What happened last week?

Central banks

Next week marks the final busy week of the year for central banks, with major developed central banks holding their last meetings of 2023. The central theme revolves around how these institutions will navigate the market's anticipation of substantial rate cuts in 2024, juxtaposed with the backdrop of persistently elevated core inflation measures. In the U.S., the Federal Reserve (Fed) has entered a blackout period, restricting members from commenting on U.S. monetary policy. The concluding FOMC meeting for 2023, scheduled for Wednesday, is expected to affirm the pause, maintaining the Fed Fund rate at 5.5%. The market, however, anticipates a substantial 130bps cut in 2024 and a cumulative 200bps cut by the end of 2025, aligning with lows observed in March (SVB crisis) and late July. Moving to Europe, the ECB meeting on Thursday, led by President Lagarde, is likely to maintain interest rates. An important discussion point may revolve around the potential cessation of PEPP reinvestments. The market has priced in the likelihood of a first rate cut by March 2024 and a total of 150bps in cuts for 2024. In the UK, the Bank of England (BOE) meeting suggests a probable pause, yet the market has already factored in a first rate cut by June 2024. Meanwhile, in Japan, the likelihood of the Bank of Japan (BOJ) ending its negative rates policy this month has surged to nearly 45%. Governor Himino's relatively hawkish speech has elevated the significance of the BOJ's December meeting, making it a live event to watch closely.

Credit

US Investment Grade (IG) corporate bonds have surged by over 1% so far this month, primarily propelled by interest rate movements. We concluded the previous month with an average credit spread of 106 bps, seemingly marking the bottom thus far. In High yield, bonds have gained 0.5% with tighter credit spreads. The Bloomberg US high yield index's average credit spread recently touched 364 bps, the lowest level since April 2022. Despite this positive sentiment toward lower-quality companies, there are ominous signs on the horizon. The percentage of US companies with robust Altman Z-scores (activity ratios, leverage, liquidity, profitability, and solvency) has fallen below 10% for the first time in history. Chapter 11 bankruptcy filings have surged to the highest level in 13 years. Over the past two years, the average maturity of high-yield bonds has significantly decreased, reflecting companies' hesitancy to issue new debt amid rising interest rates. This trend underscores the formidable challenges faced by high-yield borrowers on both sides of the Atlantic, with refinancing costs reaching levels seen only in severe crises over the past two decades. In Europe, IG corporate bonds have extended their November rally, with the Bloomberg EUR AGG Corporate bond index gaining 1% so far in December. In High yield, the iTraxx Xover index remains at 2023 lows below 370 bps. The Bloomberg EUR high yield index has risen by more than 0.5% in December. Finally, in the AT1 realm, UBS has announced the exercise of its January 2024 AT1 call, confirming the success of the recent $3.5 billion AT1 new issue. The iBoxx EUR CoCo index is up by 1% in December so far.

Rates

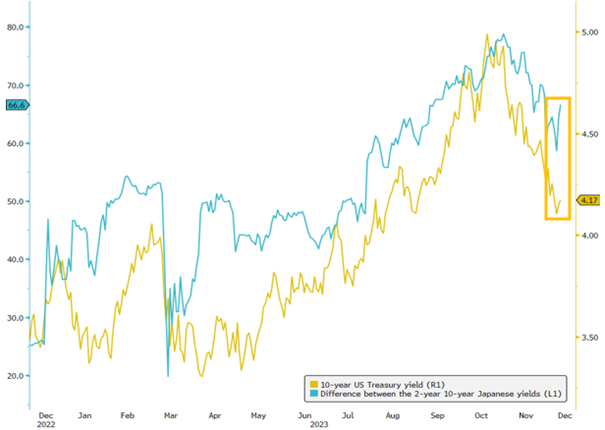

US Treasuries are once again accruing gains in December, despite a robust job report. The Bloomberg US Treasuries index has surged by 1%, driven by both lower real and breakeven rates. Real rates plummeted below 2%, recovering slightly post the job report, marking the first instance since summer. US breakevens, accompanying the drop in the Bloomberg commodity index which hit a 2-year low, with a 5 bps decrease month-to-date. This week, the iShares 20+ Year Treasury Bond ETF (TLT) witnessed the second-highest call option daily volume in history, following the second-heaviest month in trading volume in November. The decline in long-end US Treasury yields has flattened the Treasury yield curve (2s10s) by 30 bps since the start of November. The sharp decline in yields since the end of October has been partially fueled by CTAs covering short positions while Asset managers held extremely long positions. However, this trend could be reversed. According to BofA, Treasuries funds have experienced last week their most substantial outflows since August 2022. In Europe, government bonds performed also well this week, with the 10-year German yield dropping by 20 bps since the start of December. Meanwhile, the yield on the Japanese 10-year bond surged by 12 bps, propelled by comments from BOJ Governor Ueda and Deputy Governor Himino, sparking anticipation of change sooner than expected. Adding to market tension, the Japan 30-Year Bond Sale recorded its lowest bid-cover since 2015. Notably, the sharp steepening of the Japanese curve, from 20 bps in March to 80 bps at the end of October, coincided with a significant increase in US Treasury yields over the same period.

Emerging market

Emerging market debts saw a robust performance, gaining +1.5% for sovereign debts in early December, driven by notable increases in Argentina (+5.5%) and Peru (+2.5%). EM corporate bonds also experienced positive movement, albeit more modest at +0.7%, influenced by factors such as shorter duration and slight spread widening. Braskem, facing imminent threats of additional salt mine collapses in Alagoas, recorded a -10% performance in December. The company's investment-grade rating is now on thin ice, with Fitch on high alert. Moody's revised China's sovereign rating outlook to negative from stable, citing increased risks associated with structurally and persistently lower medium-term economic growth and the ongoing downsizing of the property sector. China Evergrande Group gained a reprieve as a Hong Kong court deferred a decision on its potential winding up. Despite a robust November performance (+12%), China's real estate bonds retraced by 3% since the beginning of December. In India, the Reserve Bank of India (RBI) maintained a policy pause in December, retaining the "withdrawal of accommodation" stance. Analysts anticipate a continued pause, with a potential rate cut cycle commencing in June 2024, projecting 100bps of rate cuts through FY25. Lastly, in Egypt, President Sisi's expected extension of power until 2030 depends largely on reaching an agreement with the IMF for an additional $6 billion in funds. Notably, Egyptian debts in USD total return have returned to positive territory in 2023, erasing a -25% drop earlier in the year.

.png)