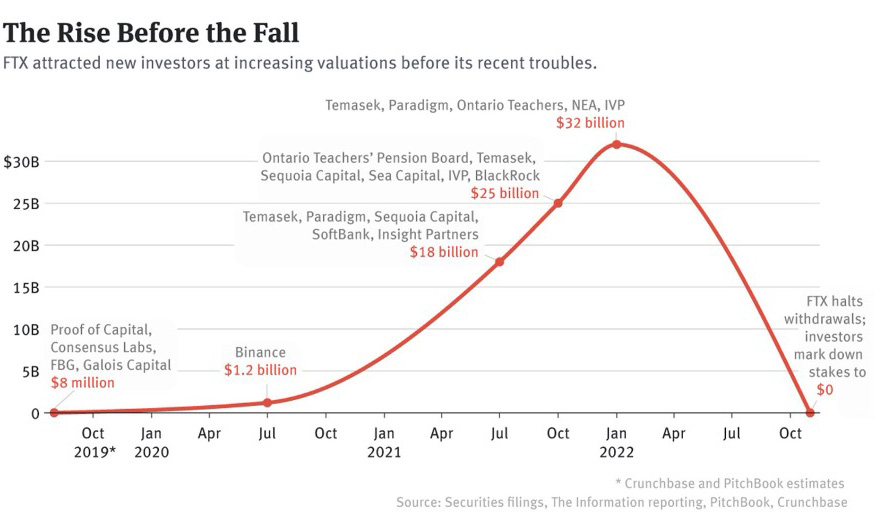

The year 2022 is definitely a long one for crypto-currency investors. After the bankruptcy of Celsius, the collapse of Terra Luna and the evaporation of more than two trillion dollars in crypto-currency market capitalization, the shockwaves shook crypto-sphere once more last week. FTX, the world's 2nd largest crypto exchange platform (and 1st in the US) is indeed an icon in the business. Its founder and "philanthropist" Sam Bankman-Fried (SBF) has become a multi-billionaire. And its aura goes far beyond the unconditional fans of the crypto scene, since it was able to raise capital from the biggest names in venture capital and institutional management: Sequoia, Tiger, Blackrock, SoftBank, the sovereign wealth fund of Singapore Temasek or a pension fund in Ontario. The FTX wallet is used by millions of users worldwide. FTX is also a partner of major companies (Visa, Gamestop, Reddit) and supports South Korea's blockchain projects. After a vertiginous growth, which saw the company’s value go from 1 to 32 billion in twelve months, FTX lost everything in the space of 72 hours. How to explain such a disaster?

FTX had raised capital from the largest institutional investors

- Source: Crunchbase

On paper, FTX looked solid with $14.6 billion in assets versus $8 billion in debt. But a recent Coindesk article highlighted something particularly troubling: nearly 40% of the assets held on the balance sheet are made up of (or collateralised by) FTX's digital tokens, FTT. In a way, FTX's borrowings were partly used to fuel the rise in FTT's share price, 75% of whose outstanding tokens are held by FTX. Above all, such leverage creates the risk of any fall in the value of FTT to drag FTX down.

Binance, the world's leading crypto exchange and one of the largest investors in FTX, realised the extent of the danger. By declaring that it wanted to sell its FTT holdings, Binance triggered a liquidity crisis that sounded the death knell for FTX. The main reason for the fall was excess leverage backed by illiquid and unsegregated assets.

Can the crypto industry recover from such a debacle? Unlike traditional finance, no central bank or government has stepped in to save FTX and limit the fall of crypto-currencies. Until now, it has been big crypto players who have rescued some of the struggling protocols. But it is clear that the number of players able to play the white knight is melting like snow in the sun. FTX had been particularly generous in the past by coming to the aid of some companies on the verge of bankruptcy. It will no longer be able to do so. As for Binance, which was identified as a possible buyer of FTX for a few hours, it has finally given up on the idea.

Another negative consequence for the crypto ecosystem: a very hard blow to the appetite for digital asset projects from institutional investors. But also very strong pressure from regulators and investors who will demand more information, transparency and risk limits from the various crypto entities. An increased level of due diligence that could precipitate the fall of other entities and further accelerate the ongoing purge.

Almost a blessing in disguise, as it were. The exponential and unguarded growth of crypto-currencies can be compared to the dot.coms in the 2000s. Back then, the crash resulted in the collapse of thousands of internet companies, run by teams with no experience whatsoever, with business models that were not sustainable and a financial situation that did not allow them to survive the sudden withdrawal of cash. Cryptos are currently facing a similar situation; in a typically Darwinian process, thousands of entities will disappear, leaving the field open to the most solid financial protocols and models. The comparison may not end there; indeed, Bitcoin, Ethereum and Binance may one day be the crypto equivalent of what the GAFAs are to technology.

And as every crisis creates opportunities, it is also worth remembering the role that traditional and regulated financial actors could play: that of offering private and institutional clients a crypto-currency deposit and trading solution with the same guarantees of security and transparency as for the traditional asset classes.

Finally, the lines should also move on the exchange side. Binance has proposed the implementation of a Proof-

of-Reserves system, a reserve audit using blockchain technology, to provide full transparency of the liquidity held by exchanges. Regulation of centralised cryptocurrencies is urgently needed to restore credibility to the industry.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

.png)