What happened last week?

Central banks

Fed President Austan Goolsbee recognized progress in curbing inflation but highlighted challenges, especially in housing inflation. President Thomas Barkin expressed skepticism about a smooth path to the 2% inflation target, citing factors like the partial reversal of Covid-era price spikes. Vice Chair Philip Jefferson emphasized persisting uncertainties linked to pandemic-specific factors. The market anticipates a first cut by May 2024 and a 1% rate cut by end-2024. In Europe, the ECB’s decision to pause rate hikes in October, led by Council member Francois Villeroy de Galhau, is supported by a notable inflation slowdown, affirming effective monetary policy. Villeroy is optimistic about reaching a 2% inflation target by 2025, underscoring the importance of patience. He also noted the positive impact of higher rates on French banks and insurers. Council member Mario Centeno highlighted a swift decline in euro-area inflation, emphasizing persistent financial tightness. Centeno discussed normalizing policy, stressing the need for rates aligned with the 2% inflation goal. The market now implies a first rate cut in April and a 1% rate cut for the entire 2024. Bank of Japan Governor Kazuo Ueda stated discussions on an exit strategy from ultra-loose policy are approaching with the sustained 2% inflation target. Ueda emphasized patience, awaiting a positive wage-inflation cycle, and mentioned the fate of ETF holdings in exit discussions. The market implies a first rate hike by June 2024.

Credit

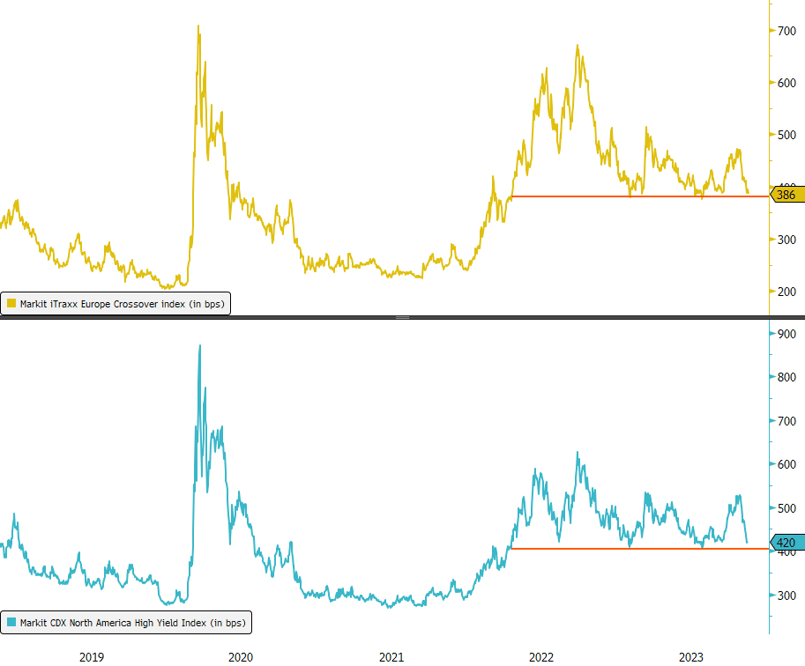

US investment-grade (IG) bonds excelled this week, driven by lower interest rates and tighter credit spreads, resulting in a 1.6% gain in the Bloomberg US corporate bonds index. Credit spreads contracted to 115bps, almost 10bps tighter than the previous week. US high-yield (HY) posted a smaller gain of less than 1%, but it remains the best-performing fixed-income segment year-to-date with an impressive 8% total return. The CDX HY index hit 415bps, the lowest since early August. The BofA Credit Investor Survey revealed notable shifts in sentiment, with IG investors moving from a +8% net overweight in September to a -8% net underweight in November. Conversely, HY witnessed an uptick, reaching +18% net overweight in November, the highest since January 2022. In Europe, credit indexes performed well, with both IG and HY gaining around +0.8%. Notably, banking junior subordinated debts (AT1) stood out as the best performer, posting an almost +2% gain for the week and a cumulative +3.7% increase in November. The recent surge in demand for AT1 bonds, as seen in offerings from Societe Generale, Barclays and UBS, alleviates concerns for the upcoming refinancing of $30 billion in callable AT1 debt in 2024. Additionally, Andrea Enria, the European Union's top bank regulator, called for global rules governing AT1 bonds, emphasizing the need for standardized regulations to enhance their regulatory role and provide clarity during periods of stress, following the turmoil caused by the Credit Suisse bailout this year.

Rates

Another positive week for rates saw the 10-year US Treasury yield drop by nearly 30bps, while the front end of the US yield curve finished the week 25bps lower. Real rates accounted for over two-thirds of the drop, with the 10-year real rate concluding the week at 2.12%, 20bps lower. US breakeven rates, reflecting inflation market expectations, fell to 2.3%, a 4bps decrease. The yield curve (2s10s) remained relatively flat over the week at -41bps. The Bloomberg US Treasury Bond Index is up over 1% for the week, poised to achieve its most substantial monthly gain of the year at +2.75% MTD. Notably, liquidity conditions in the US Treasury market have recently reached higher levels (worse liquidity conditions) than at the peak of COVID. In Europe, rates mirrored the positive trend in the US as the German 10-year yield fell by 16bps to 2.55%, a level not seen since the end of August. The German yield curve (2s10s) remained flat over the week at -36bps. Peripheral spreads outperformed, with the spread between the 10-year Italian and German yields decreasing by 10bps to 175bps, a level not reached since September. The Bloomberg EUR Government Bonds Index gained 1.3% for the week and is up over 2% in November so far. In the UK, government bonds were standout performers, with the 10-year UK yield down by almost 30bps. Similar to the US, inflation in the UK declined more than expected. Additionally, UK retail sales in October were much more negative than anticipated. The Bloomberg UK Government Bonds Index is now up more than 4% in November. Finally, in Japan, the 10-year Japan yield dropped by 10bps to 0.75%.

Emerging market

EM corporate bonds showed a modest 1% gain, in line with US Treasuries, as spreads remained largely stable. EM local bonds, buoyed by a weakening US dollar, and sovereign bonds, benefitting from higher duration and reduced concerns over contagion risks in the Middle East, posted a robust 1.5% increase over the week. In China, President Xi Jinping's visit to the US and regulatory efforts to meet the "reasonable" funding needs of property firms provided a slightly positive sentiment. Despite this, Asia IG spreads tightened to their narrowest levels since 2018. In contrast to the US and EUR credit markets, Asia IG bonds outperformed their HY counterparts, boasting a 2.8% gain in 2023 compared to HY's 0.3%. Notably, China real estate bonds seem to be experiencing another rebound, with the iBoxx USD Asia China Real Estate index up more than 6% in November, despite a decline in new-home prices. In Uruguay, the Central Bank executed a widely expected 25bps interest rate cut to 9.25%, signaling a cautious approach to monetary easing and indicating the end of the current cycle is approaching. Finally, this weekend, Argentinians will cast their votes in a closely contested presidential election, featuring economist Javier Milei and Ministry of Economy Sergio Massa as the main contenders.

.png)