What happened last week?

Central banks

Atlanta Fed President Bostic urged caution in avoiding overly tight monetary policy, citing potential harm to the US labor market. He highlighted the appropriateness of the current policy's restrictiveness and emphasized the need for patience to allow its continued influence on the economy, preventing unnecessary challenges. The market now anticipates a clear pause, with only a 10% probability priced for a rate hike in September. In Europe, the ECB's minutes revealed dovish concerns about stagflation and contained wage-price spiral risks. After the ECB account and Eurozone CPI data were released, indicating a slight improvement in CPI Core (5.3% vs. 5.5% YoY) while headline inflation remained at 5.3%, market expectations for a September rate hike decreased from 55% to under 25%. ECB officials held diverse views. Banque de France's Villeroy de Galhau suggested the ECB may be nearing the peak of its interest rate cycle, emphasizing the duration of elevated borrowing costs over specific rate levels. At the same time, ECB Executive Board member Isabel Schnabel expressed concerns about euro area growth and persistent high inflation, advocating for restrictive policy to control it. ECB Vice President De Guindos noted that forecasts indicate limited changes in the inflation outlook despite worsening economic prospects. In Switzerland, Swiss CPI came in below the BNS target, showing no significant progress over the past month. This development raises questions about the possibility of a September rate hike by the BNS, with the market pricing in only a one-third chance for such an increase.

Credit

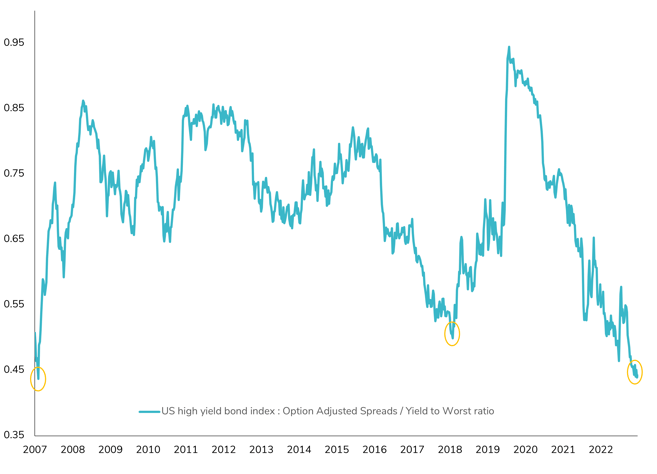

In August, the US credit market displayed mixed performance, trailing behind Treasuries due to widening credit spreads. US investment-grade bonds registered a -0.8% decline, influenced by rising interest rates and a 5bps increase in credit spreads. Conversely, high-yield bonds ended the month positively, up +0.3%. This can be attributed to their shorter duration compared to investment-grade bonds, stable spreads, and favorable carry. The high-yield segment also benefited from the prevailing soft-landing narrative and the absence of significant refinancing needs among high-yield companies. Additionally, the positive momentum in oil prices (+4% in August) boosted the energy high-yield segment, making it one of the top-performing sectors during the month. In Europe, credit market performance mirrored that of EUR government bonds, with investment-grade corporate bonds posting a +0.2% gain for the month. High-yield bonds in Europe recorded a +0.3% increase. However, banking junior subordinated debts faced challenges in August, resulting in a -1% loss. The AT1/CoCo bond market experienced turbulence as two banks, Banco Santander and Zürcher Kantonal Bank (ZKB), chose not to redeem their AT1 bonds, thus avoiding the issuance of new notes at higher coupon rates. While the market had expected Santander's decision, ZKB's move came as a surprise and led to a 5-point decline in the bond's value on the day of the announcement. This marks the first instance of a skipped call since Deutsche Pfandbriefbank AG's similar action in March. Typically, AT1 bonds are promptly redeemed to mitigate significant costs.

Rates

US Treasuries faced headwinds in August, with the Bloomberg US Treasuries index declining by -0.5% during the month. Interest rate volatility reached its peak in August, hitting 131 on the MOVE index, only to close the month at 108, the lowest level since the final week of July. The 10-year US Treasury yield scaled to 4.35% in August before undergoing a notable retracement, concluding the month at 4.11%. This still marked a 15bps increase over the month, primarily propelled by real rates as breakeven rates declined by 15bps. August witnessed a pronounced steepening of the yield curve, with the spread between 2-year and 10-year US Treasuries narrowing to -75bps from -92bps a month earlier. Despite volatility, the front end of the yield curve stabilized since the end of June, ending the month at the same level as the previous month. Technical factors continued to exert pressure on US Treasuries, exacerbated by diminished foreign demand in August, notably China's reduced holdings, which dropped to $835 billion, the lowest since 2010. Additionally, the Fed's balance sheet reduction and increased supply contributed to this scenario. In Europe, government bonds outperformed their US counterparts, closing the month positively, with a +0.3% gain for the BB EUR Government Bonds index. Core rates outshone peripheral rates, resulting in a 5bps widening of the spread between 10-year Italian and German yields over the month. The 10-year German yield concluded the month at 2.47%, 2bps lower than the previous month, and the German yield curve (2s10s) experienced a marginal 3bps steepening to -51bps. Meanwhile, in the UK, rates climbed, particularly in the intermediate/long end of the curve. The 10-year UK yield closed the month at 4.35%, marking a 5bps increase compared to the previous month.

Emerging market

In August, emerging market bonds faced formidable challenges, with all segments falling behind the performance of the US fixed income market. EM corporate bonds recorded a 0.9% loss, while EM sovereign bonds saw a decline of 1.5%, and EM local currency bonds tumbled by over 2%. China played a pivotal role in the underperformance of the corporate segment, primarily due to turmoil in the real estate sector, notably the Country Garden crisis. Additionally, long-dated Chinese technology bonds were adversely affected by the steepening of the US yield curve and investor apprehensions about China's economic recovery. Despite these headwinds, certain positive technical factors offered some support to the EM corporate segment. Primary market activity reached its lowest point of the year, totaling $9.3 billion. Sovereign bonds faced their own set of challenges, stemming from extended durations and concerns surrounding African bonds in the wake of events in Gabon. The turmoil in African debt markets during August intensified following a coup d'état in Gabon orchestrated by Gabonese soldiers. Gabon's dollar-denominated debt maturing in June 2025 saw its yields surge from 11.76% to 17.45%. This particular bond emerged as the poorest performer among a basket of more than 600 sovereign securities tracked in a Bloomberg index of emerging and frontier debt according to Bloomberg. The risk-off sentiment spilled over to other nations, affecting Ghana, Senegal, Ethiopia, and Côte d'Ivoire similarly. Consequently, the spread between yields on bonds from African developing countries and US Treasuries widened by 74 bps, reaching 826 over the course of the month.

.png)