What happened last week?

Central banks

In the week shortened by the Easter weekend, central bank commentary highlighted a global divergence in monetary policy approaches. Federal Reserve Governor Christopher Waller underscored the necessity for prudence, advocating for either a postponement or reduction in the number of rate cuts this year, given the recent unsatisfactory inflation figures. This sentiment was echoed by Fed Chair Jerome Powell, who reiterated the need for more substantial evidence of inflation's containment before considering rate reductions. Powell acknowledged the U.S. economy's robustness and the progress made in inflation control but emphasized a cautious stance towards easing policies, aiming for further validation that inflation trends are aligning with the Fed's 2% target. Across the Atlantic, François Villeroy de Galhau of the European Central Bank struck a more forward-looking tone, suggesting the potential for initiating rate cuts as early as April or June. This stance aims to mitigate economic downturn risks while addressing balanced inflation concerns, signaling the ECB's readiness for an earlier policy adjustment, independent of the Federal Reserve's decisions. In the UK, Bank of England members Jonathan Haskel and Catherine Mann, known for their hawkish views, conveyed a more restrained outlook. Haskel indicated that rate cuts were "a long way off," advocating for a measured approach to easing. This cautious perspective, shared by Mann, highlights concerns over persistently high wage growth and the slow pace of its anticipated reduction, suggesting a deliberate path forward for the BoE. As Q1 2024 concludes, market expectations lean towards a coordinated global shift towards monetary policy easing, with around three rate cuts projected for the Federal Reserve, ECB, BoE, and Bank of Canada. While the Swiss National Bank has already enacted a cut, additional reductions are anticipated, contrasting with the market's prediction of rate hikes in Japan, underscoring the nuanced and varied central bank strategies as they navigate through the remainder of the year.

Credit

In Q1 2024, the credit market exhibited a dual pace: robust performances driven by credit spread tightening on one side, and challenges posed by rising interest rates on the other. Despite credit spreads in the U.S. Investment Grade (IG) sector tightening by 10bps to 90bps, the Vanguard USD Corporate Bond ETF closed the quarter down 0.2%. Meanwhile, the iShares USD High Yield Corporate Bond ETF outshone with a +1.9% gain, benefiting from lesser duration risk and a 30bps spread compression. The U.S. IG primary market was particularly active, with March witnessing a total of $140 billion in issuance. This activity contributed to a record-setting first quarter, accumulating $530 billion and surpassing the previous high of $480 billion set in Q1 2020 by approximately 10%. In contrast, the European credit market fared slightly better, with the iShares Core EUR IG Corporate Bonds ETF finishing the quarter in positive territory. This outcome was aided by less duration exposure compared to U.S. counterparts and a more significant spread tightening of 25bps to 114bps. However, the European High Yield (HY) market mirrored its U.S. counterpart until the last fortnight of March, when idiosyncratic risks emerged from CCC-rated debts. Notably, companies such as Altice, Intrum, and Ardagh faced market pressures, with losses ranging from 20 to 30 points, thereby affecting the lower-quality segment of the high-yield market. Consequently, March saw European HY performance level off, and it now trails behind its U.S. counterpart year-to-date (+0.3% vs +1.9%). Adding to the sector's challenges, S&P downgraded Altice France’s credit rating to CCC+ from B-, prompting a 20-point drop in bonds following the company’s announcement that creditors would need to accept haircuts to achieve more aggressive leverage targets. Undoubtedly, the standout performer this quarter was the European banks' CoCo bonds sector, with the Bloomberg EUR Banks CoCo Index soaring by +3.3%. This robust gain underscores strong investor confidence in European banks, further echoed by the Eurostoxx Bank Index's impressive +20% rally in Q1 2024. The quarter’s diverse outcomes in the credit landscape underscore the intricate balance between spread trends, rate shifts, and market sentiment, highlighting the intricate dynamics driving credit investment decisions.

Rates

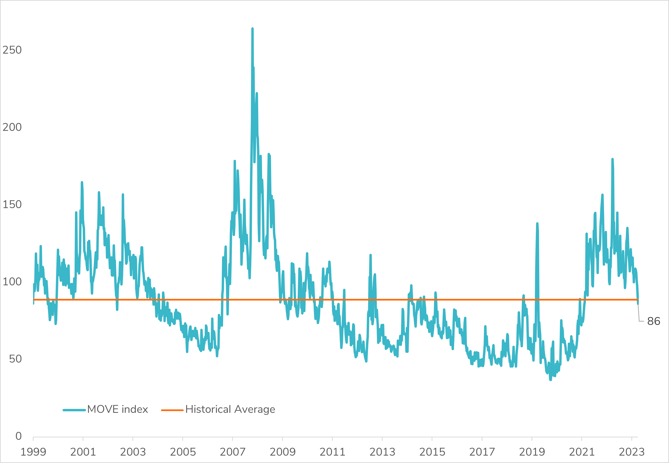

As the first quarter of 2024 draws to a close, U.S. Treasuries have shown positive momentum, recording a 0.2% increase last week and a 0.6% rise in March. Despite these gains, they remain in the red year-to-date, with a slight decline of approximately -1%. The successful execution of last week's bond auctions, notably a record $66 billion offering for 5-year notes, alongside a significant drop in interest rate volatility—evidenced by the MOVE index reaching a two-year low—has bolstered market confidence. Additionally, the S&P's reaffirmation of the United States' stable outlook further supports this sentiment. The 10-year U.S. Treasury yield concluded the quarter at 4.2%, up by 32 basis points since the year's start, and the yield curve (2s10s) has slightly flattened to -42bps from -38bps at the end of 2023. Market-based inflation expectations, as seen through breakeven rates, have also risen over the quarter, with the 10-year breakeven rate climbing 15bps to 2.32%, and the 2-year rate surging over 70bps to 2.72%. In contrast, U.S. Treasury Inflation-Protected Securities (TIPS) have relatively outperformed nominal bonds, with the iShares TIPS ETF remaining flat over the quarter, compared to the iShares US Treasury Bond ETF, which declined by -0.7%. European government bonds experienced a strong rebound in March, with the iShares Core EUR Government Bond ETF advancing by more than 1%, finishing the first quarter with a modest loss of -0.9%. The 10-year German yield ended the quarter at 2.3%, up from 2% at the year's commencement, and the German yield curve steepened to -55bps from -38bps. Notably, Italian government bonds emerged as a standout performer, securing a +1.5% gain in March and closing the quarter up by 0.9%, driven by a substantial spread tightening of 30bps relative to German bonds. Despite looming threats of a ratings downgrade due to heightened fiscal deficits, the spread between the 10-year French and German yields contracted by 3bps to 50bps. The UK bond market also demonstrated strong performance, concluding March with a 1.6% increase. However, this robust showing only partially mitigated the negative returns from the year's initial two months, leaving the quarter down by -1.8%.

Emerging market

EM bonds showcased a robust performance in the first quarter of 2024, with both corporate and sovereign segments benefiting from substantial spread tightening. The Bloomberg EM Corporate Bonds Index recorded a gain of +2.2% over the quarter, while the Bloomberg EM Sovereign Bonds Index increased by +1.7%. The positive trend continued into March, with the indexes up +1.0% and +2.0% respectively, highlighting a strong close to the quarter. The performance boost primarily stemmed from a 60bps tightening in EM corporate spreads, settling at 229bps. Central and Latin America led this advance, with standout performers like Braskem bonds surging +38% over the quarter. Similarly, EM sovereign spreads tightened by 40bps to 325bps, driven by recovery narratives in countries like Egypt and Argentina, which saw their bond values increase by +22% and +30% respectively in Q1 2024. This optimistic market sentiment enabled EM sovereigns to leverage favorable conditions, resulting in a record $81 billion in Eurobond issuances during the quarter, signifying improved funding opportunities. However, local currency EM debts faced challenges, marking their second toughest quarter in the last 18 months due to adverse currency movements. The CEEMEA region underperformed significantly in the local debt market, with Asia and Latin America showing relative resilience thanks to duration and carry gains mitigating currency losses. India and Mexico emerged as the best performing markets in local debts, with India's gains largely attributed to duration and carry, while Mexico benefited mostly from favorable FX movements. Conversely, Chile, Turkey, and Hungary experienced the most significant underperformance in their local debt markets during the quarter. Recent political events in Turkey, particularly Erdogan's party facing defeat in municipal elections amid high inflation and borrowing costs, have had a positive impact on the Turkish Lira and tightened the 5-year CDS for Turkey to 300bps. Meanwhile, Fitch's downgrade of Panama, citing fiscal and governance concerns, raises the prospect of the country losing its investment-grade status, underscoring the nuanced challenges and opportunities within the EM fixed income landscape.

.png)