What happened last week?

Central banks

In the U.S., rising energy costs have exerted upward pressure on inflation data, notably in the Producer Price Index (PPI) and Consumer Price Index (CPI). This has prompted the market to reconsider the likelihood of the Federal Reserve (Fed) implementing another rate hike by the year's end. While the market currently assigns a negligible probability to a rate hike at the Fed's September meeting (scheduled for Wednesday), it still maintains a 50% chance of another hike before the year concludes. In Europe, the European Central Bank (ECB) raised its key rates by 25 basis points, bringing the deposit facility rate to 4%. These levels are deemed sufficient by the Governing Council to steer inflation back toward its target. Notably, ECB member Muller of Estonia, known for his relatively hawkish stance and his status as a voting member in the upcoming two meetings, expressed confidence that these elevated rates are effective in reigniting inflation to the desired 2%. He mentioned that no further rate hikes are anticipated in the coming months, though he did leave the door ajar for additional hikes if inflation fails to improve by year-end. In light of these developments, markets are now pricing in only a 35% chance of another rate hike by the close of the year. In the UK, the Bank of England (BoE) is scheduled to announce its rate decision on Thursday. Monetary Policy Committee member Catherine Mann has indicated that it might be premature to halt the upward trajectory of interest rates, despite some dissenting views among her colleagues. The market currently assigns a 70% probability of another rate hike at the BoE's September meeting. Lastly, the Bank of Japan (BoJ) is set to release its latest monetary policy decision, and no changes are expected in this regard.

Credit

The credit market is thriving in the backdrop of a soft-landing scenario and a significant drop in equity market volatility, epitomized by the VIX hitting its lowest point since January 2020. Mirroring this trend, the CDX IG index, tracking 5-year CDS from investment-grade companies, touched its lowest level since January 2022 at 62bps. In the high-yield segment, spreads have returned to their lowest levels (366 bps) since April 2022, despite the resurgence in the high-yield primary market. Indeed, the high-yield primary market witnessed one of its busiest weeks this year, with $7 billion issued. Of particular note, Bank of America conducted a scenario analysis on high-yield bonds, considering various inflation scenarios and their impact on interest coverage ratios (ICRs) within the market. In a 3% inflation scenario, the situation appears manageable, with only 8% of issuers facing potential default. However, in a 4% inflation scenario, there's more pressure, with 10% potentially facing default, and 25% in the CCC segment. If inflation were to reach 5%, a full-scale credit cycle turn could be triggered, resulting in 15% cumulative high-yield defaults, with 33% in CCCs, signifying significant challenges for the credit market. Nevertheless, US high-yield bonds have managed to post positive returns for a fourth consecutive month so far. In Europe, spreads for investment-grade (IG) and high-yield (HY) bonds ended the week lower, with a 3 bps and 15 bps drop, respectively. European high-yield bonds achieved slight gains this week despite a lackluster performance in European rates, while investment-grade bonds ceded some ground. Finally, the Markit iBoxx EUR CoCo index performed well this week (+0.3%), bolstered by the ECB rate hike, which is expected to enhance earnings for European banks.

Rates

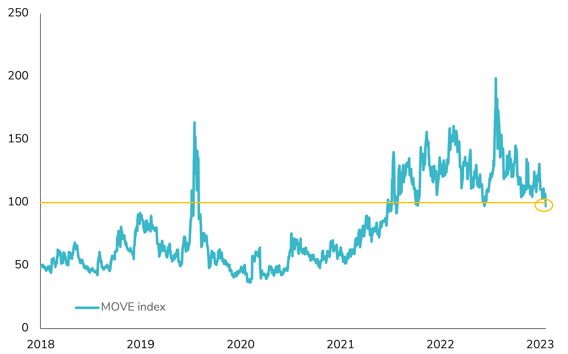

The US yield curve remains inverted, marking over 213 consecutive days, surpassing the 1980 record. Although it hit a low of -190 basis points (bps) in May, the difference between the 3-month US Bill yield and the 10-year US Treasury is still at -120 bps. While there's some emerging stability indicated by the MOVE index dropping below 100, several factors influence rates. Commodity prices, notably the BB Commodity Index at its highest since July, have raised US breakeven short-term rates by 7 bps in the front-end this week, while long-term rates have remained nearly unchanged. Additionally, Fed QT continues to impact rates as the Fed's balance sheet shrunk by another $2.5 bn to $8 trn, the lowest since July 2021. In this context, US treasuries have posted a slight negative performance over the week, and they are down by 1% mtd. Turning to Europe, the ECB’s downward revision of the Eurozone GDP growth outlook failed to contain the rise of core rates. The 10-year German yield increased by 5 bps to 2.66% over the week, while the front-end saw an increase of more than 10 bps in response to the slightly surprising interest rate hike. Peripheral spreads initially performed better due to the ECB's commitment to continue reinvesting the PEPP. The ongoing reinvestment of maturing sovereign bonds held by the ECB was maintained, and these reinvestments will be carried out "with flexibility," potentially allowing the ECB to manage any further widening in sovereign spreads, especially in Italy. However, the spread between the 10-year Italian and German yields ended the week close to 180 bps, retracing from 172 bps earlier in the week and up by 5 bps compared to the previous week. Overall, the BB EUR Govt Bonds Index concluded the week in negative territory and is now down by more than 1% in September. In the UK, the 10-year government yield dropped by 10 bps, reflecting the decline in the Citi UK Economic Surprise Index, while the 2-year yield fell below 5% for the first time this month. Lastly, in Japan, the yield curve rose, with Japan's 20-year bond yield reaching 1.47%, its highest level since May 2014.

Emerging market

Emerging markets in local currencies had a robust week, with EM currencies on track for their most substantial weekly gain against the US Dollar since July. The index recorded an impressive uptick of nearly 1% over the week. In hard currency, other EM indexes held their ground relatively well compared to their counterparts in developed markets, partly propelled by positive developments in China. China, in particular, contributed to the positive sentiment by releasing favorable economic data for August. Furthermore, the People's Bank of China (PBOC) announced a 25-bps reduction in the reserve requirement ratio for most banks. This move is expected to fortify banks' lending capacity and facilitate efforts toward fiscal stimulus. However, the Chinese real estate sector presented a mixed picture. On the positive side, Country Garden, one of China's largest developers, successfully extended 8 out of 9 domestic bonds as part of its extension plan. The final vote is scheduled for Monday, as the company endeavors to avert a full-scale default by rearranging its repayment dates in the local bond market. Conversely, state-backed Sino-Ocean announced on Friday its decision to suspend offshore debt payments and embark on a comprehensive restructuring plan, a move that comes less than a month after receiving bondholder approval to extend coupons on three dollar-denominated bonds. Meanwhile, in Peru, the Central Bank executed an anticipated 25-basis-point cut in its interest rates, bringing them to 7.50%. This adjustment aligns with the country's economic challenges, which include a recession and decelerating inflation.

.png)