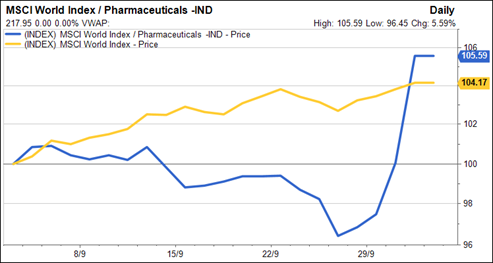

On 25 September 2025, President Trump announced 100% tariffs on medicines and pharmaceutical goods imported into the US. The levies, effective 1 October, apply to all branded or patented pharmaceuticals. Why then have pharmaceutical stocks rallied strongly since that date?

Although President Trump appeared to threaten the industry with steep tariffs, he and his administration had two clear goals in mind. The first was to encourage more production and R&D capacity on US soil, both to boost economic activity and to enhance national security. The COVID-19 crisis revealed that many countries, including the United States, were overly reliant on imported medicines. The second was to lower drug prices, which are much higher in the US than in other OECD countries that impose price controls, unlike the “market-driven” American system.

While the levies apply broadly to patented pharmaceuticals, exemptions have been created for companies actively building new manufacturing capacity in the US. This prompted a wave of announcements from global drugmakers. Pfizer pledged $70 billion for US research, development and domestic manufacturing. Roche committed $50 billion over the next five years to expand its pharmaceutical and diagnostics operations. Novartis followed with a $23 billion plan to build manufacturing and R&D infrastructure in the country. Finally, on 29 September 2025, the Pharmaceutical Research and Manufacturers of America (PhRMA) highlighted $500 billion in planned US infrastructure investments by its members over the next decade. Whether these sums are ultimately deployed in full remains to be seen, but politically the optics already count as a victory for the White House.

The industry has also moved swiftly on pricing. Several leading firms have announced direct-to-patient initiatives via the TrumpRx government platform aimed at lowering drug costs. Pfizer will cut selected prices by between 50 and 85 percent compared to current list rates. AstraZeneca plans to offer discounts of up to 70 percent on certain diabetes and asthma treatments for cash-paying patients. Bristol-Myers Squibb will reduce the price of Eliquis, its blood-clot medicine, by more than 40 percent and Sotyktu, a plaque psoriasis treatment, by over 80 percent through its new Patient Connect platform, which launches in January 2026.

These headline figures are striking, but the actual impact for pharma companies will be limited. Discounts will only apply to certain products initially, i.e. mature products that have already recouped their R&D and launch costs, and companies will bypass intermediaries to capture more margin directly. At the same time, drugmakers may pressure foreign governments to accept higher prices or, alternatively, withhold new medicines from markets unwilling to comply. For years, Americans effectively subsidised cheaper drug costs abroad by paying more at home. Trump’s strategy is designed to rebalance this dynamic.

From a political perspective, this is a win for the administration. By pushing companies to lower prices voluntarily, Trump sidestepped the need to push drug price controls through Congress, where the odds of success were low. While list price cuts do not always reflect the net prices actually paid, the White House can nonetheless claim success in forcing the industry to act.

For investors, the tariff threat appears largely defused. Yet this resolution does not address the sector’s deeper challenge: the looming patent expiries that threaten the revenue base of many large pharmaceutical groups. The ability to convert R&D pipelines into sustainable commercial successes remains the industry’s most pressing long-term issue.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Meanwhile, the Korean stock market surges to new levels. Each week, the Syz investment team takes you through the last seven days in seven charts.

Meanwhile, bitcoin and software equities are moving like twins. Each week, the Syz investment team takes you through the last seven days in seven charts.

While gold, silver and platinum were the best performing commodities over the past year, they took a hit at the end of last week. Each week, the Syz investment team takes you through the last seven days in seven charts.

.png)