What happened last week?

Central banks

The Fed Governor Powell aimed to leave the possibility of a future rate hike open, emphasizing the need to proceed cautiously. Market conviction remains low, with only a 20% probability of a rate hike by the end of January, up from 10% during the week. In Europe, ECB President Christine Lagarde expressed confidence in maintaining the deposit rate at 4% to control inflation but acknowledged the need for reconsideration in case of major shocks, especially with potential impacts from energy prices. Discussions on reinvestments in the pandemic emergency bond purchase program (PEPP) will be held in the near future. In the UK, BoE Governor Andrew Bailey stressed the importance of fighting inflation and deemed it premature to discuss rate cuts despite market expectations. However, BoE Chief Economist Huw Pill expressed a clearer stance, indicating no necessity for further interest rate hikes to curb inflation due to an already restrictive policy. In Australia, the RBA resumed rate hikes as anticipated, increasing rates by 25 bps to 4.35 bps, while the Polish Central Bank kept interest rates unchanged against market expectations. Finally, in Japan, Governor Kazuo Ueda signaled a cautious approach to monetary policy normalization, citing challenges in addressing below-target inflation and emphasizing a more dovish stance.

Credit

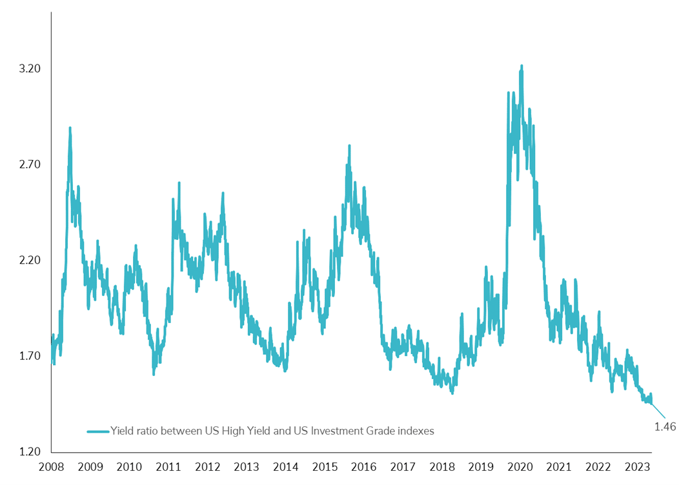

The credit markets remained relatively calm this week, with spreads holding steady compared to the previous week but impacted by a slight uptick in interest rates. In the cash market, the spread of the Bloomberg Investment Grade Corporate Bonds Index stayed at 125bps, while the Bloomberg US High Yield ended the week at 395bps. In the synthetic market, the CDX IG index remained stable at 70bps, while the CDX HY dropped to 443bps, marking a 25bps decrease over the week due to the removal of Rite Aid company's CDS. Rite Aid had announced on October 15 that it had filed for Chapter 11 in the U.S. Bankruptcy Court for the District of New Jersey. In Europe, credit index performance was also influenced by rates, with credit spreads almost unchanged over the week. In this context, both IG and HY cash indexes posted slight losses. Positive news emerged from the banking sector and its junior subordinated debt. The primary market in Additional Tier 1 (AT1) was active this week, with Société Générale drawing significant interest with a book exceeding $7 billion, and UBS issuing two tranches in US Dollars with a book exceeding $35 billion! UBS took precautions by adjusting the clause to allow AT1 bonds to convert into equity rather than being written off, aiming to avoid a similar wipeout as seen with Credit Suisse AT1 bonds, where equity holders received UBS stocks while AT1 bondholders were completely written off. The AT1 segment saw gains following UBS's success, now up almost 3% since the beginning of November.

Rates

US interest rates witnessed another volatile week. The MOVE index, measuring US Treasury volatility, remains elevated at 117, compared to its historical average of 90. The 10-year US Treasury yield inched up to 4.64%, sligthly higher than one week ago. Disappointing Treasury auctions, particularly the 30-year with a 5.3bps tail (the largest on record), and Powell's speech exerted pressure on yields, especially at the front end. The US yield curve flattened by 15bps, driven by the rise in the front end; the 2-year UST yield increased by 18bps, returning to 5%. Interestingly, the rise in yields was led only by real rates, while US breakeven rates and inflation swaps decreased. In Europe, the flattening was less pronounced, with the German yield curve flattening by only 4bps. The German 2-year yield is back above 3%, while the 10-year yield returned above 2.70%. Peripheral spreads remained stable over the week, with the difference between the 10-year Italian and German yields at 186bps. Better-than-expected UK GDP numbers and the dovish speech of BoE Chief Economist Pill steepened the UK yield curve by 6bps over the week to -33bps, led by real rates. Finally, in Japan, the rather dovish speech from BoJ Governor Ueda benefited Japanese yields. The 10-year Japanese yields ended the week at 0.85%, down from 0.93% one week ago.

Emerging market

EM debts exhibited a solid performance this week, particularly in the Middle East, where the region reclaimed half of its losses since the onset of the Israelo/Palestinian conflict. This robust showing buoyed the index, as the credit spread of the Bloomberg EM Corporate Bonds Index tightened by more than 10bps, completely offsetting the impact of rising interest rates and resulting in a gain of +0.2%. While the EM sovereign bond index faced a minor dip (-0.5%)due to interest rates, EM local currency bonds showcased resilience, recording a solid gain of 0.4%. In China, defensive real estate issuers such as Vanke and Longfor rebounded following a PBOC meeting involving government officials, regulators, and developers. Although this boosted sentiment for developers with state support and strong financials, it's unlikely to fully resolve China's persistent property debt crisis. Concurrently, Country Garden experienced a brief rebound amid reports that Chinese authorities might urge Ping An Insurance Group to acquire a controlling stake. However, Ping An promptly denied receiving such a request. Turkey made a successful return to the international bond market, issuing a 5-year $2.5 billion Sukuk, thereby achieving its 2023 external issuance target of $10 bn (unchanged in 2024). The robust demand, coupled with this year's lowest yield, signifies a tightening in Turkey's CDS spread following post-election policy changes. In Latin America, the Central Bank of Peru executed a widely anticipated 25 bps interest rate reduction to 7%, prompted by the deterioration in economic activity and easing inflationary pressures.

.png)