What happened last week?

Central banks

This week, the narrative was shaped by key comments from Federal Reserve members, most notably from Governor Christopher Waller, who indicated that the Fed might consider reducing interest rates later this year if inflation does not show a significant rebound. Waller's perspective, pointing to strong economic activity and labor markets along with a gradual decrease in inflation towards the 2% target, suggests a more measured approach to rate adjustments. This cautious stance resonated with the market, leading to a recalibration of expectations: the anticipation of rate cuts in 2024 has been dialed back from six to five, with the first cut now eyed for May. Across the Atlantic, the European Central Bank's outlook diverges. Robert Holzmann, known for his hawkish views, cast doubt on the likelihood of rate cuts in 2024, considering the current economic and inflationary landscape and not discounting geopolitical tensions in the Middle East. This sentiment was echoed by ECB's Simkus, who expressed skepticism about imminent rate cuts, foreseeing them to potentially start around summer. Christine Lagarde, aligning with other ECB policymakers, is also pushing back against market expectations of near-term rate reductions, emphasizing the crucial role of wage trend data in informing policy decisions. Consequently, market expectations for ECB rate cuts have cooled, with the projection for 2024 now standing at five cuts, a notable decrease from the more than seven anticipated at the end of last year. In the UK, the unexpected rise in December's inflation to 4%, driven by sectors like alcohol, tobacco, and clothing, has prompted a re-evaluation of the Bank of England's rate cut timeline. This uptick, the first in 10 months, has shifted market bets, pushing the forecast for the first rate cut from May to June 2024, underscoring the fluid nature of economic forecasting and the constant interplay of various market forces.

Credit

The Investment Grade (IG) credit market is exhibiting robust health with positive excess returns. The credit spread (OAS) of the Bloomberg US Corporate Index has reached 95bps, marking its lowest level in two years. This tightening of spreads is attributed to strong demand and rising interest rates, which have been generally favorable for spreads. Illustrating this buoyancy, US IG companies are issuing bonds at the quickest pace since 2017 to start the year. However, despite narrower credit spreads, the overall total return of corporate bonds has been adversely impacted by the rising interest rates. Consequently, the Bloomberg US Corporate Index recorded a negative return of 1% over the week. In contrast, the High Yield (HY) market hasn’t mirrored the IG sector's resilience. Credit spreads in this segment remain wider than at the beginning of the year, with the Bloomberg US High Yield credit spread ending the week at 342bps, compared to 323bps at the start of 2024. Due to its lower duration risk, the HY index has fared somewhat better, down by just 0.6% over the week. Shifting to Europe, IG spreads edged slightly lower over the week to 138bps but are still at the same level as the beginning of 2024. European HY spreads remained unchanged at 382bps. Both European IG and HY indexes experienced negative returns this week, with declines of -0.4% and -0.6% respectively. The credit sector is receiving support from further upgrades, as highlighted by Lufthansa's long-term rating being upgraded by Moody's to Baa3 from Ba1. This upgrade reflects the airline sector's remarkable recovery, further exemplified by Air France's BBB- rating assigned by Fitch in December, marking it as a fully IG company.

Rates

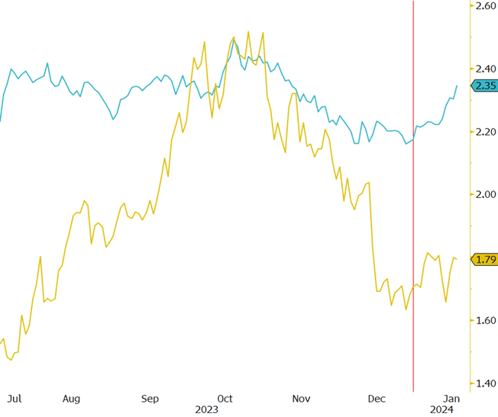

In the U.S., the 10-year Treasury yield has risen sharply from 3.9% to 4.2% since the start of the year. Contrary to discussions about strong disinflation, the pressure on higher rates is actually due to increasing long-term U.S. inflation expectations. The rise in the 10-year U.S. breakeven rate (by around 20 basis points) exceeds the increase in the real rate (10 basis points). This development raises questions about whether it reflects the Federal Reserve's success in steering towards a soft economic landing, or if it's a response to anticipated rate cuts, indicative of the resilience of the U.S. economy. U.S. Treasury bonds have declined more than 1% this week and 1.5% year-to-date, with hedge funds holding the largest short position in history on 10-year Treasury contracts. In Europe, the bond market is experiencing similar stress. The 10-year German yield has increased by 15 basis points over the week and more than 30 basis points year-to-date, closing above 2.3%. Notably, the yield curve (2s10s) remains inverted at -22bps since the start of the week. Peripheral rates have outperformed, with the spread between the 10-year Italian and German yields narrowing to 153bps, the lowest in two years. The Bloomberg Treasury Italy index is down 1% year-to-date, demonstrating the rush of investors to capitalize on higher yields in European debt, as seen in the record €1.04 trillion bids for January's syndicated debt sales. In the UK, an unexpected rise in inflation has pushed up rates, with the 10-year UK yield ending the week above 3.90%, a 40 basis point increase from the 2023 close. This upward pressure is attributed to a more resilient British economy, adjustments to current mortgage rates, and expectations of high government bond supply in the longer-term segment in the first quarter. In Japan, the 2-year yield dropped into negative territory for the first time since August 2023, while long-end yields faced pressure following a weak 20-year JGB auction. The Japanese yield curve (2s30s) has steepened significantly over the past month, moving from 140bps to 170bps.

Emerging market

In the Emerging Markets (EM) sector, corporate debts are showing significant strength, mirroring the positive trends seen in the American Investment Grade (IG) market. EM corporate bond spreads (OAS) have tightened to 270bps, the lowest since the COVID-19 crisis began. Despite this positive trend in spreads, the overall performance of EM bonds varied. The Bloomberg EM Sovereign Bonds Index experienced a 1% decline over the week, influenced by the global rise in interest rates. Conversely, the Bloomberg EM Corporate Bonds Index fared slightly better, ending the week with a modest loss of 0.3%. Local currency bonds in EM markets also faced challenges, recording a loss of 1%. In a notable development, China is exploring the issuance of 1 trillion yuan ($139 billion) in special sovereign bonds. This rare fiscal move aims to boost the economy by funding key projects in sectors such as food, energy, and urbanization, reflecting a strategic effort to stimulate growth and counter deflationary pressures. Ping An Bank’s initiative to support 41 property developers, including prominent companies like Longfor and Vanke, highlights China's concerted efforts to stabilize its real estate sector. JPMorgan's decision to exclude Egypt from its local-currency bond indexes due to foreign exchange shortages signifies the economic challenges the country faces, including severe dollar scarcity and repeated currency devaluations since early 2022. Furthermore, Moody’s downgrade of Egypt’s credit outlook to negative highlights the increasing risks to the country's financial stability.

.png)