Gold’s recent price correction

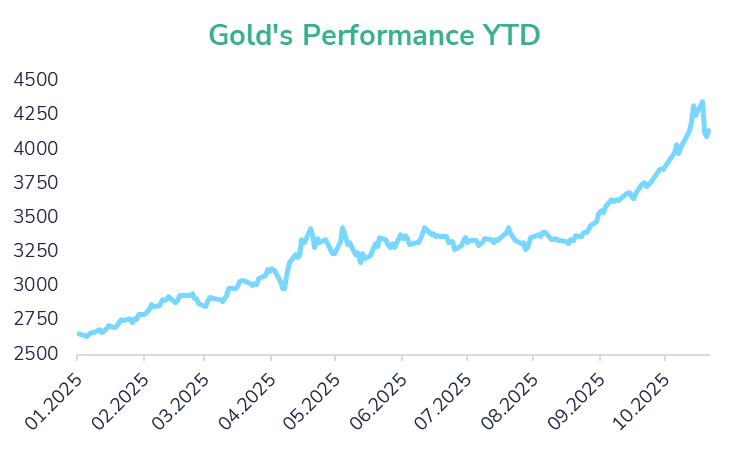

Gold rose over 59% this year as central banks kept driving the debasement trade, reinforcing its appeal as the ultimate safe haven in an uncertain yet supportive environment.

However, prices saw a sharp selloff starting on Tuesday, after an exceptionally strong two-month rally left the metal overheated. A pullback was overdue and can be considered as a healthy correction for the asset.

The metal now needs to “cool down” before resuming a more sustainable uptrend. Obviously, confidence has been shaken by this sharp correction, particularly among market participants (like retail investors and hedge funds) who joined late in the rally, often building their exposure through heavy ETFs buying. Sentiment will take time to recover. This contrasts with long-term investors and central banks, which have been steadily accumulating gold for years as part of their long-term de-dollarization strategy.

Noticeably, the fact that equities, the USD, and yields stayed stable during this gold price correction suggests that the drop was mainly a technical correction specific to the asset and not a sign of a broad market stress.

Nevertheless, gold’s correction may last as long as the speculative excess that has been recently built up in the market is not fully flushed out. Some of this flow could eventually be redirected toward base metals such as copper and aluminium, which are showing signs of technical strength and stand out as key beneficiaries of the energy transition.

Despite the possibility of further volatility, gold remains a strategic safe haven, not just a short-term trade. Persistent geopolitical risks, inflation upside risks, recent concerns on potential weak links in the US financial system and the prospect of a more accommodative Fed’s monetary policy ahead all continue to provide medium to long term support for gold.

Source: Bloomberg

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Meanwhile, the Korean stock market surges to new levels. Each week, the Syz investment team takes you through the last seven days in seven charts.

Meanwhile, bitcoin and software equities are moving like twins. Each week, the Syz investment team takes you through the last seven days in seven charts.

While gold, silver and platinum were the best performing commodities over the past year, they took a hit at the end of last week. Each week, the Syz investment team takes you through the last seven days in seven charts.

.png)