What happened last week?

The feud between President Trump and the Fed escalated further last week. Governor Lisa Cook was “dismissed” from her position on the Board of Governor by the President, via letter posted on the TruthSocial network citing allegations that she committed mortgage fraud. However, she refused to quit her position, filed a lawsuit challenging her firing and even sued Trump over his move to oust her from the Fed’s board. Trump’s push to remove Fed Governor Lisa Cook, could flip the balance of power inside the Fed. If Cook eventually leaves the Fed’s board and is rapidly replaced, Trump-appointed Governors would hold 4 of 7 seats (excluding Powell). That would give Trump’s nominees’ a majority on the board for the first time in history. This shift could open the door to aggressive easing in 2026.

And in 2026 an important deadline looms: the appointment of 12 Regional Fed President at the end of February 2026. Crucially, they are subject to final approval by the rapidly transforming Board of Governors in Washington. This will provide President Trump with another opportunity to cement his influence the Fed’s monetary policy for the years ahead. All these potential shifts could open the door to a much more expansionary monetary policy in 2026.

In parallel, Governor Waller made again the case for a 25bps cut in September. The odds of a September Fed rate cut stay steady around 90%.

The release of the minutes of the ECB’s July meeting revealed that ECB members saw inflation risks as broadly balanced and didn’t want to send hints on potential next moves. Future markets price only a small chance of another ECB rate cut by the end of the year (30%).

In Asia, the Bank of Korea kept its Base Rate unchanged at 2.50%.

Credit markets continued to see a strong inflow, and stronger than in the previous decade in EUR credits. Investors favored EUR investment-grade funds over government bond funds, with short-term EUR investment grade funds posting their 27th consecutive week of inflows and capturing the lion’s share—despite French political risks.

EUR high-yield funds also recorded their 18th consecutive week of inflows, as investors continue to reach for yield.

In the U.S., foreign participation in credit markets was notably strong, marking the largest net foreign purchases in the first half since 2015. Attractive all-in yields in corporate bonds drew demand, and concerns over investors’ underweighting USD credit did not materialize.

Spreads widened across most segments, with the exception of U.S. high yield. U.S. investment-grade total returns slipped slightly, while U.S. high-yield ETFs gained (Vanguard USD Corporate Bond ETF -0.2%; iShares Broad USD High Yield ETF +0.1%). In Europe, EUR investment-grade ETFs posted a modest loss (-0.1%) and EUR high-yield declined (-0.4%), with EUR HY spreads now trading slightly wider than U.S. high yield.

Arguably, September’s heavy issuance calendar may weigh on spreads, though historically the impact has been more pronounced in Europe than in the U.S. The heavy issuance in May-June this year may reduce the supply risks.

Treasury yields twisted steeper last week as rate cut expectations continued to pull front-end yields lower. Persistent concerns regarding Fed independence, with the dismissal of Fed Governor Cook, maintained upward pressure on longer-term bond yields in the US.

USD rates declined on maturities up to 10 years but edged higher on longer-maturities last week. The US Treasury 2y yield was down -8bp to 3.62%, the 5y fell by -6bp to 3.70% while the 10y was down -3bp to 4.23%. Meanwhile, the 30y rose +5bp to 4.93%. The US 10-year inflation breakeven rate didn’t moved much (-1bp to 2.41%).

The iShares USD TIPS ETF was down -0.2% last week, a similar decline than for the broad USD Treasuries ETF (-0.2%). US Treasury ETF’s performances were positive in absolute terms across maturities up to 10 years (+0.2% for the 1-3y, +0.4% for the 3-7y, +0.4% for the 7-10y) while they were slightly negative for longer-term bonds (iShares 20y+ -0.5%).

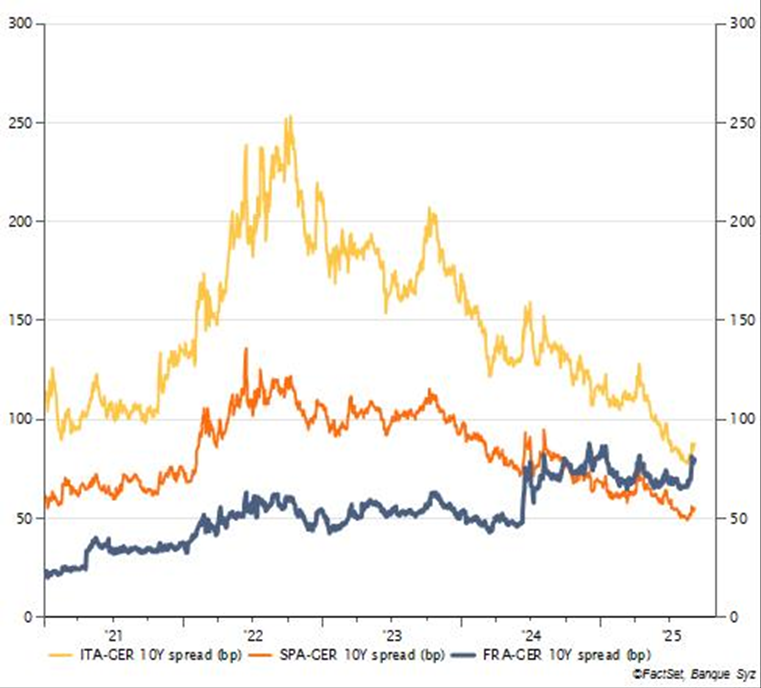

EUR long term rates were up last week, led by a resurgence of French sovereign risk after the call by Prime Minister Bayrou for a confidence vote in Parliament on September 8th. The OAT-Bund spread climbed back to 80bp, a level last seen in December 2024 when former PM Barnier was himself ousted. The French 10-year yield rose +9bp to 3.51%, while the German 10-year was flat at 2.72%. Other European sovereign yields experienced milder increases than French OATs (Italy +6bp to 3.59%, Spain +3bp to 3.33%).

Emerging market

Sovereign USD bonds edged lower last week after several weeks of strong gains, while global EM debt funds recorded their 19th consecutive week of inflows. Argentina bonds came under pressure following a corruption scandal involving President Milei’s sister, Karina Milei, and the General Secretary of the Presidency, Diego Spagnuolo. While the case has dented public trust, it is unlikely to seriously threaten Milei’s leadership. Milei maintains a comfortable lead in the polls, implying that majority voters may have already made up their mind.

In Mexico, the government is weighing higher tariffs on Chinese imports to protect domestic factories and respond to longstanding demands from Donald Trump.

Market performance diverged across EM segments. EM USD sovereign bond fell -0.1%, giving back part of prior gains. The VanEck J.P. Morgan EM Local Currency Bond ETF lost -0.2%. EM USD corporate bonds held firm at +0.1%. The iShares USD Asia High Yield Bond ETF fell -0.3%.

Looking ahead, we stay vigilant on the political agenda with major elections in Argentina and Chile this year, followed by Colombia, Peru and Brazil next year.

.png)