What happened last week?

Central banks

The Federal Reserve's recent dovish inclination, as hinted by Chairman Jerome Powell with a suggestion of 75 bps of cuts in 2024, has been subtly moderated in this week's speeches. Philadelphia Fed's Harker advocated for a cautious reduction in rates, emphasizing a non-immediate approach. Atlanta Fed's Bostic, advocating patience, expressed no urgency for rate cuts in the near term, suggesting inflation may recede slowly. Chicago Fed's Goolsbee, Cleveland Fed's Mester, and San Francisco Fed's Daly echoed this sentiment of caution, indicating that market expectations for early 2024 rate cuts might be premature. Collectively, these comments suggest a tempered, more nuanced approach to the previously indicated dovish pivot, as the Fed carefully navigates between supporting growth and controlling inflation. Despite this, the market is still increasing its rate cut expectations with 7 rate cuts within one year, while the first rate cut could occur in the first quarter of 2024. In Europe, the ECB maintains a cautious stance on rate cuts despite a recent inflation slowdown. Isabel Schnabel and Luis de Guindos emphasize the need for sustained inflation control, targeting a 2% rate by 2025 before considering easing. Klaas Knot advises waiting for more wage data in 2024, suggesting it's premature to discuss rate reductions. Overall, the ECB signals vigilance, prioritizing a firm grip on inflation over immediate policy relaxation. However, the market has priced a similar path to the US with 7 rate cuts, and the first occurring between March and April.

Credit

In the US, Investment Grade (IG) corporate bonds experienced a positive week, largely benefiting from the robust performance of US Treasuries, although the excess return from credit spreads was slightly negative due to a modest widening. The Bloomberg US Corporate Bond Index reflected this mixed sentiment, closing the week up by +0.25%. In the high yield segment, conditions were more favorable, with US high yield spreads tightening to their narrowest since April 2022. The spread of the Bloomberg US High Yield Index decreased to 329bps, down nearly 10bps from the previous week, resulting in a notable gain of +0.6%. European credit markets also witnessed an uplift, with the Bloomberg EUR Corporate Bonds Index gaining +0.4% and the Bloomberg Pan EUR High Yield Index up by +0.3%. A significant milestone was reached as the spread of the Bloomberg Pan EUR High Yield Index fell below 400bps for the first time since April 2022. Looking ahead, the European high yield market is anticipated to see a net supply of approximately €20bn in 2024, a shift from two consecutive years of negative net supply. However, while the European credit environment appears resilient against the backdrop of a potential 2024 recession, concerns loom over CCC-rated debt, particularly within the real estate and telecommunications sectors. Notably, the spread (OAS) difference between EUR and US CCC-rated bonds has reached its highest level since 2009, indicating heightened risk perception in these segments. Lastly, AT1/CoCo bonds continued their upward trajectory, registering a gain close to +0.5% over the week.

Rates

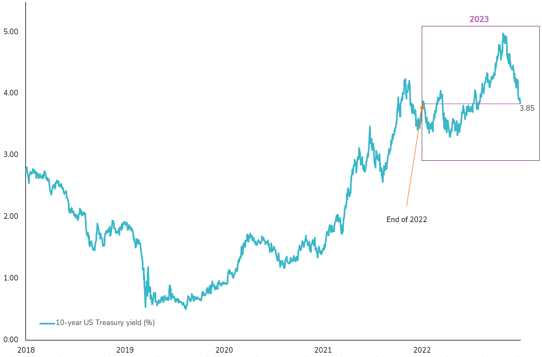

Government bonds had another favorable week, with the 10-year US Treasury yield dropping by 5bps and the 2-year yield falling by 12bps, leading to a steepening of the curve (2s10s) to -46bps. This activity contributed to a 0.3% rise in the Bloomberg US Treasury Index over the week. The front end of the US breakeven curve and real rates both fell by 6bps, while the 10-year US breakeven edged down slightly to 2.2%. Notably, the 5y5y forward rate reached 2.13%, a low not seen since March. Adding to the positive sentiment, the Fed's favorite inflation indicator tumbled to a 32-month low at 2.6%, reassuring concerns regarding the inflation trend and further bolstering the case for a potential dovish pivot. In Europe, the 10-year German yield declined by 6bps, with the front end dropping nearly 10bps. Peripheral yields, particularly the 10-year Italian yield, saw a significant drop of 20bps, hitting its lowest level since August 2022 at 3.53%. The spread between the 10-year German and Italian yields narrowed to 158bps, the tightest since June 2023. The Bloomberg EUR Government Bond Index reflected these movements with a rise of over 1% for the week. The UK saw government bonds outperform following an unexpected softer inflation print in November (CPI YoY at 3.9% vs 4.3% expected), with the market close to a 1.5% gain over the week. Finally, in Japan, the 10-year government yield jumped on Friday after an announcement of a rise from 1.1 to 1.95% in assumed interest rates for FY2024/2025, the first increase in 17 years, alongside plans to reduce debt sales by about 10% in the next fiscal year.

Emerging market

This week, Emerging Market (EM) bonds showcased positive momentum, with both Sovereign Bonds and Corporate Bonds notching a 0.55% gain. EM local currency debt also enjoyed gains, rising by 0.3%. A significant development was the narrowing of the Bloomberg EM Corporate Bonds Index spread to 285bps, marking its lowest level since June 2021 and reflecting heightened investor confidence in EM corporate debt. In China, the long-term borrowing costs have notably declined, with the 30-year yield reaching its lowest point since 2005. This move came as major Chinese banks cut deposit rates across various terms, signaling a broader easing in financial conditions. Moreover, foreign investors significantly increased their holdings of Chinese bonds in November, buying $35bn worth, the largest monthly purchase in over six years. Turkey's Central Bank (CBRT) continued its monetary tightening with a 250bp rate hike. This move was less aggressive compared to the substantial 500bp hikes seen in recent months, indicating a possible moderation in its tightening cycle. Brazil's economic outlook received a boost as S&P upgraded its credit rating to BB. The agency praised Brazil's recent tax reform, predicting it will lead to long-term productivity gains and economic improvement. This upgrade brings S&P's assessment in line with other major credit rating agencies, reflecting a more optimistic view of Brazil's fiscal and economic reforms. Lastly, Colombia's central bank took a modest step to ease its monetary policy, reducing the lending rate to 13% from 13.25%. This decision comes amidst efforts to balance economic growth with inflation control, reflecting the ongoing challenges faced by EM economies.

.png)