What happened last week?

Central banks

In the U.S., Fed Chair Jerome Powell cautioned against premature expectations of rate cuts, emphasizing a cautious stance and the potential for further policy tightening if necessary. Despite market speculation favoring rate cuts in early 2024 (March rate cut odds hit 70%), Powell reaffirmed the Fed's dedication to maintaining a restrictive policy until confident in achieving the 2% inflation target. Some officials, like Governor Christopher Waller, suggested the possibility of rate cuts if inflation declines, citing guidelines such as the Taylor Rule. Powell, however, expressed reluctance to speculate on policy easing, emphasizing a careful approach due to the risks of both under- and over-tightening. The Fed's monetary policy now appears to be more balanced between an extended pause and a rate cut than another round of tightening. In Europe, there is growing confidence in the market that the ECB will implement rate cuts in the early months of 2024, with over a 60% probability of a rate cut by March and a 100% chance of multiple rate cuts by April. The unexpected acceleration in the decline of inflation is likely to generate differing opinions among ECB members. On the dovish side, peripheral ECB members have expressed concerns. Italy's Governor, Fabio Panetta, emphasized the ongoing disinflation and the need to prevent unnecessary harm to economic activity and risks to financial stability, which could ultimately undermine price stability. On the contrary, core countries are cautious about celebrating low inflation. Bundesbank President Joachim Nagel mentioned on Thursday that inflation risks are tilted to the upside, and it is premature to consider a potential interest-rate cut. The upcoming ECB meeting in two weeks is anticipated to focus on the reduction of the Balance Sheet, specifically the end of PEPP reinvestments.

Credit

Credit markets took the spotlight as the standout performer in November, extending its impressive run throughout 2023. Leveraging a significant drop in interest rates and robust tightening of credit spreads, the Bloomberg US corporate bond index surged by an impressive 6%, marking its most substantial monthly gain since December 2008 and propelling the year-to-date increase to 4%. The resilience of U.S. investment-grade corporate spreads was striking, contracting notably by 25 bps to 104 bps, a level not witnessed since January 2022. It's noteworthy that the spread on the US IG 15+yr index is in just the second percentile since the year 2000. While U.S. high-yield bonds recorded a slightly more modest gain (+3%), attributed to a shorter duration, the credit spread witnessed a significant drop of 35 bps to 370 bps. The year-to-date performance for U.S. high-yield bonds has now surpassed 9%, setting the stage for its best year since 2019. Shifting focus to Europe, Investment Grade bonds posted a commendable gain of +2.3% in November, contributing to a robust increase of over 5% year-to-date. European credit spreads narrowed to 147 bps, showcasing a decline of 13 bps. In a departure from the U.S. trend, European high yield outperformed in November, registering a gain of +3%, driven by a noteworthy 50 bps credit spread tightening. The cumulative performance for the year is nothing short of outstanding, approaching double digits and establishing European high yield as the leading fixed income segment. The AT1 Bonds market also demonstrated its resilience, concluding the month with an impressive performance of almost 5%, elevating the year-to-date increase to nearly +9% in 2023.

Rates

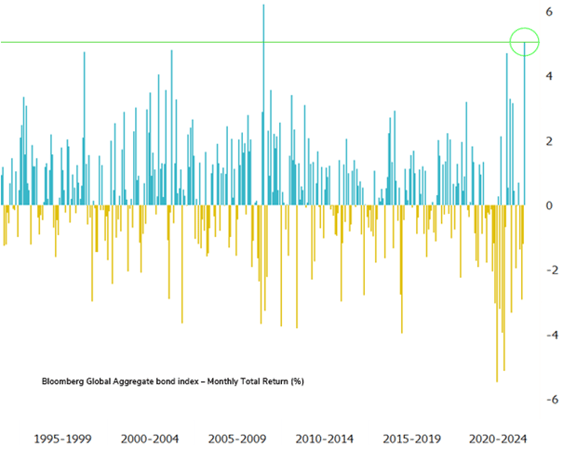

In the U.S., the 10-year Treasury yield slid by 60 basis points (bps) to 4.32% in November, driven by a nearly 40 bps dip in real yields to 2.08%, while U.S. breakevens closed the month at 2.2%, down by 20 bps from the previous month. The yield curve (2s10s) flattened by 20 bps to -35 bps, accompanied by the 10-Year U.S. Term Premium turning negative. Market anticipation of a 2024 recession continued to be priced in, with a fully factored 1% rate cut. In this context, the Bloomberg U.S. Treasury market gained +3.5% in November, turning also positive (+0.7%) in 2023. Despite this stellar performance, market conditions did not witness significant improvement, as rate volatility remained roughly at the same level, with the MOVE index closing the month at 115 compared to 120 a month ago. Meanwhile, a liquidity gauge, the Bloomberg U.S. Govt Securities liquidity index, persisted at the same "poor" level as one month ago. In Europe, the decline in rates was less prominent, with the 10-year German yield finishing the month at 2.45 bps, marking a 33 bps drop. The 10-year German breakeven contracted by 12 bps to 2.14%, and the 10-year German real yield concluded the month below 0.3%, a level not observed since September. The yield curve (2s10s) flattened by 13 basis points to -37 bps. The Bloomberg EUR government bonds recorded a gain of +2.9% over the month, supported by peripheral bonds, particularly Italian government bonds, which outperformed with a +3.3% increase. The spread between 10-year Italian and German yields closed the month at 178 bps, down by 15 bps. Notably, the three largest drops in 10-year government yields in Europe in 2023 are Greece (-85 bps), Italy (-50 bps), and Portugal (-45 bps).

Emerging market

EM bonds reaped the rewards of the comprehensive market rally across both fixed income and equity markets, with a particular highlight on EM Sovereign bonds capitalizing on their extended duration. The Bloomberg EM Sovereign bonds index gained +6.7%, while the Bloomberg EM corporate bonds index rose +4.3%, and the Bloomberg EM Local currency bonds index increased by +4.8%. Year to date, EM sovereign bonds led with a +5.7% gain, EM local CCY bonds rose +4.0%, and EM corporate bonds +3.4%. The credit spread of EM corporate bonds reached 290 bps, its tightest level since May 2021. However, it's important to note that 2023 witnessed a high level of default rates in EM High Yield, anticipated to end the year at 10%, a decline from the almost 15% default rate recorded in 2022. This was primarily driven by the Russia/Ukraine conflict and the China real estate market downturn. The China real estate market continues to face challenges; the sales of China's top 100 property developers fell 14.7% YoY, growing only 1.6% from January to October 2023. In November, the PBOC introduced additional easing measures for the real estate sector, stimulating China real estate bonds. The iBoxx USD China real estate bonds gained +12% in November but remain more than 50% lower year to date. The Asia and Latin America regions were the top performers in November within the Emerging Market fixed income universe. EM bonds flows remained negative year to date at -$30 billion.

.png)