What happened last week?

Central banks

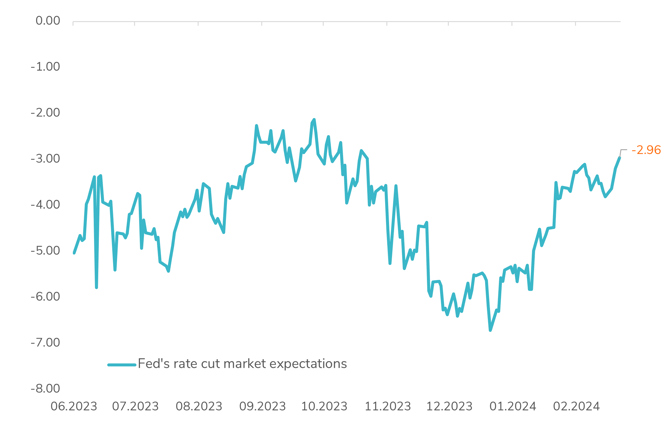

In the shadow of the "Last Smile" of disinflation, the Federal Reserve navigates a path of caution and deliberation. The latest inflation data from the U.S. reinforces the complexities of achieving a stable inflation rate. This scenario underscores the lingering uncertainties within the economic landscape, affirming the Federal Reserve's inclination towards a patient and measured approach before initiating any shifts in monetary policy. As Fed officials adhere to a blackout period ahead of the March FOMC meeting, the market's alignment with the Fed's projection of three rate cuts reflects a shared anticipation of cautious steps forward. Eyes are now keenly set on Chairman Powell's forthcoming decisions. In Europe, a notable change in rhetoric among ECB officials suggests a growing inclination towards earlier rate reductions. ECB’s Stournaras's call for two rate cuts before the summer, supported by Villeroy de Galhau's openness to an April adjustment, reflects this shift. This stance is bolstered by a notable deceleration in wage growth to 3.7% as per February’s Indeed wage tracker, potentially smoothing the ECB's path to policy easing. Market consensus is now firmly anchored around a June rate cut, with a total of 3.5 adjustments anticipated by year-end. The UK's monetary policy landscape appears increasingly dovish following Governor Bailey's recent comments, igniting speculation of a potential early rate cut, with August currently seen as the likely timing with a 99% probability according to market bets. The upcoming Bank of England meeting is highly anticipated for the signals it may send, with current forecasts predicting two rate cuts in 2024. Meanwhile, Japan is on the cusp of a significant monetary policy transition, buoyed by the largest union group securing unexpectedly robust wage deals. This development, intensifying expectations for the Bank of Japan to potentially conclude its negative interest rate policy (NIRP) as soon as next week, positions this move as the week's focal event. Such a rate hike, the first since 2007, would represent a critical pivot in Japan's monetary stance, aligning with current wage growth and economic recovery signals..

Credit

Credit markets remain buoyant amidst strong inflows, a lively primary market, and declining demand for credit protection, contrasting sharply with the rate market's volatility. This stability has been instrumental in maintaining low credit spreads and securing attractive excess returns. Notably, High Yield (HY) CDS market volatility has hit its lowest point since 2021, with the CDX HY and Xover indices marking their narrowest spreads since early 2022 at 321bps and 289bps, respectively. Despite this, the iShares USD HY Corporate Bond ETF experienced a slight decline of -0.3%, affected by U.S. interest rate challenges. CCC-rated corporate bonds stood out, gaining +0.3% this week and leading year-to-date performance in fixed income with nearly a 6% return in the U.S. However, the leveraged loan market shows signs of stress, with a 12-month trailing issuer-weighted U.S. leveraged loan default rate reaching 6.2%, the highest since the pandemic's onset. In the investment grade sector, while credit spread CDS remained stable, cash indices in both Europe and the U.S. tightened. The Vanguard U.S. Corporate Bond ETF saw a weekly loss of -0.8% due to U.S. rate movements, despite a 5bps spread compression. European cash IG corporate spreads tightened by nearly 10bps to 112bps, helping offset losses from European rate adjustments, with the iShares EUR Corporate Bond ETF recording a -0.5% loss over the week but maintaining a positive March performance at +0.4%. The ECB's Framework Review, maintaining banks' minimum reserve ratios at 1%, may reduce the need for senior preferred or covered bond issuances. In the European high yield domain, despite the high proportion of EUR HY bonds maturing within the next two years—a decade peak—the primary market's vibrancy and the declining marginal cost of refinancing hint at an impending normalization of the maturity wall. European subordinated debts, particularly highlighted by the WisdomTree AT1 CoCo Bond ETF's stable performance this week, continue to outperform, reflecting the nuanced dynamics within the credit market amidst evolving economic and monetary policy landscapes.

Rates

Navigating through March's turbulent waters, the U.S. Treasury market faced a challenging week, relinquishing its early gains with a downturn exceeding 1% over the week. The 10-year U.S. Treasury yield escalated to 4.32%, surging over 20 basis points to tie with the peak rates of 2024. Amidst this backdrop, the yield curve remained persistently flat at -41bps, marking a historical inversion duration that now eclipses the 1978-1980 record, signaling prolonged caution among investors about the future economic outlook. However, amidst the tumult, certain positive signals have emerged within the rate markets. Notably, interest rate volatility has shown signs of abatement, with the MOVE index— a critical gauge of U.S. interest rate volatility—descending below 100 for the first time since September 2023. This descent marks a tentative breach of a persistently high volatility threshold, offering a glimmer of stabilization in an otherwise uncertain market landscape. Market reception to treasury auctions was notably positive, underscoring a degree of investor confidence or search for safe havens, exemplified by successful $61 billion 10-year and 30-year UST auctions. Echoing the U.S. trajectory, European rates also ascended, with the 10-year German yield climbing by 17 bps to 2.43%. A noteworthy development has been the compression of the spread between Italian and German 10-year yields to 122bps, its narrowest since November 2021, reflecting a risk-on sentiment currently prevailing in the market, despite broader uncertainties. In the UK, post-Bailey's dovish remarks and a significant drop in consumer inflation expectations to 3% in February, the 10-year yield momentarily dipped below 4% for the first time in a month. However, the overarching global macro pressures nudged the yield back up to 4.10% by week's end, indicating a nuanced outperformance relative to global rates. Japan's rate market was not immune to pressures, with the 10-year Japanese yield escalating to 0.8% on Friday—its zenith for the year and a peak not seen in the past five months. Anticipation of the Bank of Japan possibly concluding its negative interest rate policy has exerted upward pressure on Japanese rates, reflecting the broader global trends of rate recalibrations and monetary policy adjustments.

Emerging market

Emerging market (EM) corporate bonds demonstrated resilience last week, recording a modest loss of only -0.3% despite a sharp uptick in U.S. rates. This performance is attributable to a notable spread tightening of 16 bps, bringing spreads down to 226bps, a level not seen since early 2018. EM sovereign bonds echoed this trend with an almost 20 bps spread compression to 336bps, marking the lowest point since January 2022. However, due to their greater sensitivity to rate movements, the Bloomberg EM Sovereign Bond Index experienced a -0.7% dip. Additionally, EM local currency bonds faced a -0.6% loss, primarily driven by the dollar's robust performance. The real estate sector in China continues to grapple with challenges, as Country Garden, one of the largest developers, missed a coupon payment on a domestic bond for the first time. In contrast, Vanke received backing from the State Council, which urged banks to support the troubled developer, while Longfor managed to fully repay its onshore debts due in Q1 2024. The coming week is pivotal for EM central banks, with several key policy decisions anticipated. The Banco Central do Brasil is expected to cut the Selic rate by 50bps to 10.75%, reflecting market expectations for easing. The Banco de Mexico is likely to maintain its hold stance at 11.25%, amidst the highest minimum wage growth since 2020. In Türkiye, the new governor faces the decision to either maintain or cut the Overnight rate at 45.00% despite high inflation data. Meanwhile, Argentina witnessed an unexpected rate cut by its central bank, slashing interest rates by 20% to 80% following lower-than-anticipated February inflation figures. Additionally, the International Monetary Fund (IMF) has expressed openness to discussing a new program to replace Argentina’s existing $44 billion arrangement, possibly including additional funding, signaling a significant week ahead for EM monetary policies and their potential impact on global markets.

.png)