In its December meeting, the US central bank (Federal Reserve) decided to cut its key rate by 0.25 percentage points to the range of 3.50% to 3.75%. In addition, it stopped its quantitative tightening programme (i.e., the reduction of its balance sheet) on 1 December and decided to initiate purchases of shorter-term Treasury securities as “needed to maintain an ample supply of reserves on an ongoing basis”.

By cutting its key rate a third time in a row and announcing to assign purchases of shorter-term Treasury securities, the Fed finally met all market expectations. The Christmas present was given in form of Powells “dovish touch” at the press conference, arguing to aim for a strong economy, although he also indicated that the key rate got now close to a “plausible estimate of a neutral rate”, bringing the Fed into a situation where it can afford to “wait and see”.

The dissent is growing at the Federal Reserve

However, regional Fed president Jeffrey Schmid voted against the action as in October, and this time, he was joined by another regional Fed president, Austan Goolsbee. Both argued for keeping the key rate steady. On the other hand, Stephan Mirran argued again for lowering rates by 50 basis points. This shows the growing division in the FOMC as the current situation to operate within the two opposing targets of an inflation mandate of 2%, but at the same time facilitating a solid labour market becomes even more challenging.

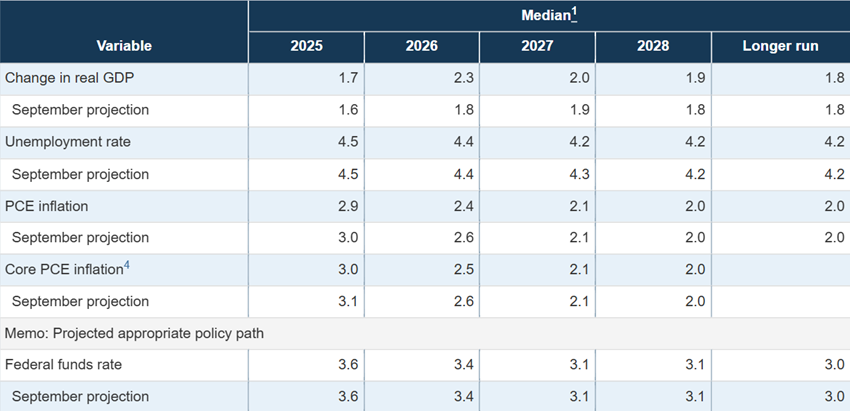

The difficulties in the Fed’s mandate were also shown in the so called “summary of economic projections” as seen in the table below—the Fed’s summary of its economic outlook: cutting the key rate despite an upward revision of the Fed’s median GDP forecast by half a percentage point up to 2.3% for next year looks strange to an economist and investor. It’s almost the same story as in September, when the GDP forecast was revised upwards, but the Fed conducted its first “risk-management” rate cut of the running year. However, at that time, the FOMC members did also increase its inflation forecasts, which was even more “eyebrow raising”—something the Fed refrained from today while slightly lowering the inflation outlook for 2026, giving some “technical credibility” to its key rate cut.

No change in the “median” FOMC outlook for the key rate

For investors, it was important to see the whole federal funds rate path as forecasted by the “median” FOMC member did not change. It still estimates for 2026 and 2027 to have only 1 rate cut, while in the long run the rate is expected to remain at 3.00%, the same rate as in the September projections. Nevertheless, in the press conference, Powell argued that with last night’s rate cut, the new key rate is “in the upper range of a plausible estimate for a neutral rate”. This indicates that with the new 3.5%-3.75% range, the economy should not be stimulated nor slowed down. When asked whether arriving at a mostly neutral rate signaled a potential shift in course—specifically, that the next move might be a rate hike rather than a cut—Powell said that no one at the table discussed raising rates. He noted that FOMC members spoke only about keeping rates steady or lowering them.

Interestingly, the so-called “dot plot,” where all 19 FOMC participants indicate their projections for the federal funds rate at the end of each year, shows that six members would have aimed to have no change to the rate in 2025 and also to see no change next year. In addition, three dots suggest that three members foresee even raising the rate back to the 3.75%–4% target range next year (see chart).

On a separate note—but equally important for investors—Powell emphasised that any “front loading” of Fed’s purchases of short-term US treasuries is not an act of monetary policy. Instead, he stressed that the sole purpose is to rebuild ample liquidity reserves ahead of next year’s tax deadline on 15 April.

Uncertainty about the stance of the economy remains high, now wait and see

So, the bottom line is that the Fed—as well as other economists and market participants—currently lacks a reliable gauge of the US economy’s true stance, as much of the key data is still missing due to the shutdown. On top of this, the new equilibrium in the labour market is difficult to interpret. Labour demand currently appears weak, yet labour supply has tightened due to new immigration policies. As Powell reiterated several times during the press conference, the FOMC views the current policy rate as close to neutral, which will likely allow the Fed to “wait and see” how the recent series of three rate cuts feeds through to the economy. This points to a slowdown in the pace of rate adjustments in the new year, as the hurdle for an additional cut appears to have risen after last night’s meeting.

Chart 1: The new Fed outlook sees more GDP in 2026 but lower inflation versus the September projections

Notes: For each period, the median is the middle projection when the projections are arranged from lowest to highest. When the number of projections is even, the median is the average of the two middle projections.

Source: US Federal Reserves, Syz Group

Chart 2: The new dot-plot with the FOMC members forecasts of where the key rate should stand at the end of a specific year shows significantly differing views

Source: US Federal Reserve, Syz Group

Source: US Federal Reserve, Syz Group

Chart 3: The Fed cuts rates three times while inflation stays at around 3%

Source: US Federal Reserve, Syz Group

Source: US Federal Reserve, Syz Group

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Meanwhile, the Korean stock market surges to new levels. Each week, the Syz investment team takes you through the last seven days in seven charts.

Meanwhile, bitcoin and software equities are moving like twins. Each week, the Syz investment team takes you through the last seven days in seven charts.

While gold, silver and platinum were the best performing commodities over the past year, they took a hit at the end of last week. Each week, the Syz investment team takes you through the last seven days in seven charts.

.png)