacht Club NFTs (see image below), of which Adidas, Stephen Curry and Eminem, among others, avid buyers.

Why such a craze for a simple avatar?

The interest for NFT avatars has surged in 2021, with some buyers spending up to millions of dollars on individual virtual images that can be collected and used on social media.

Created in 2017, CryptoPunks are the first NFT avatars based on the Ethereum protocol. But of the recent projects inspired by CryptoPunks, the Bored Ape Yacht Club is the most prominent.

Developed by Yuga Labs, the Bored Ape Yacht Club is a (limited supply) collection of 10,000 Bored Ape avatars - or unique images of monkeys - created and registered as NFTs on the Ethereum blockchain. In this case, buyers own an illustration of a disinterested-looking monkey, with randomly generated features and accessories. No two images are exactly alike. The rarer its attributes, the higher its value. The Rarity.tools platform allows you to check the number of rare attribute combinations and has the added benefit of giving each NFT a rarity score.

Bored Ape's NFTs have already generated over $750 million in trading volume, including subsequent variants, according to CryptoSlam data. They have become the Twitter NFT avatar of choice for athletes, musicians, etc. The purchase of a Bored Ape Yacht Club NFT provides access to a sort of "club" and membership to certain benefits. As the name suggests, the Bored Ape Yacht Club is presented as an exclusive society or social organisation, and owning one of the coveted NFTs unlocks its membership. It allows users access to an exclusive Discord server, for example, where other owners - including celebrities - meet to chat. Bored Apes tend to congregate on social media, where increasingly familiar avatars have created a kind of digital brotherhood. Owning a Bored Ape NFT also gives you access to other NFT avatars, which can then be resold for potentially massive amounts of money. Yuga Labs first offered Bored Ape owners free Bored Ape Kennel Club dog NFTs, then later free "mutant serum" NFTs that generate a Mutant Ape Yacht Club image. It's almost like paying once for an ongoing subscription plan for NFTs and the benefits that come with them.

No market crash for NFT avatars

According to DappRadar, the index representing the top 100 NFT avatars has lost "only" 15% of its value since late November. What is even more remarkable is that the "premium" avatar NFTs, such as Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club and World of Women, have even seen their share price appreciate since November.

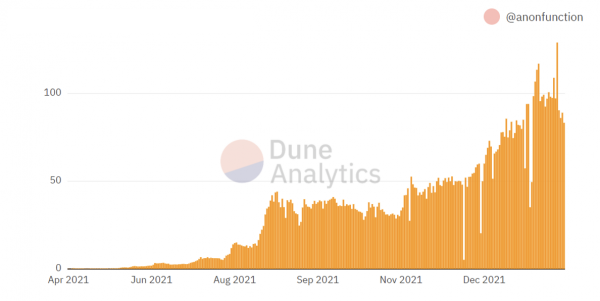

An example of this can be seen in the chart below, which shows the floor price paid for BAYC avatars on the OpenSea marketplace. Since November 2021, prices have almost doubled...

Bored Ape Yacht Club Opensea Price Floor

Source: Dune Analytics

Why is this type of asset - which can rightly be considered among the most speculative on the planet - not impacted by the drying up of liquidity caused by central banks determined to become less accommodating? According to the Finimize website, several explanations can be envisaged.

Reason #1 -

NFTs are in a bubble that has not yet burst

As mentioned above, the NFT market - or part of it - emerged much later than cryptocurrencies. The cryptos have gone through several boom and bust phases and it may only be a matter of time before NFTs go through similar motions.

Reason #2 -

NFTs attract a different type of investor

It is possible that investors in NFTs are different from those who invest in cryptocurrencies. The investment horizon is likely to be longer, with buyers of NFTs willing to hold on to a digital asset or artwork to which their identity is attached, or that has emotional value.

Reason #3 -

A negative correlation with Ether

Most NFTs are denominated in ether and seem to have a negative correlation with the price of this cryptocurrency.

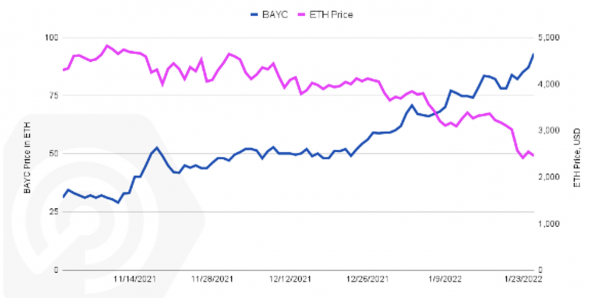

As shown in the chart below (source: DappRadar), the floor price of BAYC (in ether) seems to move inversely to the price of ether (here expressed in dollars).

It thus looks like when Ether falls, NFTs - particularly the top- tier NFTs - rise to match their pre-drop dollar value. In recent weeks, the BAYC floor price has continued to appreciate despite the steep decline in Ether prices.

Interestingly, the prices of these NFT avatars (expressed in Ether) do not fall when the price of Ether rises. Perhaps a tangible sign of a relatively strong bull market.

Value Comparison : Bayc(ETH) vs ETH Price (USD)

Source: Finimize

Reason #4 -

NFTs are still in the early phase of their adoption curve

NFTs emerged much later than cryptos. They are arguably still in the fastest and earliest phase of their adoption curve, attracting growing mainstream attention by the day. In fact, Google searches for the term "NFT" are surpassing those for "crypto" for the very first time. Giant brands such as Adidas, Coca-Cola, Gucci, Dolce & Gabbana and many others have launched their avatars or partnered with NFTs specialists to appear in this field.

Moreover, the adoption of NFTs is expected to increase further as the exchange of NFTs becomes more accessible. For example, the upcoming NFT exchange platform created by Coinbase - which already has over 3 million users on its waiting list - will directly integrate MasterCard payments, making the whole process of buying and owning NFTs easier. Similar services are also being launched by other crypto exchanges, as well as major Web2.0 players such as Facebook (Meta) and Instagram.

Reason #5 -

The scarcity effect

This term may seem overused when you consider that new NFT avatars are being launched every day. But remember that we are talking about premium NFT avatars here. And these collections have a limited supply of NFTs (between 10,000 and 20,000) that will remain the same forever.

A figure to be set against Facebook's project in the metaverse. Mark Zuckerberg has stated that he wants to bring one billion people into the metaverse within a decade. If we assume that only 10% of these people - 100 million - will be interested in having a digital avatar to go with their digital identity on the metaverse, an offer of a few thousand "premium" avatars would then find itself in a situation of supply-demand imbalance, de facto driving up prices.

It should be noted that NFTs for digital avatars are already part of the modus operandi of the main social media platforms. For example, last month Twitter launched its official verification mechanism for profiles using an NFT avatar. Instagram and Facebook are expected to follow suit.

Is the NFT market a bubble in the making or is that bubble already about to burst? It's hard to say, although their resilience during the cryptocurrency downturn is already a bit of a surprise for many investors.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Recently, we took a bold step into the digital art realm by tokenizing the unique piece "Dreamstime" by Sarah Benslimane for our employees. This pioneering move marks a significant stride in the evolution of wealth management, underscoring our commitment to innovation. In this article, we delve into the visionary collaboration between Bank Syz and the talented artist Sarah Benslimane.

Among the hot topics discussed at the Bitcoin 2022 Summit in Miami was the Lightning Network, a blockchain overlay that allows off-blockchain transactions and which is expected to enable bitcoin to become a common form of payment.

According to an index provided by Cambridge University’s Centre for Alternatives Finance, Bitcoin mining requires twice the electricity consumed in Switzerland in 2020, or 129 TWh (source : Enerdata). Ethereum, for example, uses about 31 TWh per year.

.png)