What happened last week?

Central banks

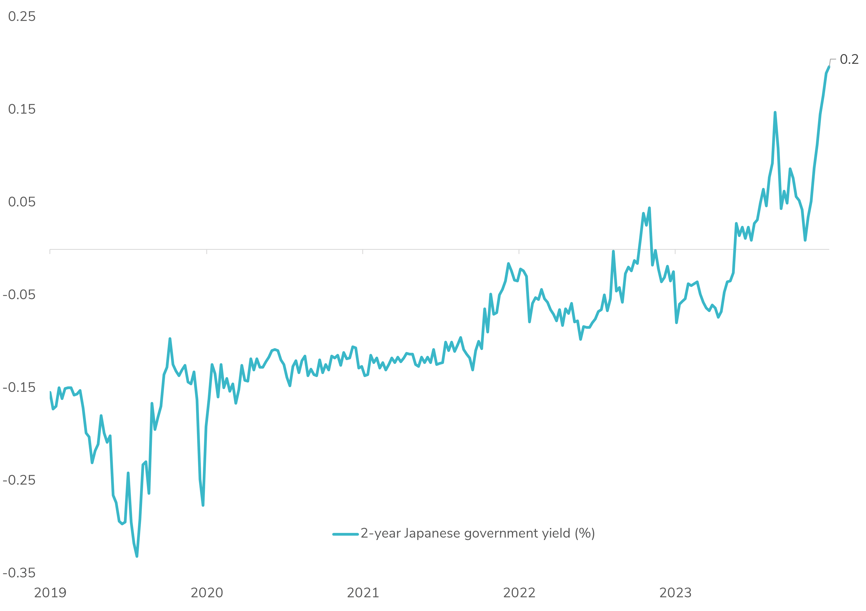

Federal Reserve Chair Jerome Powell hinted at the possibility of three interest rate cuts in 2024, underlining the necessity for "just a bit more evidence" that inflation is steadily moving towards the Fed's 2% target. This stance suggests a careful policy adjustment ahead, with Powell emphasizing robust economic growth and the criticality of not easing too hastily. Minneapolis Fed President Kashkari and Bostic share this cautious optimism, indicating a readiness to cut rates once or twice based on upcoming inflation figures, yet stressing a collective inclination towards a gradual easing beginning mid-2024. Market expectations have now aligned with the Fed, fully pricing in a rate cut by June and anticipating 3 to 4 cuts throughout 2024. In Europe, the ECB maintained steady policy rates and introduced no significant measures regarding balance sheet runoff in its Thursday meeting. President Lagarde pointed to the potential for rate cuts, albeit not before June, highlighting the importance of gaining confidence in the disinflation process. New staff projections, revealing downward adjustments to inflation forecasts, reinforce belief in inflation's return to the 2% target. Nonetheless, Friday brought a twist with officials like Nagel, Villeroy de Galhau, and Simkus signaling openness to an April cut, though the majority stance still tilts towards June, influenced by euro area wage growth. Market consensus firmly expects a June rate cut, with a 100% perceived probability. In Japan, a shift towards ending negative interest rates by March gains momentum among Bank of Japan policymakers, driven by labor unions' strongest wage demands since the early 1990s and growing confidence in economic recovery and inflation trends. Last week, market speculation about a rate hike in the BOJ's March meeting surged from 30% to nearly 70%. In the UK, market consensus for a first rate cut in August remains unchanged, with expectations of 2 to 3 cuts in 2024. Meanwhile, in Switzerland, the likelihood of witnessing the first rate cut in March has decreased from 60% to 30% over the week.

Credit

The overall sentiment in the credit market remains positive, evidenced by well-received new issues and positive inflows, reflecting investor confidence. However this week, in the Investment Grade (IG) sector, performance gains were largely attributed to favorable U.S. interest rate movements, while IG credit spreads stayed constant. U.S. IG bonds saw a +0.9% increase, with European IG bonds up by 0.6%. The high-yield (HY) market revealed a divergence between cash bonds and Credit Default Swaps (CDS). Cash HY spreads in both EUR and U.S. indices widened slightly—by 10bps and 5bps respectively. However, their CDS counterparts saw significant tightening, with the CDX U.S. high yields index hitting a 2-year low at 328bps, and the XOVER index dropping below 300bps for the first time since January 2022. Despite this divergence, the iShares U.S. HY Corporate Bonds and iShares EUR HY Corporate Bonds ETFs achieved gains of +0.7% and +0.4% respectively since March began. Subordinated debts, particularly highlighted by nearly a 1% increase in the WisdomTree AT1 CoCo Bond ETF, showcased robust performance, further affirming the sector's appeal to investors. Fitch's recent upgrade of 26 EU/UK Solvency II RT1 and Tier 3 hybrid debts, following a revision in its Insurance Rating Criteria, reflects a more nuanced risk assessment. This adjustment suggests that the perceived risks associated with these instruments are lower than previously estimated, highlighting the ongoing recalibration within the credit market's risk evaluation frameworks.

Rates

March has seen U.S. Treasuries off to a robust start, with a month-to-date performance of 1%. Several factors contribute to this rebound: a decline in the Citi U.S. Economic Surprise Index, a shift towards a negative correlation with equities, and a surge in inflows. Technically, the futures price on 10-year U.S. Treasuries has reclaimed positions above its 50, 100, and 200-day moving averages, suggesting a positive momentum. The 10-year U.S. Treasury yield has decreased by nearly 20bps since the onset of March, closing the week at 4.08%. The yield curve remains flat at -36bps, with the reduction in yields largely attributed to a drop in real yields, as U.S. breakeven rates have shown little movement. Volatility, as measured by the MOVE index, has decreased yet remains elevated, indicating ongoing market sensitivity. European government bonds echoed the positive trend set by U.S. Treasuries, achieving a 1% gain since the week's start. The recent ECB meeting played a pivotal role, comforting markets with its clear intent to lower interest rates in the coming months. This announcement spurred a 15bps decrease in both the 2-year and 10-year German yields to 2.75% and 2.25%, respectively, month-to-date. Peripheral bonds saw substantial outperformance, with the spread between the 10-year Italian and German yields narrowing to 130bps, a level not observed since January 2022. In the UK, the 10-year government bond yield retreated below 4%, signaling a broader trend of easing yields across major markets. Meanwhile, in Japan, the 10-year yield experienced a slight increase of 2bps, ending the week at 0.73%.

Emerging market

Emerging market (EM) bonds have joined the broader fixed income rally in March, with the EM Aggregate Bond Index recording a 0.8% uptick. However, a closer examination reveals a nuanced picture: while U.S. rate performance bolstered the sector, EM credit spreads have subtly widened since the onset of March. Specifically, EM sovereign bonds saw their spreads expand by 5 bps, and corporate spreads from emerging countries increased by 10 bps. Contrastingly, EM bonds have experienced capital outflows since March began, diverging from the inflow trends seen in the U.S. and Europe. Highlighting the diverse performance within EMs, sovereign high-yield bonds from Ecuador and Egypt stood out, buoyed by positive developments with the IMF. Ecuador's optimism stems from a newly secured IMF agreement, while Egypt's recent $8 billion pact with the IMF and an unexpected 600 basis point rate hike have propelled its bonds. Conversely, Turkey grapples with persistent inflation, dwindling reserves, and looming local elections at March's end, pushing its 5-year CDS from 298bps to 322bps in just a week. In Asia, the narrative remains mixed, with High Yield bonds displaying a flat performance month-to-date, largely dragged down by the Chinese real estate sector again. Vanke, China's second-largest property developer by sales, faces renewed debt obligation concerns amidst China's economic growth target of "around 5%" for 2024, supported by fiscal measures and a 3.0% deficit target, aligning with the new leadership's focus on political stability. A noteworthy development is Adani Group's return to the bond market, attracting strong demand for a $409 million 18-year senior secured bond, indicating investor confidence rejuvenation. The oversubscribed offering is part of Adani's broader strategy to secure at least $2 billion in mainly new debt within the year, marking a significant step in its financial rehabilitation.

.png)