What happened last week?

Central banks

The Federal Reserve continues to grapple with differing perspectives among its members regarding the path of rate hikes. The ongoing debate centers on whether to continue the upward trajectory in September or to initiate a pause. The consensus seems to be moving closer to the latter option. Recent inflation data is showing encouraging progress, while the consistent rise in initial jobless claims from a low of 180k in September 2022 to 248k this week introduces an interesting dynamic. Fed officials remain divided on the necessity for further rate increases. Governor Michelle Bowman suggests a potential need for more hikes to achieve price stability. In contrast, San Francisco Fed's Mary Daly believes more action is required to curb inflation, despite July's data indicating modest price increases. Philadelphia President Patrick Harker's view is more conservative, implying the possibility of maintaining the current stance moving forward. Market sentiment, on the other hand, reflects only a 10% likelihood of another hike in September. In Europe, the German Central Bank's decision to offer no remuneration for government deposits held with the Bundesbank, starting October 1, 2023, is noteworthy. The market remains divided over the anticipation of another rate hike by the European Central Bank (ECB) in September, with a current probability of 40%.

Credit

This week witnessed the impact of rising interest rates on investment grade (IG) bond indices, particularly susceptible to duration risk compared to high yield indices. In the U.S., the Bloomberg (BB) U.S. IG Corporate Bond Index recorded a loss of over 0.5%, driven by slightly widened credit spreads (+3bps to 121bps) and higher U.S. Treasury yields. Similar observations were made in Europe, where the BB EUR IG Corporate Bond Index showed a marginal decline of -0.2% with widened credit spreads (+3bps to 152bps). In the high yield (HY) sector, both U.S. and European markets exhibited stabilization, evident in the credit default swap (CDS) market. The Itraxx CDX HY index, tracking U.S. HY CDS, and the Itraxx XOVER index, its European counterpart, remained relatively steady throughout the week, recording changes of -1bps to 433bps and +5bps to 401bps, respectively. In this context, both indices posted slight positive gains of +0.3% for U.S. HY bonds and +0.2% for European HY bonds over the week. Even amid developments like Italy's decision to implement a one-time 40% tax on bank profits derived from increased interest rates, European subordinated debts performed commendably. The Iboxx EUR CoCo index managed to stay flat for the week, though down 0.3% for August. While the positive factors of bolstered capital, improved returns, and distribution plans remain pertinent, the uncertainties linked to taxes and the potential repercussions on earnings introduce new variables that need to be carefully considered when evaluating the prospects for European banks.

Rates

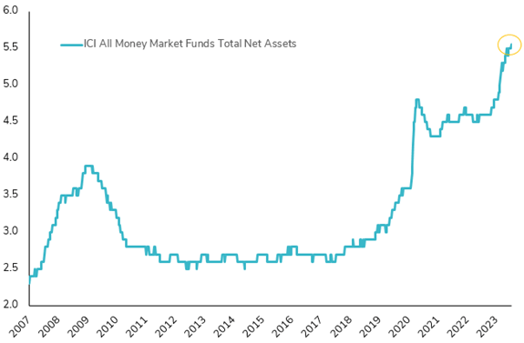

U.S. Treasury (USTs) bonds hover on the brink of a fourth consecutive month of negative performance, endangering 2023's accrued gains. This week, the Bloomberg Treasury bond index dipped nearly half a point (-0.5%), driven by elevated USTs yield curve yields, up around +10bps. At the long end of the USTs yield curve, rates approach 2023's peak levels. The 10-year USTs yield exceeded 4.10% and the 30-year yield reached 4.26%. Yet, the curve's front end remains over 20bps below its highs, reflecting the ongoing economic challenges. The landscape involves navigating significant U.S. Treasury Department supply announcements, particularly for the long end, amidst an unexpectedly resilient economy and mixed inflation signals due to surging commodities prices over three months. On a brighter note, the MOVE index, gauging USTs' volatility, decreased this week. Moreover, the USTs market continues to attract investors, as evident in the chart of the week (see below). Across the Atlantic, the week commenced with the Bundesbank's decision (as discussed in the central bank section), which could potentially influence the front end of the German yield curve, generating heightened demand. Moreover, news of the proposed "super tax" on Italian banks failed to significantly impact the Italian yield curve. Instead, the spread between 10-year Italian and German yields tightened further this week (-2bps to 163bps). As the German 10-year yield exceeded 2.6%, the German yield curve exhibited a steepening trend. Notably, for the first time since May, the difference between 5-year and 10-year German yields has turned positive.

Emerging market

Across emerging markets, the week delivered a mixed performance in bond indices, as tighter EM credit spreads sought to offset the impact of rising rates. Notably, the spread of the Bloomberg (BB) EM Corporate Bond Index reached its lowest point for 2021, closing at 304bps on Thursday, marking a -6bps decrease over the week. Similarly, the BB EM Sovereign Bond Index also hit an 18-month low in spreads. Nonetheless, EM bond indices experienced an overall decline of approximately 1% in August, primarily attributed to the surge in U.S. rates. Local EM bonds faced challenges as well, with a monthly dip of 1.3%, largely influenced by the depreciation of EM currencies, which dropped by -2% over the month. The week's most significant development emerged from China's real estate sector. Country Garden, one of the largest and historically secure Chinese developers, unexpectedly missed a coupon payment on U.S. dollar bonds. This marks the first instance of such an occurrence and is compounded by a projected multibillion-dollar loss in H1 2023. The repercussions of this event are anticipated to impact the broader real estate sector as well as the China high yield market, evident in the plummeting average prices of Chinese high-yield dollar bonds, reaching lows for 2023 according to a Bloomberg index. Turning to central bank decisions, both the Mexican and Peruvian central banks maintained their key rates at 11.25% and 7.75%, respectively. While Banxico reiterated its intent to maintain rates at this level over an extended period, the Peruvian central bank signaled a potential cut in its upcoming meeting by removing the reference from previous meetings that holding rates steady "does not necessarily imply the end" of the rate hiking cycle. This alteration suggests a shift in their stance and opens the door to a possible rate reduction.

.png)