- Chair Powell’s Jackson Hole speech highlighted that “in the near term, risks to inflation are tilted to the upside, and risks to employment to the downside—a challenging situation”. But for investors, his key sentence seemed to be that “with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” Although he later added that “with inflation above target, our policy rate is restrictive—modestly so, in my view”, and that “the neutral level [of the key rate] may now be higher than during the 2010s, reflecting changes in productivity, demographics, fiscal policy, and other factors that affect the balance between saving and investment.”

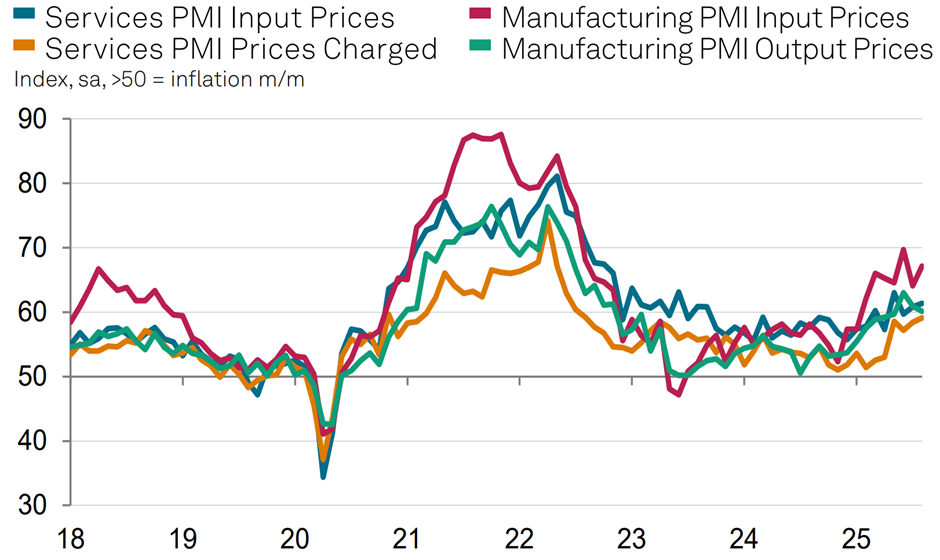

- Powell gave his speech after the minutes of the July Fed meeting revealed a majority of the FOMC voting members weigh the current inflation pressures as more worrisome than indications for a weakening of the labour market. Also, the purchasing manager indices (PMIs) in the US showed strong economic activity, and the PMI price subindex points to ongoing price pressures.

- This adds to last week’s US producer price data for July, which came in substantially above the market’s expectations and mirrored consumer price data, which also pointed to significantly elevated service sector prices. On the other hand, we still must acknowledge the signals from the strong downward revisions of the latest non-farm payroll data that point to a weakening of the labour market data.

- Over the last ten days, markets have reduced their expectations for rate cuts from 2.5 by the end of the year to less than 2—but currently are repricing this view towards more than 2 rate cuts again. Hence, the market view, after coming closer, started to move away from our view that the Fed might not cut rates more than one time in the remainder of 2025 and the risk to see more than one cut did clearly increase after Powell's presentation. We will carefully watch the upcoming data for the US labour and inflation to update our view.

Chair Powell’s speech at the Jackson Hole Symposium was a balance between the concerns around the upside risks to US inflation and the potential weakness of the labour market and even hinted that it might be now warranted to adjust the current policy stance. This led markets to start to pricing in more than two rate cuts again after having priced out about a half cut over the last ten days. The US stock markets started to rally, and the USD weakened while US treasury yields decreased across maturities.

Powell started to balance the emphasis on the labour market and the inflation

In his speech, Jerome Powell emphasised that he continues to think “the labour market appears to be in balance” while adding that “it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers. This unusual situation suggests that downside risks to employment are rising.”

On the inflation side, Powell highlighted that “the effects of tariffs on consumer prices are now clearly visible”, and that “the question that matters for monetary policy is whether these price increases are likely to materially raise the risk of an ongoing inflation problem.” Yet, he added that “a reasonable base case is that the effects will be relatively short lived—a one-time shift in the price level”. Hence, he went on to share his view that “given that the labour market is not particularly tight and faces increasing downside risks, [a wage-price spiral] does not seem likely.”

A kind of conclusion in Powell's speech seemed to be his words on how to balance the two mandates of the FED:

“In the near term, risks to inflation are tilted to the upside, and risks to employment to the downside—a challenging situation. When our goals are in tension like this, our framework calls for us to balance both sides of our dual mandate. Our policy rate is now 100 basis points closer to neutral than it was a year ago, and the stability of the unemployment rate and other labour market measures allows us to proceed carefully as we consider changes to our policy stance. Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.”

Our take and the market’s view

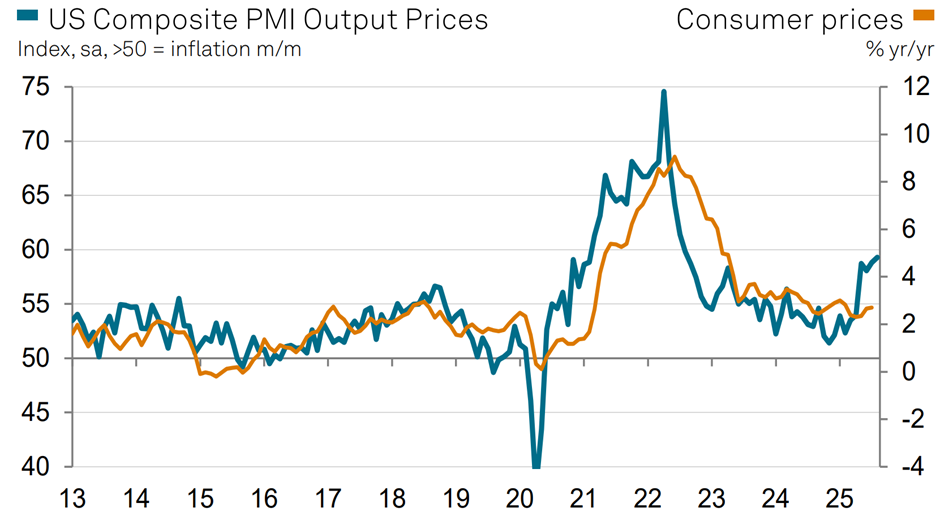

We highlighted last week that a traditional central banker would likely perceive the latest consumer price (CPI) and producer price (PPI) data as worrisome. In particular, the 1.1% jump in producer prices within the service sector (versus the previous month) represented the highest monthly surge in the past 3 years. This was mirrored by the CPI, where prices in the service sector – the part of the CPI basket that normally slows when the economy loses steam – exhibited a strong and accelerating price growth of 3.6% on a year-over-year. Remarkably, Powell did not elaborate on service price inflation, leaving us to reconsider our current view on the Fed’s focus.

Of course, the latest downward revisions of the non-farm payroll data, a gauge for the health of the labour market, were negative signs and warrant close attention of central banker and market participants. Yet, for the moment, we still think that the latest data about economic activity and prices overshadow the latest signs of a weakening of the labour market. Therefore, we currently stick to our view of only 1 rate cut by the US central bank by end 2025 but have to acknowledge that the latest speech by Powell increased the risk again towards more than one rate cut in the remainder of the year.

Trump’s tweet more important than Powell’s speech?

From an institutional perspective, Trump’s tweet about firing Lisa Cook—if she will not leave the board of the federal reserve on her own—pointed to a potential worrisome development for investors. Lisa Cook, a Fed governor that came under pressure due to a potential misconduct with her mortgage, said yesterday that she did not conduct any wrongdoing and will not step down due to false accusations. However, the real issue for investors will be the question about the future of the Federal Reserve’s independence. It was shown empirically over the last few decades that an independent central bank was important to fight inflation and to hinder governments from inflating away their debt. If the market’s perception about this institution will change, one could expect more downward pressure on the US dollar to build and investors to start to shy away from US government debt.

Chart 1: Input and output indicators of the latest PMI readings clearly point to further price pressures in both, manufacturing and services sector

Source: S&P Global, FactSet

Chart 2: A simple comparison of the PMI output price index and the US inflation CPI index points to higher CPI readings

Source: Bureau of Labour Statistics, S&P Global, FactSet

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Meanwhile, the Korean stock market surges to new levels. Each week, the Syz investment team takes you through the last seven days in seven charts.

Meanwhile, bitcoin and software equities are moving like twins. Each week, the Syz investment team takes you through the last seven days in seven charts.

While gold, silver and platinum were the best performing commodities over the past year, they took a hit at the end of last week. Each week, the Syz investment team takes you through the last seven days in seven charts.

.png)