What happened last week?

Central banks

The minutes from the Federal Reserve revealed a cautious stance, indicating a willingness to consider a pause or further tightening depending on upcoming data. Atlanta Fed President Bostic emphasized the importance of data-driven decision-making. Recent US indicators, such as unemployment and PCE, have significantly increased the likelihood of another rate hike by July, reaching a near-certainty of 100% and potentially pushing the terminal rate to 5.5%. Meanwhile, the release of a higher-than-expected British CPI indirectly influenced the European Central Bank, adding to the pressure. While ECB Governor De Cos believes there is still progress to be made in tightening monetary policy, ECB Governor Simkus anticipates two hikes in June and July. The publication of the ECB's Financial Stability Review on Wednesday, along with the forthcoming minutes on Thursday, will provide further insights into the ECB's assessment of the current European economic landscape.

Rates

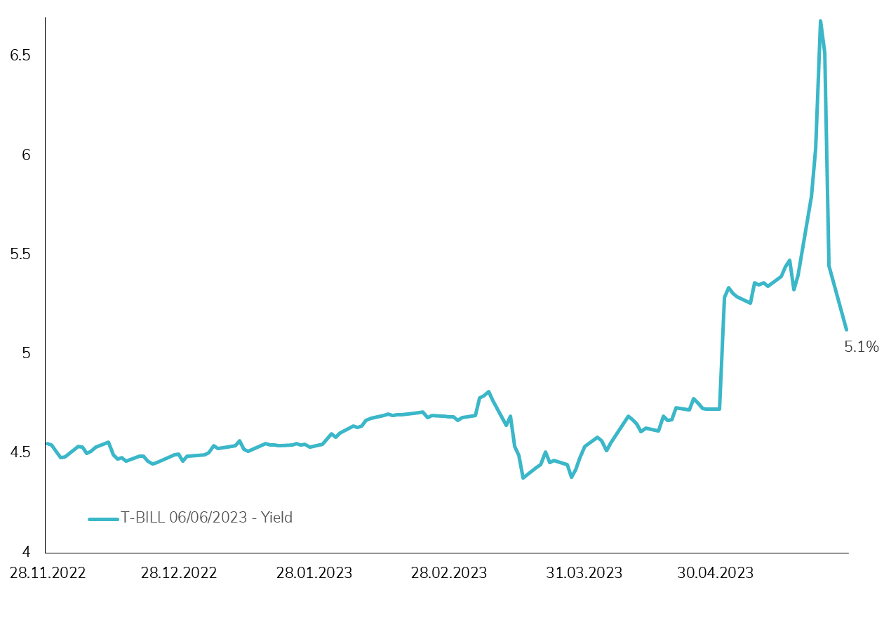

In the United States, last week witnessed the most significant flattening of the U.S yield curve (2s10s) since April 2022, resulting in the largest inversion since the peak of the SVB crisis. The 2-year US Treasury yield (UST) surged by 30 bps, surpassing 4.5%, while the 10-year UST closed the week above 3.8%. These upward movements in yields sparked increased volatility for US Treasuries, pushing the MOVE index above 145, a level unseen since early April. The potential resolution of the debt ceiling issue and the release of key economic indicators, such as inflation and unemployment figures, further intensified pressure on government bonds, causing them to decline by over 2% in May.

In Europe, government bonds outperformed despite a negative performance of -1.6% in May. Unexpected improvements in inflation in Spain relieved some of the recent yield pressures. On the other hand, the UK bond market experienced a sharp decline due to an unforeseen surge in the core inflation rate, reaching its highest level in over three decades. This surprising development resulted in a significant 50 bps increase in the two-year UK Treasury yield throughout the week. UK sovereign bonds are currently heading towards their worst month (-5.3% so far) since September 2022 (-8.4%).

Credit

Corporate bonds have emerged as the star performers of 2023, surpassing sovereign bonds in terms of performance, thanks to the stabilization of credit spreads in both the investment-grade (IG) and high-yield (HY) segments. This trend continued last week, as credit spreads narrowed slightly in the US and Europe. In the US, IG credit spreads tightened by 6 basis points to 137 basis points, while HY spreads decreased by 30 basis points to 446 basis points. The high-yield segment has been the standout performer in the US bond market this year, delivering a remarkable performance of over 3%, despite a 1.2% decline in May. In Europe, the Itraxx Xover index tightened by 10 basis points to 425 basis points, while EUR HY spreads reached 480 basis points, down 25 basis points, marking their lowest levels since early March. Additionally, the AT1 (Additional Tier 1) market is experiencing its best month since January, as concerns surrounding the Credit Suisse incident fade away. The iBoxx Europe AT1 index achieved a gain of over 2% in May, reinforcing the positive sentiment in this segment.

Emerging market

Last week witnessed a decline of 0.5% in both emerging market corporate bonds and US corporate bonds. Furthermore, emerging market bonds experienced ongoing negative performance in local currency, with a monthly decline of 1%, primarily influenced by the strengthening of the US dollar. In Latin America, there was a positive development as 5-year sovereign CDSs tightened across the board, notably in Colombia, where they decreased by 10 bps to 279 bps. In China, the real estate sector continued to face challenges, resulting in a weekly performance decline of 3%. The highlight of the week was President Erdoğan's victory in the second round of the presidential election, which introduced heightened volatility in Turkish assets. However, Turkish hard currency bonds displayed a robust rebound since yesterday. Notably, the Turkey CDS has decreased by 40 bps to 620 bps since the beginning of the week.

.png)