What happened last week?

Central banks

In the U.S., the recently released Fed minutes revealed a cautious stance on future rate hikes. Officials unanimously emphasized a meticulous assessment and substantial progress in curtailing inflation. The decision to maintain rates garnered widespread support, signifying a commitment to restraining the economy until a sustained move towards the 2% inflation goal is observed. Notably, concerns about rising bond yields and the acknowledgment of uncertainty in financial conditions maintained a cautiously hawkish tone. Market expectations anticipate an almost full 1% rate cut in 2024, with the first rate cut projected for June 2024. Across the Atlantic, ECB minutes highlighted the readiness for additional hikes based on ongoing assessments, although economic contraction is causing concerns about a potential recession and uncertainties such as geopolitical events. Despite these concerns, the ECB remains conservative about rate reductions, expecting inflation to return to the 2% target in H2 2025. Similar to the U.S., the market anticipates the first rate cut by the ECB in June 2024. In the UK, Bank of England's Chief Economist, Huw Pill, notes elevated levels of services price inflation and pay growth. While avoiding comments on interest rates, he emphasizes the importance of persistently tight monetary policy. The recent downgrade of the UK economy's supply capacity has significant implications for the bank's approach. Pill anticipates a fall in inflation but deems it still too high. The market gives low chances for another hike from here, while a rate cut at the end of 2024 is expected.

Credit

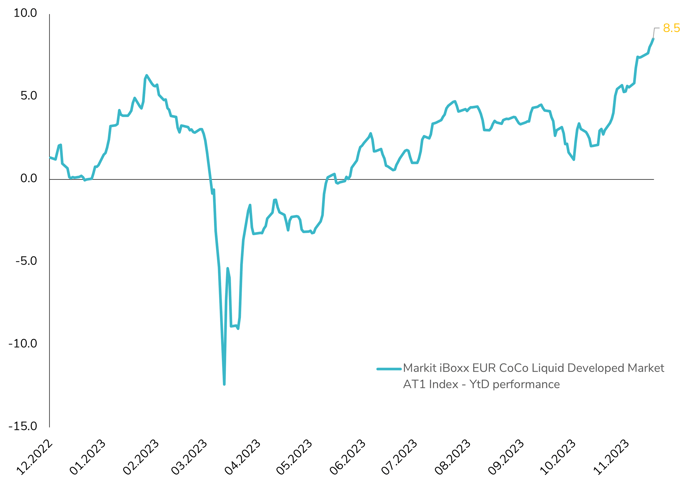

Credit markets saw minimal changes in total return over the week, as tighter credit spreads counterbalanced higher interest rates. Over the week, credit spreads tightened further, reaching levels last observed in Q1 2022. This tightening coincided with historically low volatility in the US credit market. While rate volatility has persistently remained high, experiencing a decreasing trend over the last two months, credit market volatility has taken a different trajectory. Presently, volatility in US Investment Grade (IG) corporate bonds is at levels unseen since 2021, approaching record lows. Similarly, US High Yield (HY) volatility has notably declined in the past month. In Europe, a comparable pattern emerges with tighter credit spreads and reduced credit spread volatility. The Itraxx Xover index, tracking the most liquid single-name CDS of European High Yield, has reached 375 bps for the first time since April 2022. The AT1 Bonds market has sustained its exceptional rebound throughout the year, boasting an impressive gain of over 8% year-to-date (YTD). Positive new flows continued this week as Banco Santander announced the redemption of €1 billion in AT1 bonds, three months after having skipped the first call on the notes. It's noteworthy that 92% of AT1 bonds with a 2023 call date have been redeemed, slightly below the long-run rate of 94%.

Rates

U.S. Treasury yields saw a slight uptick during the shortened week, with the 10-year US Treasury yield rebounding by 5bps to 4.46%. The yield curve (2s10s) remained virtually unchanged, holding steady at -45bps throughout the week. Rate volatility notably decreased, partly due to the Thanksgiving break, reflected in the MOVE index hitting a two-month low at 111. At the week's start, the US Treasury Department's 20-year auction performed well, with a stop-through of 0.9 bps and non-dealer bidding at 90.5%, exceeding the 88.9% average. The spread between the 2-year and the 20-year US Treasury yields contracted by 6bps to -15bps. Interestingly, the 10-Year US Term Premium dipped back into negative territory, possibly signaling market anticipation of a U.S. recession in 2024, with a full 1% rate cut already fully factored in. In Europe, the Citi Surprise Economic Index reached its highest level since May 2023, supported by a stronger-than-expected rebound in PMIs. This positive momentum, though from a low base, exerted upward pressure on German yields, resulting in a 5bps increase to close the week at 2.64%. The German Federal Government's announcement to halt inflation-linked bond sales contributed to steepening the nominal yield curve, boosting German inflation-linked bonds. Consequently, German 10-year bonds experienced a loss of -0.5%, while German inflation bonds gained +0.5%. In the UK, unexpectedly robust PMI data indicating resilient business activity pushed UK rates higher, with the 10-year UK rate closing the week at 4.29bps, up from 4.10bps one week ago.

Emerging market

EM bonds demonstrated positive performance over the week, driven by tighter credit spreads and a weakening US Dollar. Both EM corporate bonds and EM local currency bonds gained +0.3%, while EM sovereign bonds saw an increase of over 1%. In Argentina, Javier Milei secured the presidency with 55.8% of the votes in the runoff, compared to 44.2% for Sergio Massa. The new government is set to take office on December 10, leading to a remarkable surge of more than 20% in Argentina bonds. YPF bonds also experienced a sharp rebound, fueled by plans for the privatization of the state energy company under Milei's administration. In China, property bonds saw a significant increase as the Chinese regulator is developing a "white list" of developers eligible for support in the form of bank loans, bond financing, and equity financing. This move eased concerns in the sector. Furthermore, China is contemplating unprecedented support for builders, including unsecured loans. The potential allowance for banks to offer unsecured short-term loans to qualified developers is a notable development. In Turkey, the Central Bank unexpectedly raised its key interest rates by 5% to 40%, continuing efforts to combat high inflation with a more conventional monetary policy. While the currency remained relatively stable, the 5-year Turkey CDS hit the lowest level since March 2021.

.png)