What happened last week?

Central banks

Some Fed officials, including Chicago Fed President Goolsbee and Atlanta Fed President Bostic, suggest a shift in the rate-hike debate from "how high" to "how long" rates should be maintained. They emphasize the need to ensure a sustained path towards the inflation target. Fed officials appear inclined towards a pause, aligning with the market's low expectation of less than a 10% chance of a rate hike at the next meeting. In Europe, Economists are divided on the ECB's next move, with some expecting a "hawkish pause" before rates potentially reach 4% in October. Market expectations lean towards a 40% chance of a rate hike at the next ECB meeting and 60% for the October meeting. ECB Governing Council member Klaas Knot suggests that investors betting against a rate increase might underestimate the likelihood of it happening. Knot emphasizes the importance of achieving the 2% inflation target by the end of 2025, acknowledging that the decision is uncertain amidst an expected economic slowdown. Bank of England (BOE) Governor Andrew Bailey hints that UK interest rates may have peaked due to expectations of a significant drop in inflation, potentially marking a pause in the bank's tightening cycle. Concerns about the impact of further rate hikes on the UK economy coincide with signs of weaker economic sentiment. The market reflects a 75% chance of a hike at the next BOE meeting, the lowest level since the last meeting. Finally, the Reserve Bank of Australia (RBA) and the Bank of Canada (BoC) have both left their key rates unchanged as expected, providing stability amidst global economic uncertainties.

Credit

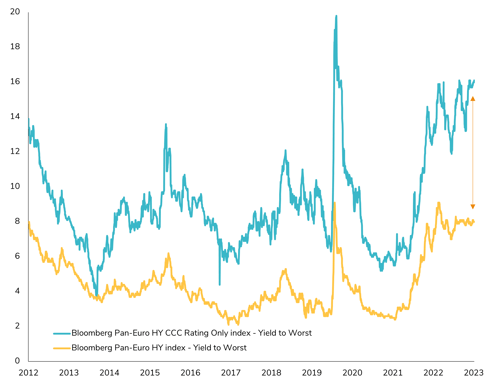

The North American credit market experienced significant activity, as the supply of US investment-grade bonds during the first two days after Labor Day reached a total of $52.6 bn. This marked the third-largest issuance during the same period since 2010. Surprisingly, this influx of bonds did not lead to a substantial widening of credit spreads. The CDX IG index widened by only 2 bps, and the Bloomberg US IG corporate bonds index widened by just 1 bp. However, the US HY market faced some challenges, with the BB US corporate HY index widening by more than 10 bps over the week. This came after last Friday, when we closed at the lowest credit spread level for high-yield bonds since May 2022. Notably, the largest issuer in the US HY market, Ford Motor, received an upgrade from Fitch, moving from BB+ to BBB-. This marked its first investment-grade rating. Interestingly, despite recent data indicating that domestic banks have tightened standards for commercial and industrial loans to large and medium-sized companies, mirroring levels historically associated with recessions, the credit market has not shown significant distress. In Europe, the credit picture was mixed, with a notable divergence between the synthetic market (CDS) and the cash market. While the Itraxx Europe index widened by 2 bps, and the Itraxx Xover index increased by 6 basis points, the cash index remained flat in IG and tightened by 6 bps in HY. The European IG market experienced heightened activity this week, with almost €48 bn in issuances, surpassing expectations. In contrast, the HY market saw only €1.5 bn in primary volume this week, contributing to changes in credit spreads. It's worth noting that the most distressed debts, represented by CCC-rated bonds, have significantly widened in recent weeks and now offer yields as high as 16%, marking the largest yield difference between CCC-rated bonds and the high-yield index since the COVID-19 crisis.

Rates

US Treasury yields saw a slight uptick during the week, buoyed by positive US macroeconomic data, elevated oil prices, and some hedging activities. The week featured overall positive US macroeconomic data, as evidenced by the rebound in the Citi US Economic Surprise Index. This improvement was fueled in part by a better-than-expected ISM Services index and its components, notably prices paid and employment. In this backdrop, the 10-year US Treasury yield concluded the week more than 5 bps higher at 4.24%. Similar upward movements of +5 basis points were observed for both the front-end and long-end of the US Treasury yield curve. While interest rate volatility, as measured by the MOVE index, remained nearly unchanged for the week, it still hovered above 100. In Europe, German yields mirrored the US pattern, rising by 5 bps over the week for the 10-year yield. However, there was some flattening observed as the front-end experienced an increase of almost 10 bps. In Italy, spreads widened for the second consecutive week as the 10-year Italian and German yields closed the week near 175 bps, a level not seen since early July. This widening of spreads is attributed to growing disagreements within Prime Minister Giorgia Meloni's coalition regarding spending pledges, Italy's weak economic performance, and concerns about the sustainability of its finances, with EU deficit limits returning in January. In the UK, Gilt yields exhibited flattening dynamics, with the 10-year yield remaining nearly unchanged while the front-end registered a decrease of almost 10 bps.

Emerging market

EM debt exhibited mixed performance this week, as the US Dollar embarked on its longest weekly winning streak since 2014. However, the surge in oil prices, bolstered by Saudi Arabia's decision to extend production cuts, provided some respite. The primary beneficiaries of these recent developments were EM corporate bonds denominated in hard currency, which displayed relative stability over the week, thanks to a modest tightening in credit spreads. This credit tightening was primarily instigated by China, indicating a gradual path to recovery. China's junk dollar bonds are poised for their most extended uptrend since June. It's noteworthy that two-thirds of China's top 50 private-sector developers, in terms of dollar bond issuance, encountered delinquencies on offshore debt. Nevertheless, Country Garden managed to meet a $225 million coupon payment before the grace period ended, averting default, at least for the time being. In contrast, EM sovereign bonds underperformed, incurring a loss of -0.8% over the week, while EM local debt struggled (-1.6%) as the US Dollar gained strength. On a positive note, Turkey's President Recep Tayyip Erdogan announced in Ankara that the country would adopt a 'tight monetary policy' to combat inflation, marking a shift from his previous stance, in which he contended that higher borrowing costs led to increased inflation. On the downside, Poland implemented significant economic measures ahead of an impending election, introducing what some have dubbed a 'bazooka' stimulus. The central bank slashed rates by 75 bp, surprising many who had anticipated a 25 bp cut, bringing the rate down to 6%. This marks the first rate cut in three years and coincided with intense political campaigning. Lastly, Mexico emerged as one of the weakest performers during the week, grappling with a sharp depreciation of its currency, despite core inflation showing signs of deceleration.

.png)