What happened last week?

Central banks

As central banks navigate the evolving economic landscape, their policies reflect a delicate balance between inflation control and economic growth. The upcoming FOMC meeting is expected to see the Federal Reserve maintain its current monetary stance, as declining inflation coupled with a strong economy and job market allows for a measured approach to rate adjustments. The Fed's focus is also shifting toward managing the end of quantitative tightening, with the market pricing in a less than 50% chance of a rate cut in March and anticipating the first cut in June among more than five cuts for 2024. Across the Atlantic, the ECB has decided to hold interest rates steady, emphasizing the need for current rates to persist for an extended period. This decision comes against the backdrop of dampened demand contributing to a decrease in inflation and a moderate positive outlook on Eurozone inflation. With the market now seeing a 70% chance of a rate cut in April and nearly six full rate cuts this year, the ECB's deposit facility rate could drop to 2.5% by year end. In the UK, the BoE is expected to keep its key rates steady, despite a substantial revision in the UK's inflation outlook. With inflation now projected to return to the 2% target by summer 2024, the market anticipates the first rate cut in June. This earlier-than-expected return to the inflation target could significantly influence the BoE's policy direction. Meanwhile, the BoJ maintains its current rates, with Governor Kazuo Ueda preparing for an earlier end to yield-curve control and negative interest rates. The BoJ’s recent Outlook Report indicates a rising likelihood of achieving its 2% inflation target, acknowledging positive wage-price cycle developments. Ueda’s comments hint at a continued accommodative policy even after exiting the current framework, signaling a cautiously optimistic stance towards reaching the inflation target.

Credit

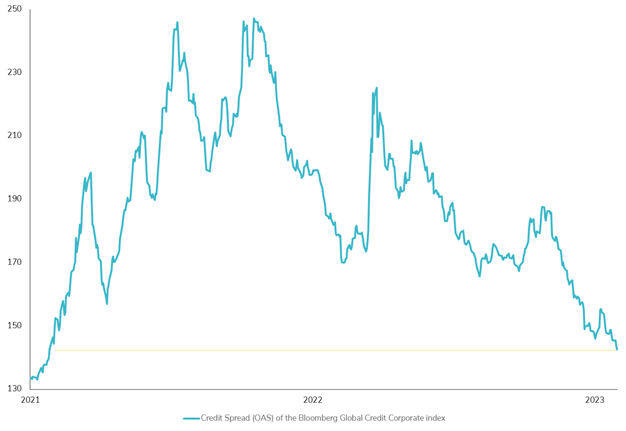

Global credit markets are exhibiting signs of resilience and investor confidence, as evidenced by the continual tightening of credit spreads. This trend is seen as a strong indicator against any immediate recession fears, with corporate bonds drawing considerable investor interest even amidst a vibrant primary market. The Bloomberg Global Corporate Credit Index's credit spread (OAS) has now descended to a two-year low, significantly undercutting its historical average of 200bps and moving toward record lows around 100bps. In the U.S., credit default swap (CDS) indices for both investment grade (IG) and high yield (HY) sectors have reached a two-year low, reflecting the market's positive sentiment. The CDX IG closed the week at an impressive 54bps, while the CDX HY settled at 349bps. A similar trend is observed in the cash market, where the spread of the Bloomberg US Corporate Index hit 92bps, marking the lowest level since early 2022. This tightening in spreads has led to slight gains in IG bonds, offsetting the impact of rising rates. U.S. high yield bonds, benefitting from these conditions, have seen an uptick of 0.5% over the week. The European credit market has paralleled this positive trajectory, buoyed by favorable European rate movements and a contraction in spreads. European IG credit spreads have hit a low of 130bps, the most favorable since early 2022, while HY credit spreads have tightened to 360bps. This has resulted in both European IG and HY indexes closing the week in positive territory, up by +0.5% and +0.6% respectively. Notably, Additional Tier 1 (AT1) bonds have outperformed other categories, with gains surpassing 0.8%, highlighting their strong appeal in the current market.

Rates

In the realm of global interest rates, dynamics are shifting rapidly. In the U.S., rates concluded the week near their highest points for the year. A strong set of U.S. economic data, as indicated by the Citi Economic Surprise Index reaching a two-month high, has taken the market by surprise. Additionally, U.S. inflation continues to decelerate, with the PCE Core Deflator for December reported at 2.9%, down from 3.2% in November. This backdrop has led to a notable steepening of the U.S. yield curve, with the 2-year Treasury yield dropping by 5bps over the week, while the 30-year yield jumped by 7bps. The spread between the 2-year and 30-year Treasury yields has returned to positive territory, aligning with the emerging 2024 theme in fixed income of favoring the front end of the yield curve for duration-adjusted positions. Interestingly, long-term breakeven rates, indicative of inflation expectations, remained stable this week, while short-term real rates decreased significantly. Conversely, front-end breakeven rates rebounded by over 5bps, further benefiting TIPS, which have outperformed nominal bonds by 100bps year-to-date. In Europe, January 2024 marked the busiest bond sales month in the continent's history, with total issuances nearing €300 billion, driven by borrowers capitalizing on investor liquidity and securing yields before expected central bank rate cuts. Investor demand for euro, pound, and dollar-denominated debt surged, with orders reaching €1 trillion remarkably fast. European performance has outpaced its U.S. counterparts, with the 10-year German yield closing the week at 2.3%, down 4bps, and the 2-year German yield falling 10bps to 2.63%. Peripheral spreads tightened further, with Italian bonds reaching new lows; the spread between the 10-year Italy and German yields narrowed to 152 bps, the lowest level since April 2022. In Japan, the 10-year Japanese yield experienced a sharp rebound, reaching 0.75% for the first time this year, reflecting a broader trend of fluctuating yield dynamics across global markets.

Emerging market

Emerging Markets (EM) are showing buoyancy, particularly in corporate bonds where spreads have tightened to levels not seen since before the pandemic. The Bloomberg EM Corporate Bonds Index slightly rose by +0.3% over the week, while EM sovereign bonds held steady. Key to this uptrend is China's monetary policy easing; the People's Bank of China (PBOC) plans a 50bps Reserve Requirement Ratio (RRR) cut soon, injecting about CNY 1 trillion into the economy. Additionally, the PBOC has reduced loan refinancing and rediscounting rates for targeted sectors, complementing broader efforts to support economic growth. In Latin America, Brazil's record bond offering of $4.5 billion signifies a vibrant market, with corporate debt issuance gaining momentum. This surge in bond sales from firms like Codelco, America Movil, and Cosan suggests a strong year for corporate debt in the region. With Banco Santander SA forecasting a doubling of sales from 2023's $44 billion, the early weeks of 2024 have seen a substantial increase in international bond issuance, eclipsing last year's figures. Turkey's Central Bank's recent rate hike of 2.5% to 45% might signal the end of its current tightening cycle, despite ongoing inflation challenges. In sub-Saharan Africa, the Ivory Coast's issuance of a $2.6 billion Eurobond, the first such sale in almost two years, marks a notable return of investor interest to the region.

.png)