What happened last week?

Central banks

In recent speeches, Federal Reserve officials have articulated a spectrum of viewpoints regarding future monetary policy decisions. Some, like Barkin and Daly, appear vigilant in monitoring inflationary pressures and labor market conditions, signaling a readiness to support further tightening measures. Conversely, others, including Goolsbee and Mester, emphasize the importance of maintaining interest rate stability. They advocate for this stance, particularly if there are signs of a cooling labor market or if inflation returns to target levels. Additionally, they factor in the influence of tight financial conditions when making rate decisions. Turning to market sentiment, it currently reflects a 40% probability of a rate hike by year-end and no rate cuts before summer 2024. Across the Atlantic, ECB members' speeches imply a consensus that the current rate levels are sufficiently restrictive to steer inflation back toward the target. Villeroy de Galhau has stated that a new rate hike is unwarranted, while Lagarde reiterated the need for borrowing costs to remain substantially restrictive for an extended period. Consequently, the market is pricing in only a 5% likelihood of a rate hike by year-end in Europe. In the UK, Bank of England Deputy Governor Ben Broadbent has cautioned that there are "clear signs" that interest rate increases are affecting the UK economy, resulting in rising unemployment. He also suggested that the remarkable surge in pay might be a "lagging indicator." Nevertheless, the market still assigns a 60% probability of a rate hike by year-end in the UK. Lastly, in Switzerland, it appears that the peak of the SNB policy rate at 1.75% has been reached, supported by the latest inflation figures showing a significant decline in the core CPI to 1.3%. Consequently, the market prices in less than a 20% chance of the SNB raising rates by year-end.

Credit

In the US, the selloff has spilled over into the credit market, with the CDX HY crossing the 500 bps mark for the first time since May. Over the course of just two weeks, high yield spreads in the synthetic market have surged by almost 100 bps, while US high yield cash bonds have experienced a nearly 3% decline since the beginning of September 2023. Although US high yield spreads have seen a substantial increase, the widening of Investment Grade corporate spreads has been relatively contained, with only a modest 7 bps increase. It's worth noting that one of the segments most impacted by these developments in the Investment Grade sector is financials, as credit default swaps (CDS) for the four largest US banks soared by approximately 15-20 bps this week. In Europe, the weakness in peripheral bonds has begun to affect Investment Grade corporate bonds, particularly those from Italian issuers, which have reached their widest differentials since February. The Itraxx Main Europe index, tracking the 5-year CDS of Investment Grade corporate issuers, rose by 10 bps over the week to 88 bps, a level not seen since May. Consequently, the European Investment Grade primary market saw the lowest weekly issuance volume since mid-August. In the high yield segment, the iTraxx Xover index, monitoring the 5-year CDS of high yield bonds, hit 475 bps, a level not witnessed since April, before closing the week at 467 bps, marking a 40 bps increase over the week. In the cash market, high yield credit spreads widened by 30 bps to 475 bps. The average yield to worst for European high yield has surpassed 8.3%, reaching levels not seen since the Credit Suisse crisis. As a result, the Bloomberg European high yield index has declined by almost 1% since the beginning of October. European financials have also felt the pressure, with the Itraxx subordinated financial index hitting 190 bps for the first time since May.

Rates

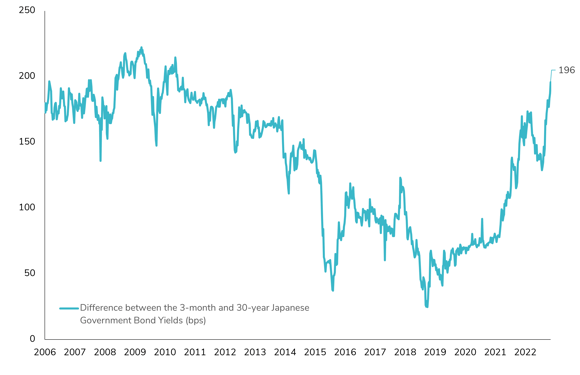

The week concluded with a robust US employment report, propelling yields to fresh cycle highs. The 10-year real yields surged beyond 2.5%, marking a level not seen since 2008, while the 10-year nominal yield briefly touched 4.89% before retreating slightly by week's end. In a historic milestone, the 20-year US Treasury yield reached 5% for the first time since the maturity's introduction, currently standing at 5.1%. The recent spike in US 10-year bond yields also followed an unexpected upswing in the US manufacturing ISM, which climbed to 49.0 in September from 47.6. The yield curve 2s30s is on the verge of turning positive after a remarkable 60 bps surge in just two weeks. Furthermore, the surge in the US 30-year bond future implied volatility is reminiscent of the volatility observed during the March regional bank crisis, coinciding with a soaring 30-year bond yield to 5%. The sentiment is mitigated by the open interest for call contracts which has hit an all-time high for the Ishares US Treasuries 20y+ ETF (TLT). In Europe, the 10-year German yield ascended to 3.0%, reaching a level unseen since 2011, before slightly pulling back to 2.9%, still up 10 bps over the week. This surge is primarily attributed to the rise in real yields, which have surged by 50 bps in just 15 days. Meanwhile, inflation expectations, as measured by the breakeven rate, have remained resilient since the start of 2023, with the 10-year German breakeven rate standing firm at 2.29%. Peripheral rates are beginning to feel the pressure from this rise in real yields, evident in the spread between the 10-year Italian and German yields, which has crossed the 200 bps mark for the first time since January. Shifting our focus to Japan, the Japanese yield curve is currently on the verge of becoming one of the steepest in recent history, driven by one of the swiftest moves ever witnessed in the Japanese yield curve. The spread between Japanese 3-month and 30-year yields has surged to nearly 200 bps.

Emerging market

EM are grappling with a challenging start to October due to a sell-off in US rates, which is causing EM credit spreads to widen. The EM corporate bond index has surged to levels last seen in July, hitting 323 bps (up 15 bps over the week), resulting in a month-to-date total return of nearly -1%. Simultaneously, the EM sovereign bond index has witnessed a 2% drop within just one week, primarily driven by credit spreads widening by more than 20 bps. EM local debt has also seen a decline of 1.2%. Regarding index adjustments, JPMorgan is contemplating the inclusion of Saudi Riyal bonds in its EM bond indexes, following the recent addition of India. In a somewhat unexpected move, Moody's has downgraded Egypt's long-term foreign currency rating to Caa1, albeit with a stable outlook. This decision took place ahead of schedule, as the review was originally planned for November. Despite this downgrade, Moody's maintains the view that Egypt's credit profile should remain resilient, provided it can effectively manage program delays and economic fluctuations. Shifting our focus, in Peru, the BCRP has implemented a 25 bps reduction in borrowing costs, bringing the rate down to 7.25%. This move aligns with market expectations and is driven by weakening economic activity and easing inflationary pressures. However, it's important to note that the central bank's post-meeting statement emphasizes that this rate cut doesn't necessarily indicate a series of successive cuts; future adjustments will depend on incoming data. Meanwhile, in India, the RBI has opted to maintain its interest rates at 6.5%. An intriguing development was the RBI's announcement of considering bond sales to absorb excess liquidity, indicating a potential shift away from relying solely on interest rates as a tool for managing liquidity and controlling inflation. This announcement triggered a notable increase in the yield on 10-year notes. Lastly, the Reserve Bank of Australia has chosen to keep its interest rates steady at 4.1%.

.png)