What happened last week?

Central banks

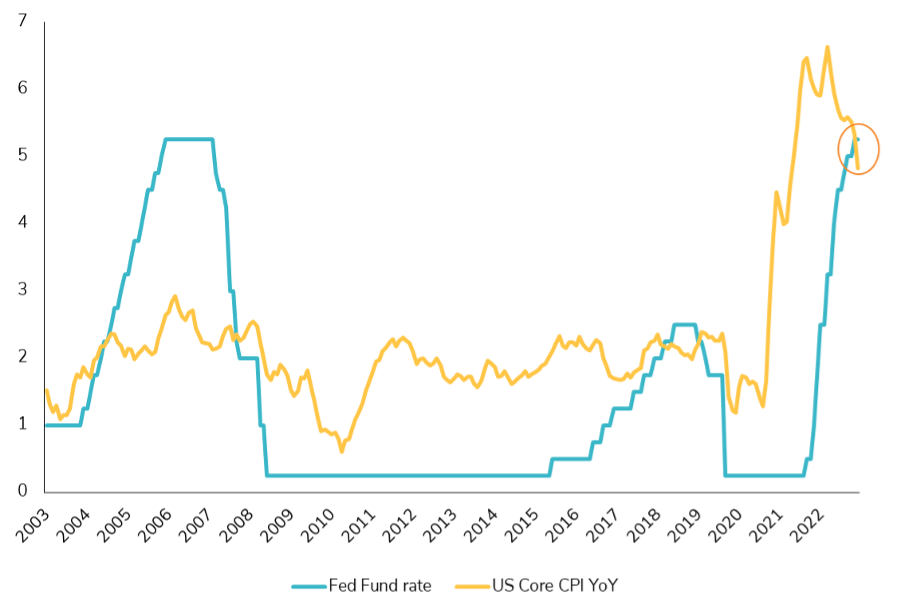

The Federal Reserve's recent commitment to raise rates in July has resulted in minimal changes over the week in market expectations for the upcoming meeting. The likelihood of a rate hike is currently priced at close to 100%, reflecting the prevailing scenario. However, other segments of the yield curve experienced notable movements during the week, driven by the market's reassurance regarding inflation, particularly in core services excluding shelter, which saw a modest monthly increase of 0.09%. The market has adjusted its expectations for a second-rate hike in September, with the likelihood now below 20%. Fed officials have taken a measured approach, with Mary Daly, President of the San Francisco Fed, stating that it's premature to declare victory on inflation. The Fed's balance sheet remained stable at $8.3 trillion, its lowest level since August 2021. In Europe, the European Central Bank (ECB) has confirmed another rate hike at its July meeting, but all options remain open for its September meeting. ECB officials, such as Ignazio Visco from Italy and Makhlouf from Ireland, have indicated varying perspectives on the need for rate adjustments and the transmission of past hikes through banks. The market, however, has priced in a slightly more hawkish outlook, with expectations of two more rate hikes by year-end. Lastly, the Bank of Canada (BoC) rose its key rates to 5%, as expected, earlier this week.

Credit

The credit market had a strong week, mirroring the positive performance of equities. Investment Grade bonds outperformed US Treasuries bonds (+1.5%) and US high yields (+1.7%), posting a gain of over 2% for the week. The CDX IG index, which tracks Investment Grade CDS, reached its lowest level since April 2022 at 63bps. US high yield spreads tightened by more than 10bps, remaining below 400bps since the beginning of July. In Europe, both Investment Grade and High yield segments also saw gains, with increases of +0.8% and +0.6% respectively. European high yield bonds have now achieved a positive performance of over 5% in 2023. The iTraxx Xover index, tracking European high yield CDS, reached its lowest level since the SVB crisis at 385bps. Financial subordinated debt had also a particularly strong week, with gains exceeding 1%. The iBoxx EUR Contingent Convertible liquid AT1 index has risen over 2% year-to-date, fully recovering from the Credit Suisse incident.

Rates

US Treasuries experienced their largest weekly inflows in 16 weeks, totaling $16 billion, as the release of CPI data prompted short sellers to cover their positions. The price action was significant, resulting in a 1.5% gain for US Treasuries bonds, making it one of the best weeks in 2023. The 10-year US Treasury yield currently stands around 3.8%, down 30bps from the previous week. The trend of yield curve steepening, which had been temporarily halted during Q2, appears to be resuming, with the 5s30s spread nearly flat compared to a decrease of 30bps just a week ago. The 4% yield level is seen as a psychological entry point for the 10-year US Treasury, attracting dip-buying whenever it is surpassed. Liquidity remains a concern, exacerbating price movements in US Treasuries, while the Federal Reserve's balance sheet continues to shrink, and the US Treasury department builds up its Treasury General Account. In Europe, rate movements have retraced only half of those observed in the US. The German 10-year Treasury yield declined by 15bps to 2.5% over the week, while the German 2-year yield ended the week at 3.18% compared to 3.25% the previous week. It is worth noting that peripheral rates benefitted from the risk-on environment, as the spread between Italian and German 10-year yields narrowed by almost 10bps to 165bps.

Emerging market

EM hard currency corporate bonds saw a gain of over 1% for the week, although they underperformed US Treasuries due to a widening of EM corporate spreads by more than 10bps. On the other hand, EM local currency bonds experienced a strong performance, rising over 2% for the week, benefiting from the significant depreciation of the US Dollar. In China, real estate bonds showed signs of bottoming out, with a 5% increase for the week, albeit still down -7% month-to-date and over -30% year-to-date. Authorities extended loan relief for developers and signaled additional targeted support measures in the property market. In Latin America, the Peru Central Bank (BCRP) maintained its key interest rate at 7.75%, following the trend of other regional central banks. The next move in this region could potentially be a rate cut, with the possibility of Brazil's Central Bank (BCB) taking action as early as August. In positive news, Fitch upgraded Uruguay's sovereign rating from "BBB-" to "BBB" with a Stable outlook. The upgrade reflects Uruguay's strong fiscal performance, resilience to the pandemic, improved fiscal credibility, and reduced risk of increased public debt. This marks Uruguay's highest rating from Fitch since 1995. EM Latam bonds have been among the best performers this year, with a year-to-date gain of 6% for the Bloomberg EM Latam hard currency index.

.png)