What happened last week?

Central banks

Central bank meetings recently have showcased divergent monetary policy paths. The Federal Reserve, in a notable shift, has leaned towards a dovish stance. Chairman Jerome Powell, deviating from his earlier "higher for longer" rate approach, hinted at the possibility of rate cuts before inflation reaches the 2% target. This change in tone suggests 75 bps of cuts in 2024, prompting markets to anticipate six rate cuts (150bps) for the year, with the first cut expected early in 2024. In contrast, the European Central Bank (ECB) and the Bank of England (BoE) are taking a more cautious route. The ECB kept its rates unchanged, planning a gradual phase-out of PEPP reinvestments by reducing the portfolio by €7.5 billion monthly in the latter half of the year. Despite market expectations of a rate cut by April 2024, ECB President Lagarde emphasized that no such cuts were discussed, indicating a stance of vigilance. ECB Governing Council member Madis Muller also cautioned against early rate cut expectations. The BoE maintained its Key Rate, with some members advocating for a hike, underscoring ongoing concerns about persistent UK inflation. Indicating a need for restrictive policy for a longer period, the market now foresees a first rate cut by May 2024, with a total of four cuts during the year. Elsewhere, the Norges Bank unexpectedly raised its interest rates by 25 basis points, going against the broader trend. The Swiss National Bank (SNB), on the other hand, kept its rate steady but altered its focus away from foreign asset selling, suggesting a potential shift in its monetary policy strategy.

Credit

This week, US Investment Grade (IG) corporate bonds received a significant boost, driven by falling rates and tightening credit spreads. The spread of the Bloomberg US IG Corporate Bond Index narrowed below 100 bps for the first time since January 2022. Consequently, the yield of this index plummeted from 6.5% to 5.0% in under two months, marking a substantial decrease. The index itself saw an impressive gain of almost 3% over the week, bringing its 2023 increase to an unexpected +8%. In the high yield (HY) segment, the compression of credit spreads nearly offset the shorter duration compared to IG bonds. The Bloomberg US High Yield Index climbed +2% over the week, buoyed by a spread tightening of nearly 30 bps. This brings the spread of US HY to 335 bps, the lowest since April 2022. The 2023 performance of US HY has been remarkable, with gains exceeding 12%, largely due to a spread tightening of nearly 150 bps. In the European market, IG credit spreads touched 138 bps, the lowest since April 2022, while the spread for EUR High Yield (HY) ended the week at 400 bps, also a low since April 2022. The Bloomberg European IG Corporate Index mirrored these movements, rising by 1% over the week, in line with the Bloomberg EUR HY Index. Remarkably, the yield of the Bloomberg EUR HY Index has dropped by 150 bps in just six weeks. European subordinated debt also saw strong performance. Following its busiest month over the last 5 years in the primary market this November, the iBoxx EUR Developed Market AT1 Index rose by 2.6% over the week.

Rates

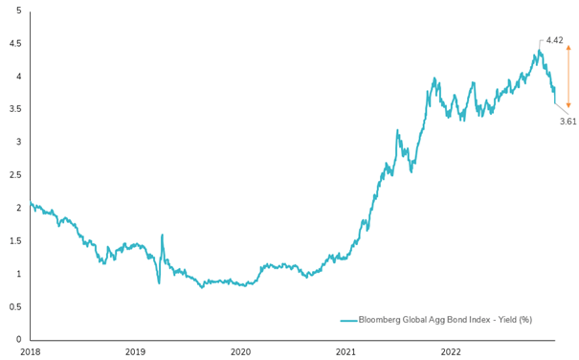

This week witnessed remarkable movements in government bonds, particularly following the Federal Reserve's dovish announcement. The 10-year US Treasury yield experienced a substantial drop of over 30 bps, settling at 3.9%. Interestingly, the front end of the yield curve mirrored this decline, maintaining the US yield curve (2s10s) around -50 bps unchanged over the week. This significant drop was largely attributed to the real rate component, as evidenced by the 10-year real yield decreasing by 30 bps to 1.70%, while the 10-year US Breakeven yield, which reflects long-term inflation expectations, remained steady at 2.2%. The 5-year real yield saw its sharpest two-day drop since the Covid pandemic and the Global Financial Crisis (GFC). In response, the Bloomberg US Treasuries Index performed exceptionally, gaining over 2% for the week. In Europe, government bonds also benefited greatly from the Fed’s pivot, despite the ECB’s relatively hawkish tone. The 10-year German yield fell by 25 bps to 2%, aided in part by weaker-than-expected economic data, including PMI and Industrial Production. The front end of the curve was more resilient, dropping by 18 bps, influenced by the ECB's statements. Notably, peripheral bonds outperformed, even as the ECB announced plans for a gradual phase-out of PEPP reinvestments. The spread between the 10-year Italian and German yields narrowed to 171 bps, 10 bps less than the previous week. In the UK, the rate rally aligned with the global trend, with the 10-year UK yield dropping to 3.70% from 4.04%, despite the Bank of England's commitment to maintaining a restrictive monetary policy. Finally, the 10-year Swiss yield reached 0.6%, its lowest level since August 2022.

Emerging market

Emerging Market (EM) bonds significantly benefited from the recent shifts in the US bond market. The Bloomberg EM Sovereign Bonds Index saw an increase of 2.5% over the week, while the Bloomberg EM Corporate Bonds Index rose by 1.5%. EM local currency debt also performed well, gaining 1.5%, largely due to the depreciation of the US Dollar. However, it's important to note that much of this performance was driven by the drop in US rates, as EM credit spreads actually widened by 7 bps to 292bps over the week. Despite the positive market tone and the weakening US Dollar, outflows from EM bond funds intensified. EM hard currency funds experienced a $1.1 billion outflow, while local currency funds saw a $356 million withdrawal. Year-to-date outflows have now surpassed $30 billion, marking a significant capital withdrawal from these markets. On a more positive note, China announced an extension of its homebuying curbs relaxation to major cities Beijing and Shanghai. These cities reduced down-payment ratios for first and second homes and revised the definition of non-luxury homes. This policy shift is expected to boost demand in the housing market. In the real estate sector, Country Garden made a proactive move by paying off a yuan-denominated note ahead of schedule, helping to alleviate its debt crisis. Additionally, Dalian Wanda Group reached an agreement with PAG to defer a $4.2 billion repayment, providing temporary relief in its debt situation. In Latin America, the Brazilian Central Bank continued its monetary easing, cutting its interest rates for the fourth consecutive time by 50 bps to 11.75%. This move is part of Brazil's ongoing effort to stimulate its economy. Lastly, Fitch downgraded Braskem to BB+, a move that was widely anticipated by market observers.

.png)