What happened last week?

Central banks

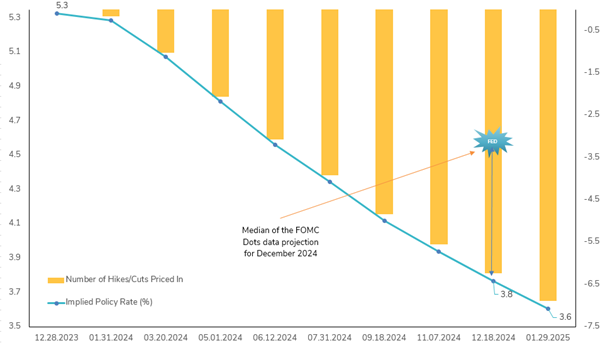

In the quiet week between Christmas and New Year, the Federal Reserve received an optimistic outlook from former Dallas Fed President Robert Kaplan, who suggested the U.S. might avoid a recession in 2024, much like in 2023. This prediction is based on robust government spending and a resilient demand for services, setting the stage for potential rate cuts as early as spring. Markets have already priced in a full rate cut for the first quarter and almost 7 cuts by the year's end. Across the Atlantic, the European Central Bank's Governing Council member Robert Holzmann underscored the premature nature of discussing rate cuts for 2024, emphasizing the ongoing impact of monetary policy normalization on slowing inflation. Despite this, markets anticipate over 5 rate cuts in the coming year, reflecting a divergent perspective between policymakers and market participants. Meanwhile, the Bank of Japan's Governor Kazuo Ueda indicated the possibility of an interest rate increase as early as April, without ruling out a January hike. This comes as the BOJ tweaks its long maturity debt buying operations, signaling a potential shift away from its ultra-easy monetary stance. The market now sees a significant probability of a rate hike by June, as the BOJ considers wage data and economic growth indicators to guide its policy decision.

Credit

In the US, December witnessed a substantial surge in Investment Grade (IG) corporate bonds, with the Bloomberg US Corporate Index rising by +4.4%, concluding 2023 with an impressive +8.5% performance. This uplift was primarily driven by a significant 30bps tightening in spreads (OAS), ending the year below 100bps for the first time since January 2022. However, the star performer in the US fixed income sector was High Yield (HY) bonds. The Bloomberg US Corporate High Yield Index climbed +3.7% in December and over 13% in 2023, with credit spreads tightening by more than 150bps to close to 300bps. Despite these gains, the 2024 outlook is clouded by challenges highlighted in the latest NACM survey, indicating potential pressure on credit conditions (high delinquencies, more accounts placed on collections and elevated bankruptcies) and, subsequently, on US credit spreads. In Europe, the narrative is quite similar, with European IG corporate bonds also enjoying a substantial gain of nearly +8.5%, accompanied by a 30bps spread tightening to 138bps. European IG spreads maintain a significant premium over US counterparts, ending the year at the same level than one year ago (40bps premium). European High Yield bonds also reported a stellar year, tightening by more than 100bps to 405bps and delivering a +12.5% performance in 2023. Despite the turmoil of the Credit Suisse debacle, the AT1 market, EUR CoCo debts issued by banks, closed the year on a high note, up close to 10%.

Rates

US Treasuries concluded 2023 positively, with the Bloomberg US Treasury Index up over 3.0% in December and around +4.0% for the year. Despite persistent interest rate volatility, the carry component at the year's outset offered substantial protection to investors. Notably, the 10-year US Treasury yield ended the year where it began at 3.9%. The 10-year US real rate increased by 12bps to close at 1.7%, while the 10-year US breakeven rate decreased by 12bps to 2.2%. The US Treasury curve steepened by more than 10bps, but remaining deeply inverted at -40bps. European government bonds showcased even stronger performance in December. The Bloomberg EUR Government Bonds Index surged +4.0% over the month and over 7% in 2023. The 10-year German yield dropped 55bps in 2023, ending at 2.0%, influenced by a decrease in real rates and a more than 30bps drop in the 10-year German breakeven rate. Peripheral bonds notably outperformed core rates, with the spread between Italian and German 10-year yields narrowing to 168bps, a decrease of over 40bps. UK government bonds had an impressive December, with the Bloomberg UK Government Bonds Index climbing +6% over the month, culminating in a close to +3.5% performance for the year. In contrast, Japan's fixed income market lagged as the Bank of Japan gradually exits its accommodative monetary policy. The 10-year Japanese yield rose 20bps in 2023 to 0.61%, marking it as the year's underperformer.

Emerging market

EM bonds capped off December with robust gains, propelled by favorable US rate movements. The Bloomberg EM Corporate Bond Index rose by +3% for the month, with the tightening of EM corporate spreads (OAS) by a modest 5bps to 285bps, marking its lowest level since June 2021. EM Sovereign bonds outshone with a +5% surge in December, benefiting from their longer duration and a 15bps narrowing in spreads to 361bps. Additionally, local currency EM government bonds recorded a +2.7% increase, supported by the weakening of the US dollar. Over the entirety of 2023, while EM corporate bonds in hard currency and local currency government bonds showed similar performances (+6.7% and +6.9% respectively), EM Sovereign bonds in hard currency stood out with an impressive gain of almost 11%. Notably, the Latin America region and Turkey's fixed income assets in hard currency were among the year's top performers. The Bloomberg EM Latin America Sovereign Index climbed 11% in 2023, while Turkish sovereign and corporate bonds in USD ascended by +17% and +13% respectively. This week, in China, investors gravitated towards shorter-maturity bonds, finding them particularly attractive amid liquidity support from the central bank and anticipation of potential rate cuts in the coming year. The yield on one-year sovereign bonds saw a substantial decrease of 20 bps, the most significant drop since April 2020. Despite a positive close to the year, the Chinese real estate sector remained under stress throughout 2023, as evidenced by the 50% drop in the Iboxx China Real Estate Bonds Index, although it did recover somewhat in the last two months (+3.8% in December and +12% in November).

.png)