We are among those who believe that there are real innovations within cryptocurrencies and blockchain. Bitcoin and some decentralized applications are among them.

However, the world of crypto-currencies is full of pitfalls as the prospects of quick gains bring out all kinds of ridiculous: from speculators of course, but also from entrepreneurs whose intention is to raise capital as quickly as possible without any real vision or technological innovation. While extraordinary profits can be made during a bull market, the harder it can fall when markets turn.

Below, we attempt to distinguish between Bitcoin and other projects including the Terra Luna ecosystem, emblematic of the excesses seen in the cryptocurrency world.

Bitcoin, a true innovation

Marc Andreessen, co-founder of Netscape and the venture capital firm Andreessen Horowitz, wrote a visionary article about bitcoin in the New York Times in 2014. As he brilliantly pointed out, bitcoin and blockchain are first and foremost a breakthrough in computer science, built on 20 years of cryptocurrency research, and 40 years of cryptography research, by thousands of researchers around the world. These enormous R&D efforts have enabled bitcoin and blockchain technology to make a technological breakthrough similar to that of PCs in the 1970s or the internet in the 1990s.

While the general public's attention is focused on bitcoin's roller-coaster evolution, its ecosystem continues to grow: a growing number of Silicon Valley programmers and entrepreneurs are focused on bitcoin. Mega-tech companies like IBM are investing significant resources in it, while the largest banks on Wall Street have included bitcoin among the assets in which their clients can invest. Major universities (MIT, etc.) are offering dedicated training to meet the surge in jobs in the field.

As Andreessen mentioned, Bitcoin is the first practical solution to a long-standing problem of how to establish trust between unrelated parties on an unreliable network like the Internet.

The practical consequence of solving this problem is that Bitcoin allows, for the first time, one Internet user to transfer a unique token of digital property to another Internet user. The scope of this technological breakthrough is immense. Think of the digitization of signatures, contracts, keys, ownership of physical assets, digital stocks and bonds... and currency. All of these are exchanged through a distributed trust network that does not require a central intermediary like a bank or broker.

Critics of bitcoin point to its limited use by ordinary consumers and merchants, but these same criticisms were leveled at PCs and the Internet in their early stages. Every day, more and more consumers and merchants are buying, using and selling bitcoins, all over the world.

The fact that the fees are very low is of paramount importance to its success. Think for example of international remittances by expatriate workers to their families, the impact on the emerging world (deprived of modern banking and payment systems) or the field of micropayments.

As has been the case with new technologies or innovative companies such as the Internet, Google, eBay or Facebook, bitcoin is what is called a "network effect" with a positive feedback loop. The more people who use bitcoin, the more valuable bitcoin is to everyone who uses it, and the greater the incentive for the next user to start using the technology.

For this reason alone, Bitcoin's competitors face significant barriers to entry. If another project were to supplant Bitcoin, the improvements would have to be substantial and would have to happen quickly. Otherwise, the network effect will perpetuate Bitcoin's dominance.

Bitcoin has become the fastest growing asset with a market capitalization of $1 trillion. To date, Bitcoin has recovered from three crashes of over 80% and several crashes of over 50%. Bitcoin holders have to live with the volatility, but what has been offered on the technical side is truly new.

Bitcoin's success is being emulated

Bitcoin's success has attracted tens of thousands of potential competitors. But to challenge Bitcoin's dominance, new entrants need to differentiate themselves on certain technological aspects, such as a different mining system, more attractive financial incentives, higher transaction speed, etc. Some of the new protocols remove energy input and replace it with human governance input.

But most of these competing projects to Bitcoin are differentiated at the expense of decentralization, which is the main goal of a blockchain.

Satoshi Nakamoto, the inventor of Bitcoin whose real identity has yet to be revealed, deliberately sacrificed most of the parameters in the design of the Bitcoin network in order to achieve an automated, decentralized and auditable global transfer agent and ledger, and nothing else. He combined existing technologies with proof-of-work algorithms, then added computational difficulty. It is this combination that is at the heart of the innovation.

Proof-of-work is not only useful but absolutely essential. You always need an anchor in the real world. And it is indeed energy that is the anchor point of Bitcoin, just like the vast majority of productive tools we use in our daily lives.

Since its inception, Bitcoin has undergone numerous updates via soft "forks". Many miners have had to shut down or move their computers. But the basic design of bitcoin remains unchanged. Its uptime since March 2013 is 100%. Even Fedwire, the U.S. Federal Reserve's interbank settlement system, has not had 100% uptime during that time.

Most other crypto-currencies promise to add more features to their protocol and present these aspects to investors as innovations. Some are indeed noteworthy (Ethereum, for example). But most protocols innovate at the expense of decentralization.

Unlike the bitcoin network, which has no central organization to operate it, most of these other projects have foundations (Terraform Labs, Solana Foundation, Ava Labs, etc.) or central individuals who play a key role in the development, marketing and ongoing operation of the network. These entities are mostly backed by venture capitalists. And some of these projects do not hesitate to use very aggressive marketing methods, such as influencers via Youtube and TikTok as a means of promotion with the general public (who will become the purchasers of their digital tokens) as the target. Many other protocol developers have made money from their projects by acquiring a large amount of pre-mined tokens, and continue to operate their networks centrally, while presenting them as decentralized.

Satoshi Nakamoto set up the open source software, never awarded himself a pre-mined amount of bitcoins, never spent any of his mined bitcoins, and then disappeared to let others perpetuate his creation. Since then, the network has relied on a set of open source developers, with no leader.

There is no one to force updates. There is no one to turn to when the price drops. Bitcoin has never needed to raise capital.

This is not to say that all crypto-currencies outside of bitcoin are bad or lacking in technological input. But we should be well aware that the industry as a whole is full of scams, frauds and ultimately failed projects with no real underlying value.

As Lynn Alden rightly said, it's as if bitcoin is the iPhone of this industry, and there are thousands of cheaper copies with Apple logos stuck on them.

The «Terra crash»

As a reminder, a stablecoin is a cryptocurrency that is supposed to maintain parity with a traditional currency (like the dollar).

Unlike the vast majority of stablecoins, the "UST" (USD Terra) stablecoin is not backed by a traditional currency reserve. UST is what is known as an algorithmic stablecoin: it is supposed to follow pre-programmed rules through a smart contract. UST has a sister crypto-currency, LUNA, which is not a stablecoin and is therefore subject to speculation.

The way the LUNA project works is that Terra's main token, LUNA, serves as a volatility offset for UST. If UST goes above $1, there is an arbitrage opportunity to "burn" (decrease the number of coins) LUNA and create more UST. If UST drops below one dollar, there is an arbitrage opportunity to create LUNA and burn UST. While UST is supposed to fluctuate around one dollar, LUNA’s protocol “allows” it to be volatile.

The more demand there is for UST over time, the more the market capitalization of UST and LUNA increases. However, if the price of LUNA does not keep pace with the expansion of UST's market capitalization, then UST may become less and less "backed" by LUNA with the risk that parity will be undermined. This risk was well known by specialists and it seems that some have managed to take advantage of it.

Indeed, large investment funds started to buy UST progressively. Then, they suddenly and massively exchanged them for LUNA, and then exchanged these LUNA for dollars. This had the effect of destroying many USTs and creating LUNAs in very large quantities. This sale had a negative impact on the price of UST that the algorithm was not able to compensate for, causing it to lose its parity with the dollar. Thus, with a UST below 1 dollar, the "attackers" were able to make a profit at each stage (buying UST, exchanging to LUNA, selling LUNA).

As a result, billions of dollars of capital suddenly withdrew from the Terra ecosystem, causing the price of LUNA to collapse and the UST peg to end. This crisis is relatively similar to currency crises sometimes seen in emerging markets.

For some, the LUNA crash could not have occurred without an attack financed by actors with considerable resources. But if an asset in the markets can be successfully attacked, it will eventually be. Algorithmic stablecoins have had many failures, and this one is the most significant to date. Since most of their adjustment mechanism is public knowledge, an "attacker" is aware of all the specific ways to hit them. One of the fundamental assumptions of financial theory is that there is never a guaranteed profit without risk. The LUNA crash provides further verification of this axiom. The Luna blockchain was marketed as decentralized, but in the end it was not. Unlike bitcoin.

Conclusion

We are witnessing a major test of the cryptocurrency ecosystem, which will separate the perennial projects from those that don't need to exist.

Bitcoin itself continues to operate without any damage other than a drop in price. The Terra ecosystem is unlikely to recover from such a crash. As for other crypto-currencies, they are being scrutinized for regulation, reputation and liquidity.

The crypto-currency asset class seems to retain a very interesting potential in the long run. There are many innovative and attractive projects. But investors should be very careful when speculating on any crypto token other than bitcoin. Even with bitcoin, investors should maintain appropriately sized positions based on their tolerance for volatility and their assessment of network risk.

During bull markets, the price of bitcoin rises, but generally underperforms many new projects that are benefiting from inflows of liquidity. During bear markets, bitcoin's price declines - sometimes sharply. However, the thousands of altcoins usually suffer even more than bitcoin. And many of them are disappearing.

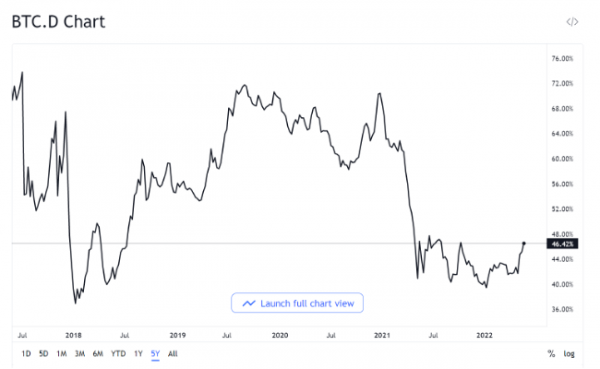

Over the past 10 years, the crypto-currency industry has moved through series of boom and busts. But bitcoin has remained on a long uptrend and preserved its leadership status. Bitcoin had the largest market capitalization in 2013 and in 2018. That's still the case today. In fact, bitcoin dominance (i.e., the weight of bitcoin relative to other cryptocurrencies) now seems to be on the rise again after falling from 75% in 2018 to 40% in early 2022.

BTC.D Chart

Source: Trading View

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

.png)