What happened last week?

Central banks

In the US, the Federal Reserve adopted a relatively dovish stance, acknowledging "good progress on wages, coming closer to aligning with 2% inflation." They recognized the tighter financial and credit conditions stemming from the recent increase in term premiums and indicated that the "risks associated with inflation have become more balanced." This statement is being interpreted by the market as signaling the Fed's completion of rate hikes for this cycle. Currently, the market is pricing in less than a 10% chance of a rate hike by year-end. In Europe, few ECB members seem content with the current interest rate levels. According to Klaas Knot, it's "a good cruising altitude." Isabel Schnabel has underscored the challenges in addressing the 'last mile' of disinflation in the euro area, emphasizing the need for precise monetary policy adjustments, vigilant data monitoring, and readiness for potential supply-side shocks to achieve the inflation target. In the UK, the BoE opted to maintain the status quo at 5.25%, while revising the growth outlook downwards and assigning a 50% probability to a recession. Lastly, in Japan, the BoJ announced a further increase in flexibility in managing the yield curve by removing the 1% ceiling for 10-year Japanese yields.

Credit

The credit market rode the wave of rate movements, with US investment-grade bonds gaining almost 2% throughout the week. The combination of falling interest rates and tighter credit spreads in the IG segment contributed to strong performance. The CDX IG, an index monitoring the most liquid CDS of US IG issuers, decreased by more than 10bps to reach a credit spread of 70bps. Ford's return to IG status after a downgrade to junk in 2020 marked a notable development this week. In the high-yield sector, significant inflows in high-yield ETFs were observed. The CDX HY, equivalent to the CDX IG but for high yield, tightened by almost 50bps, shifting from 520bps to 472bps. In the cash market, the Bloomberg US high-yield index experienced a 2% gain for the week. In Europe, credit spread tightening aligned with US counterparts, with the iTraxx Main index decreasing by 10bps to 77bps, while the iTraxx Xover index dropped by 50bps to 415bps. European investment-grade bonds generated a +0.9% increase over the week, and European high-yield bonds also gained more than 1%. Notably, subordinated financial debts, particularly the BofA CoCo index, delivered almost +2% performance.

Rates

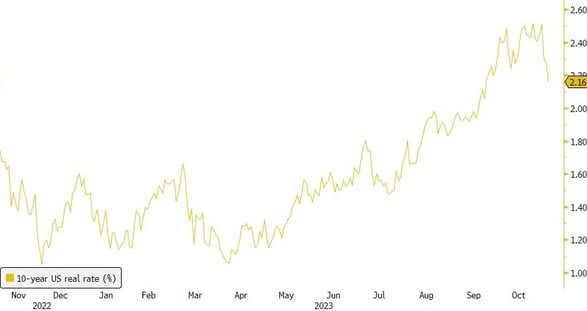

Government bonds had a remarkable week, with the 10-year US Treasury yield initially hitting 4.5% before a slight retraction at week's end, marking a notable 40bps drop in just one week. This significant movement was influenced by several key factors: a "dovish" tone from the US Treasury, which surprised by announcing its intention to conclude debt auctions by February, disappointing economic data, and a relatively dovish note from the Federal Reserve acknowledging tightened financial conditions and balanced inflation risks. In response, US government bonds experienced a +1.5% gain for the week, one of the most impressive performances in 2023. The US yield curve flattened by 15bps during the week, underlining the impact of economic data deterioration and increased supply on term premiums. The 10-year real rate fell sharply to 2.15%, its lowest level since mid-September. In Europe, rate movements were more restrained, with the 10-year German yield decreasing by 18bps to 2.65%. Peripheral spreads benefited significantly from the rate rally, with the difference between the 10-year Italian and German yields reaching 185bps, the lowest point in over a month. Meanwhile, the 10-year Gilt yield in the UK also saw a drop of over 25bps to 4.30%. In Japan, the 10-year yield reached a new high at 0.97% before concluding the week at 0.92%.

Emerging market

In the emerging market (EM) sector, the three main indexes enjoyed the decline in US interest rates and the weakening US Dollar. The Bloomberg EM Sovereign Bonds Index led the way with a significant gain of +2.5%, largely due to its heightened sensitivity to duration risks. EM corporate bonds also performed well, achieving a gain of +1%, while the Bloomberg EM Local Bonds showed a positive increase of +1.5%. These solid performances were accompanied by a reduction in outflows from EM bond funds, particularly in the case of local currency funds. In China, the PMI manufacturing data released at 49.5, falling below expectations, while Evergrande is rushing to revise its debt plan for offshore bondholders by December 4, or the company could face liquidation. The Chinese real estate market continues to grapple with significant stress, exemplified by the sharp drop in the bonds of Vanke, one of China's largest and most respected developers. Meanwhile, in Latin America, the Brazilian Central Bank reduced the Selic rate by 50 bps to 12.25%, and in Colombia, the Central Bank maintained its policy in a split decision (5-2).

.png)