Introduction

It’s been a challenging summer for the Chinese real estate market, as the difficulties faced by Chinese developers continue to cast a shadow over the industry. In this update, we delve into recent events and their consequences , including the unexpected turmoil surrounding Country Garden, while also shedding light on the sector.

Country Garden's unforeseen turmoil

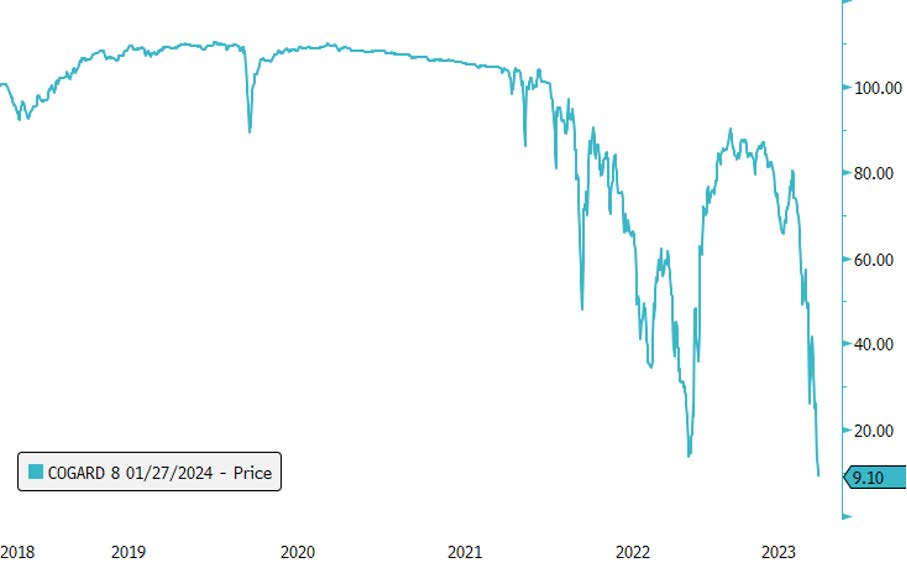

At the forefront of recent developments was the unexpected upheaval within Country Garden, a stalwart of China's real estate market. Despite its reputation as one of the largest and most secure developers in the nation, Country Garden missed a coupon payment on its U.S. dollar bonds for the first time in its history. This was further compounded by a projected multibillion-dollar loss in the first half of 2023. While boasting a credible financial reporting structure and substantial cash reserves, Country Garden's vulnerability lies in its significant exposure to smaller, struggling cities.

This positioning intensifies its challenges, especially as the company grapples to achieve the monthly sales needed to sustain projects. This prompted questions from foreign investors, who hold around $10 billion in dollar bonds, regarding potential recovery rates and the timeline for navigating this crisis. The repercussions extended beyond the company itself, significantly impacting the broader real estate sector and high-yield market.

Chart1: Bond price of the Country Garden USD bond maturing within 5 months.

Source: Bloomberg

Markets negative reaction

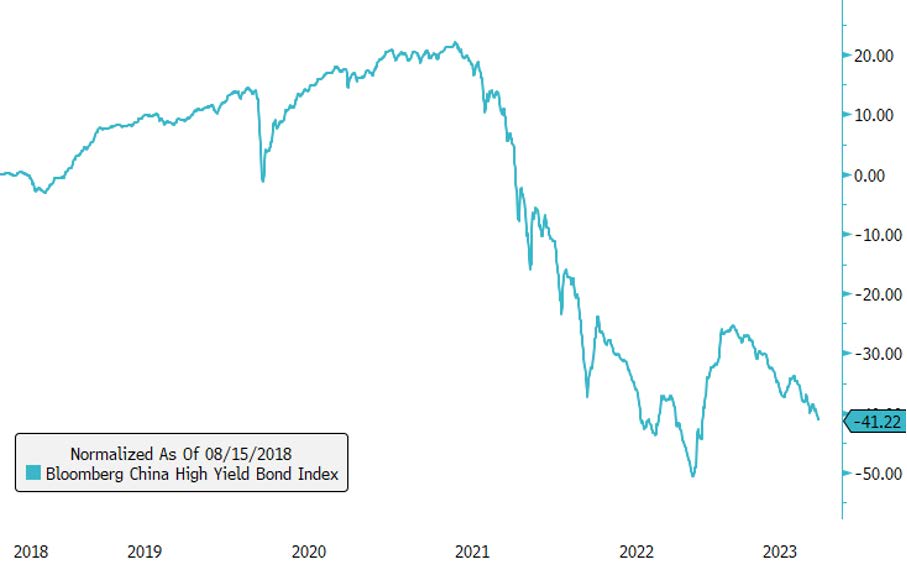

The repercussions of the Country Garden crisis reverberated throughout the industry, highlighting the vulnerabilities of even the most established developers.

This event not only raised concerns about the stability of the sector's strongest companies, but also led to a market-wide reassessment of risk. As a result, average prices for Chinese high-yield dollar bonds fell sharply, underlining investors' heightened caution.

Chart 2: 5-year Performance of China High Yield bonds

Source: Bloomberg

Support from People's Bank of China

Amidst the challenges, some relief has been sought from the People's Bank of China (PBOC). In mid-July, the Politburo signaled its intention to provide increased support to

the real estate sector, alongside commitments to boost consumption and address local-government debt concerns.

However, these initiatives fell short and early August, the PBOC took a step further by announcing plans to enhance private-sector funding support following discussions with property executives. While these actions are noteworthy, the absence of a substantial demand stimulus from the PBOC has left some industry insiders skeptical about the sector's imminent recovery.

Looking ahead

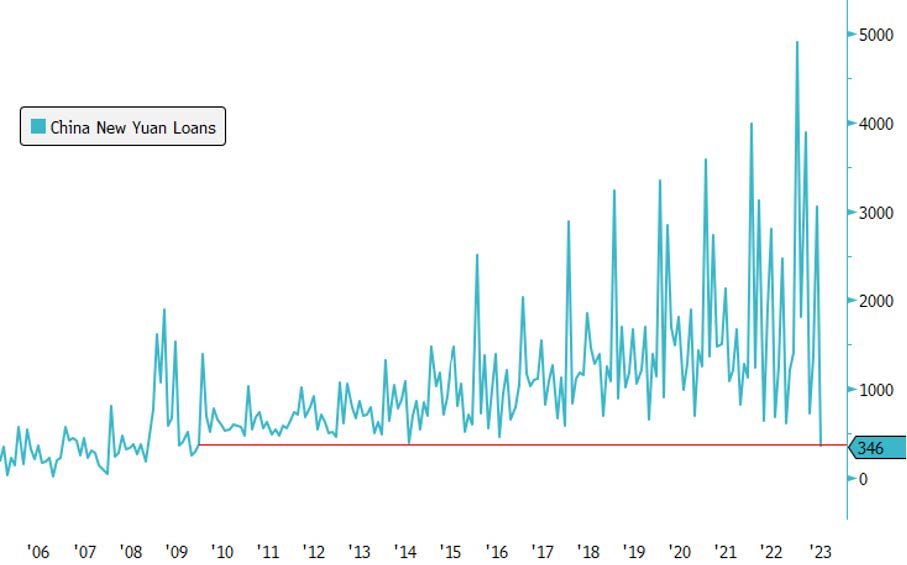

The Chinese real estate sector remains entrenched in an unbreathable environment. The turmoil surrounding Country Garden has underscored the sector's fragility, while the broader market continues to grapple with declining bank loans and significant drops in contract sales. Despite some supportive measures from the PBOC, concerns loom about the efficacy of these actions in the absence of a robust demand stimulus.

Chart 3: Total new loans in China fell to their lowest level since 2009

Source: Bloomberg

Conclusion

Once again, China's real estate sector is faced with an overwhelming wave of challenges in part due to Country Garden’s financial difficulties and the broader struggles faced by Chinese developers. The market's response to these events has triggered a comprehensive reassessment of risk, resulting in a decline in average dollar high-yield bond prices. In spite of efforts by the PBOC to fortify the sector, skepticism prevails regarding their effectiveness of their measures. The Chinese real estate market appears trapped in an adverse cycle, demanding substantial time and concerted efforts from Chinese authorities to revive, even a semblance of positive momentum. In the interim, investors must brace themselves with patience and determination as they navigate the impending restructuring initiatives.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Here's a summary of the Federal Reserve’s decision: 1. Interest rates cut by 50 bps for first time since 2020 2. Rate cuts 2 more 25 basis point in 2024 3. Fed governor Miki Bowman dissented in favour of a smaller 25 bps cut. It's the first dissent by a "governor" since 2005 4. Gained "greater confidence" that inflation is moving to 2% 5. Have an evolving outlook as "carefully assess incoming data" 6. Rate cuts of 100 bps in 2025 and 50 bps of cuts in 2026

The US labour market is cooling down, and today’s Employment report brought another confirmation of this trend. Job creations in the private sector have settled below 200k per month throughout Q2 and declined to 136k in June. The unemployment rate ticked up to 4.1%, its highest level of this expansion cycle. Only government jobs continued a solid upward trend, which may not be surprising in an electoral year. The normalisation of the US labour market is one of the five key trends to watch for the next 6 months (cf. Syz H2 2024 Market Outlook: Normalisation ahead). Today’s US Employment Report fits into this dynamic, which is at the heart of our expectations for economic growth normalisation, softer inflationary pressures and central bank rate cuts.

.png)