What happened last week?

Central banks

In the U.S., the past week remained relatively calm with the upcoming FOMC meeting on the horizon and Fed members maintaining their silence. Treasury Secretary Janet Yellen played down the idea that the recent uptick in bond yields is directly linked to the expanding U.S. budget deficit. Instead, she attributed it to the robustness of the U.S. economy, suggesting that higher interest rates may persist. Nevertheless, this perspective contrasts with the belief that the rising Treasury supply resulting from deficit spending is a key factor influencing yields. Currently, the market assigns a 19% probability of another rate hike by year-end, but there is no expectation of a rate increase at the upcoming FOMC meeting. In Europe, the ECB maintained its interest rates at 4% for the deposit facility rate for the first time since June 2022. On the dovish side, ECB President Christine Lagarde acknowledged the slowing pace of the European economy and emphasized positive developments in inflation. Notably, the acceleration of the reduction of the ECB balance sheet through PEPP reinvestments was not a subject of discussion. On the hawkish side, there was no discourse on rate cuts, with such actions considered "premature." Concerns were voiced about the potential impact of rising energy prices on inflation, which is still anticipated to remain at elevated levels for an extended period. Presently, the market foresees the first rate cut occurring in April 2024. As for the Bank of England, its members remained reserved as they approach their upcoming decisions scheduled for Thursday. The market anticipates no rate hike at this meeting.

Credit

This month has seen an unusually subdued level of activity in the primary market. US corporations have only managed to secure $70 billion in funds from bond and leveraged loan offerings in October, marking both the quietest month this year and the slowest October for borrowing since 2011. This, in turn, has positively influenced the credit market, with reduced supply supporting spreads. While the CDX IG closed the week at 83 bps, the highest level since May, spreads for IG cash bonds remained relatively stable at 127 bps. In the high-yield market, a clear dichotomy is emerging, with the gap between the cash and synthetic market in US high yield nearing an all-time high at 100 bps. The CDX HY index expanded by 5 bps to 531 bps, reaching levels not seen since the SVB crisis, while US high-yield bond spreads remained stable at 431 bps. Regarding performance, US IG corporate bonds benefited from lower rates and tighter credit spreads, resulting in a gain of +0.8% for the week, while US HY bonds posted a solid 0.3% gain. It's worth noting that high-yield defaults have continued to inch higher, surpassing 2% by the end of the third quarter, marking the highest level since 2021. In Europe, credit indexes recorded gains for the week, with EUR IG and EUR HY seeing increases of +0.4% and +0.3%, respectively, driven by tighter credit spreads. European subordinated financials delivered strong performance, as the iBoxx EUR CoCo index recorded a gain of 0.6%.

Rates

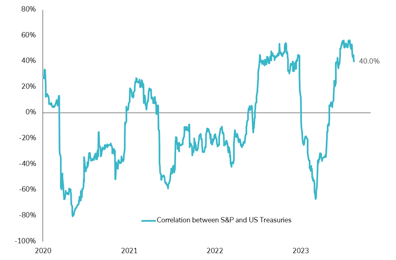

This week, the 10-year US Treasury yield surged to a new cyclical high of 5.02% but later retraced to 4.85%. Some risk-off sentiment, a call for the attractiveness of US rates by influential investors like Bill Gross and Bill Ackman, and a robust 7-year auction (highest demand since Covid crisis) contributed to this retracement. Despite this, the resilience of the US economy, evidenced by strong data releases such as US PMI, GDP, and Durable Goods Orders, continues to put upward pressure on US yields, keeping the possibility of another rate hike by the Fed in the coming months open. The current high positive correlation between equities and rates is starting to fade (see chart of the week). The US yield curve (2s10s) remained relatively stable at -17bps. On the front end, US breakevens retraced by 6 bps to 2.28bps, while real rates increased by 5bps to around 2.8%. In this context, the Bloomberg US Treasury Bond Index gained 0.5% over the week. Next week, the US Treasury Department will release its Quarterly Refunding, which is expected to confirm the ongoing challenge of higher bond yields. In Europe, there was a respite in rates with the ECB pausing its rate hikes for the first time in 18 months. The 10-year German rate decreased by 6bps over the week, and the German yield curve steepened to -20bps, the highest level of the year. Italy's 10-year spread finished the week below 200bps, as the ECB maintained its PEPP QT forward guidance, offering relief to peripheral bonds. In Japan, the 10-year yield reached 0.88%, the highest level since July 2013. The unexpected rise in Tokyo CPI to 3.3% is likely to increase pressure on the Bank of Japan in its upcoming policy meeting to move away from its controversial bond yield control, given the rising global bond yields and persistent inflation.

Emerging market

Emerging market bonds saw positive results due to the strong performance of US interest rates. Sovereign bonds in emerging markets experienced a 0.7% increase, while corporate bonds in these regions showed a 0.3% gain. In contrast, local currency bonds in emerging markets remained stable throughout the week. China introduced an additional issuance of RMB 1 trillion in central government bonds (CGB) to bolster local infrastructure projects, signaling a new phase of economic stimulus. This occurred during a week when China witnessed an unprecedented level of corporate yuan-bond issuance. Meanwhile, China's credit market faced with the debt issues of property developers such as Country Garden and Evergrande. Country Garden faced its inaugural default on a dollar bond, while Evergrande engaged in discussions with holdout creditors before a Monday hearing that could potentially lead to a liquidation order. In Turkey, the central bank continued its tightening efforts with another 500 bps rate hike, bringing the rate to 35%. The five-year Turkey CDS tightened by 17 bps during the week, reaching 412 bps. Lastly, Chile's central bank surprised the market by reducing rates by 50 bps to 9%. This move marked the second consecutive meeting in which the central bank slowed down the pace of monetary easing. The decision was influenced by the recent depreciation of the peso and increased global geopolitical uncertainty, which raised concerns about inflation.

.png)