What happened last week?

Central banks

This week, Federal Reserve officials, notably Governor Christopher Waller and Vice Chair Michael Barr, emphasized the importance of substantial evidence showing inflation's approach towards the 2% target before considering rate cuts. This stance reflects a broader call for prudence in policy normalization amid the current economic backdrop. The market response has been to temper rate cut expectations for 2024, reducing them from six to 3.5 in just ten days, particularly after receiving hotter-than-expected inflation reports (CPI/PPI). The likelihood of an initial rate reduction in March or May has now significantly diminished. Over in Europe, the ECB grapples with internal divisions over when to commence interest rate reductions. While a consensus for cuts in 2024 exists, the timing remains contentious, with opinions split between June or later and as early as April or March. This division reflects varying views on inflation and the economic forecast, amidst global monetary uncertainties. President Christine Lagarde's call for caution, requiring firm evidence of inflation containment before easing while market expectations for about four rate cuts starting in June remain stable. In the UK, softer-than-expected inflation in January spurred expectations for at least three rate cuts in 2024, with the first anticipated in August. Despite stable headline rates, the BoE's caution persists due to labor market tightness and emerging signs of economic recovery, leading traders to anticipate three cuts this year, starting in August. In Japan, BOJ Governor Kazuo Ueda's remarks suggested a continuous careful evaluation of data to determine the sustainability of economic recovery, hinting at a maintained path towards ending the negative rate policy despite recent recessionary pressures. Ueda's optimistic stance on wage trends and the expectation for real wage growth to outpace consumer inflation by April 2025 aligns with market anticipations of a potential rate hike by June 2024.

Credit

The ascent in interest rates has significantly impacted credit indexes, challenging the potential for further tightening in credit spreads to offset rate increases. In the U.S., Investment Grade (IG) corporate spreads have remained stubbornly above 90bps, despite several attempts to break lower. A similar pattern is observed in the U.S. high yield sector, where spreads hover just above the year's start levels at 317bps. This scenario underlines the pressure on performance due to rising interest rates, with high yield categories, benefiting from shorter durations, experiencing a lesser impact (-0.3%) compared to investment grade's more pronounced dip (-1.5%) in February. Notably, rating agencies have been more inclined towards upgrades than downgrades for U.S. companies, a trend exemplified by Mattel's elevation to Investment Grade by Fitch. This positive rating momentum indicates underlying strength in corporate fundamentals amidst challenging market conditions. Conversely, Europe presents a somewhat distinct picture, with Investment Grade spreads achieving new lows (126bps) since April 2022. The ongoing narrowing of credit spreads has provided some cushion against the interest rate upswing, limiting the decline in IG EUR corporate bonds to -0.8% for February. European high yield spreads have seen considerable tightening of 20bps month-to-date, contributing to the iShares EUR high yield ETF's slight gain (+0.1%) in February, showcasing resilience in this segment. The AT1 bond market has also drawn attention, notably with BNP's recent USD issuance attracting significant demand, underscoring the continued appeal of this asset class. However, like other bond indices, AT1 has experienced a slight retreat, marking a -0.8% month-to-date performance, reflecting broader market adjustments and investor recalibration in response to evolving interest rate and credit spread dynamics.

Rates

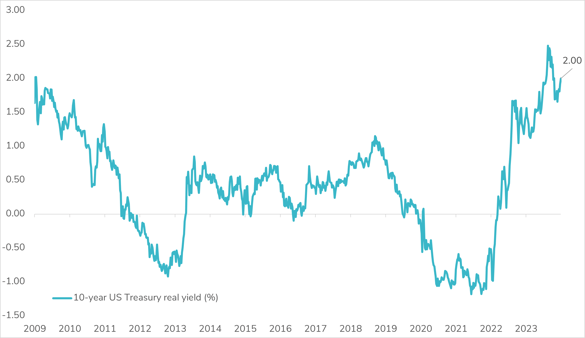

February has witnessed a stark recalibration in the U.S. bond market, triggered by unexpected developments in inflation and Producer Price Index (PPI) reports. These figures propelled U.S. yields to their highest levels in 2024, leading to a significant repricing of easing expectations. Initially, the market had anticipated more rate cuts than what now appears warranted; the adjustment aligns closer with the Federal Reserve's projections of three rate cuts. This shift has negatively impacted government bonds, with the Bloomberg US Treasury Index shedding about 2% since the month's start. Notably, the 10-year U.S. Treasury yield surged by nearly 40bps, influenced by a substantial 30bps increase in real yields and a 10bps rise in breakeven inflation expectations. Concurrently, the U.S. yield curve (2s10s) flattened by approximately 10bps. In Europe, the sentiment was similarly bearish, with German government bonds losing over 1% in February. Yet, the impact appeared somewhat muted compared to the U.S., as evidenced by the widening gap between the 10-year U.S. and German yields to 192bps, marking the largest divergence in 2024. German long-term rates have remained relatively stable, whereas the short end experienced a 10bps increase. The German 10-year real yield reached +0.4% for the first time since late November 2023, with the breakeven rate staying below 2%. Peripheral rates in Europe showcased resilience, notably with the spread between the 10-year Italian and German yields dipping below 150bps for the first time since March 2022. Meanwhile, UK government bonds demonstrated relative outperformance against their European and U.S. peers, maintaining stable yields across the curve, buoyed by a favorable inflation report. Contrary to the global trend, Japanese government bonds remained insulated from the broader market volatility, with the 10-year yield holding steady at 0.73% throughout the week. However, the front end of the Japanese yield curve edged higher, with the 2-year yield reaching its peak at 0.14% since early November 2023.

Emerging market

Emerging Market (EM) debts faced another week of downturns, marking the second consecutive week of losses, primarily driven by rising interest rates and a strengthening US Dollar. Despite these headwinds, EM spreads have shown resilience, tightening further; the Bloomberg EM Sovereign Bond Index's spread over Treasuries narrowed to 285bps, a low not seen since 2021. Similarly, EM corporate bond spreads have tightened to 242bps over Treasuries, the most compressed since 2018. Since February's onset, EM sovereign debts have dipped by 0.5%, compared to a smaller retreat of 0.2% in EM corporate bonds, underscoring a nuanced performance landscape. This week, Petroleos Mexicanos (PEMEX), a major player in the EM sphere, experienced volatility, initially hit by a sell-off following Moody's downgrade, only to find some relief from the Mexican government's decision to waive oil royalties payments for December and January. In Asia, the markets, quiet due to the Lunar New Year holiday, are anticipatory of a potential rate cut from PBOC Governor P.Gongsheng in the coming week. India's Adani Ports maintained its Baa3 rating from Moody’s, injecting a dose of optimism into the bond market. In Indonesia, the election victory of Prabowo Subianto promises continuity in macroeconomic and fiscal policies, albeit with expectations of heightened spending that could sustain the fiscal deficit at around 3% of GDP. This political stability reduces the risk of prolonged campaign turmoil and major uncertainties. Looking ahead, central banks in Turkey, Korea, and Indonesia are poised to announce their latest monetary policy decisions, with the global EM community closely monitoring these updates for indications of future policy directions and their implications for EM investments.

.png)