What happened last week?

Central banks

Fed Chairman Powell concluded the week in attend to calm the market following a series of speeches by several Fed members throughout the week. The market has heightened its expectations for a rate hike in June, aligning with the diverse range of views expressed in the speeches. Some members, such as Jefferson, Williams, Bostic, and Goolsbee, advocated for a pause, while others like Logan, Barkin, and Mester left the door open for a potential further hike. At the end of the week, the market assesses a one in three chance of a rate hike in June. Meanwhile, in Europe, European Central Bank President Lagarde has significantly influenced the European fixed income market by emphasizing the need for sustainably higher interest rates to control inflation. Consequently, the likelihood of a rate hike in September, following two hikes in June and July, has surged to nearly 50%.

Rates

The past week proved challenging for U.S. Treasury bonds, which experienced a decline of -1.4% due to progress made in debt ceiling talks. The 2-year U.S. Treasury yield saw a significant increase of nearly 30bps, marking its largest weekly rise since June 2022. The 10-year Treasury yield reached 3.72%, reaching a level unseen since the beginning of March, before settling at 3.68% by the week's end, representing a rise of +20bps. Consequently, the yield curve inversion deepened, with the difference between the 2-year and 10-year U.S. Treasury yields narrowing by 6bps to -60bps. In Europe, government bonds also faced challenges, as German bonds dropped by 1.2%. However, peripheral government bonds outperformed, with Italian bonds experiencing a more modest drop of 0.6%. Moody's confirmed Italy's BBB- sovereign debt rating on Friday evening following a comprehensive review of its credit profile. This decision solidifies Italy's investment grade status, providing stability and reassurance to the market. At the end of the week, the spread between Italian and German 10-year yields closed at 184bps.

Credit

U.S. Corporate bonds faced headwinds as U.S. interest rates climbed, resulting in a 1.5% loss for U.S. Investment grade bonds, while U.S. High yield bonds experienced a slight decline of -0.5% for the week. Despite stable IG credit spreads at 144bps, HY credit spreads widened by 7bps to 478bps. In Europe, corporate bonds displayed more resilience with a 0.8% loss for IG and a 0.4% gain for HY. The market's complacency towards this segment, which has performed exceptionally well year-to-date (up over 4%), is notable. Moreover, the recent sharp decrease in European High Yield volatility indicates a lack of concern within the market. Examining the 30-day price volatility over the past decade, the European High Yield index has returned to 2021 levels, currently standing one standard deviation below the historical average. Finally, AT1/CoCo bonds emerged as the top performer of the week. The AT1 market received a boost from a report suggesting that the EBA (European Banking Authority) is considering a ban on banks paying dividends before potentially skipping an AT1 coupon to preserve capital during stressful periods. As a result, the iBoxx Europe AT1 index surged by almost +2% over the week.

Emerging market

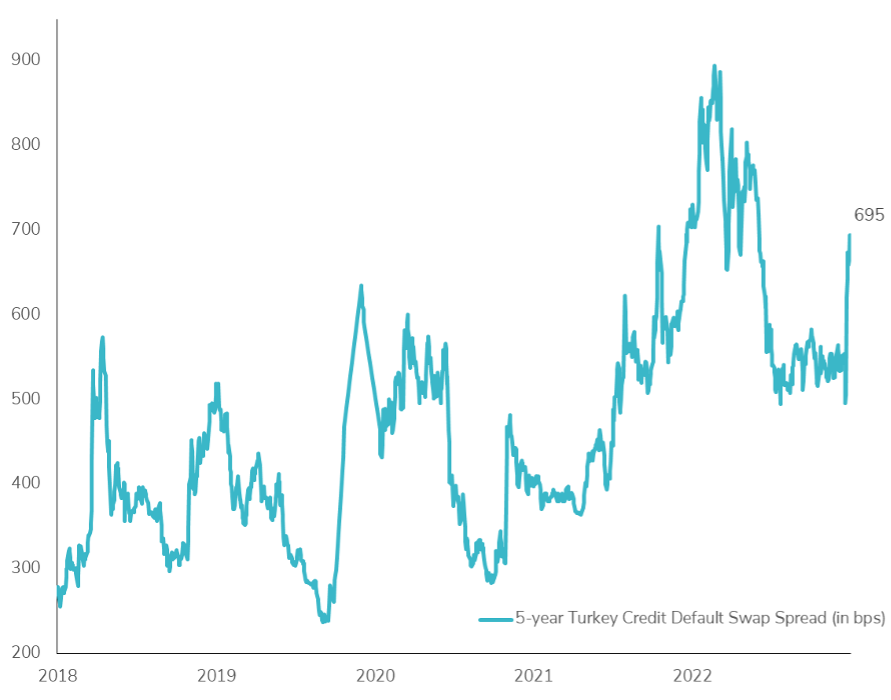

Emerging market (EM) corporate bonds experienced a 0.9% decline last week, mirroring the performance of U.S. Treasuries. With the exception of Chinese real estate bonds, which continued their significant drop and recorded their worst monthly performance (-20%) since October 2022, Turkish bonds were the worst performers. The outcome of the first round of the Turkish presidential election, leading to a run-off in two weeks' time, exerted pressure on Turkish bonds, with the 5-year CDS reaching its highest spread levels (close to 700bps) since October 2022. In terms of local currency, EM bonds have turned negative month-to-date (-0.5%) following another week of decline (-0.8%), primarily driven by the strengthening of the U.S. dollar for the third consecutive week. In Latin America, most central banks have now adopted a hold stance after the recent decision of the Mexican central bank to pause last Thursday. Market expectations point towards rate cuts within the next 6 months for Brazil, Chile, Colombia, and Mexico. Interestingly, despite having the highest real policy rate, Brazil is expected to be the slowest among these countries to cut interest rates within the next 2 years.

.png)